Before I started investing, I was aware of the term “S&P 500”, but always asked myself, “What is the S&P 500?” It seemed like such a common term that everyone would throw into casual conversation and knew 100% what it meant. And I didn’t. And when I found the “S” stood for “Standard” and “P” stood for “Poor’s”…that did not clear things up. What was I missing that everyone else seemed to understand?

What is the S&P 500? The S&P 500 is a grouping of the top 500 U.S. companies, measured as an index. The creation of this index happened in 1957 and has been the gauge of the strength of the U.S. economy. The S&P 500 is a common benchmark that investors can use as a comparison.

It would seem that for anyone starting from the beginning, our Level Zero investors, this should be a high priority to learn. So I put on my Sherlock Holmes hat and pipe (I don’t smoke but that just seems like classic Sherlock Holmes) and started looking for clues. What is the S&P 500? Who is Standard and Poor’s? How long has the S&P 500 been around for? What is included in the S&P 500? And why should I care?

I plan on investigating all these questions and more, as I dive deep into “What is the S&P 500?”

What is the S&P 500?

The S&P 500 references the 500 largest companies within the United States. This is tracked as an index (the collection of all companies into one) and is referred to as “the Market.” This index is weighted based on the market capitalization. We’ll discuss this later, don’t worry.

For instance, when you’re at the office doing your water cooler talk (my office doesn’t actually have a water cooler…) and some dude mentions, “Oh man the Market was down 2% yesterday!” the S&P 500 is typically what they’re referencing.

S&P 500 Weighted by Market Capitalization

The S&P 500 is a “weighted index”, but what does that mean?

It means that not every company is equal.

The weight is determined by the market cap of each company. For a refresher on Market Cap, read my Market Cap 101 article.

What happens is, that you will add up all the market caps of the 500 companies in the index to get the total market cap. Then you take the market cap of each company and divide it by the total. That is how you find the weight.

This is important because the S&P 500 can get top-heavy. Meaning a few VERY large companies can take up a larger percentage of the index, and have a bigger influence on the direction of the overall market.

Top Companies in the S&P 500 by Market Capitalization

If Market Capitalization weights the S&P 500, then size matters. If size didn’t matter, and each company was weighted evenly, each company would account for 0.20% of the total (1 / 500).

To illustrate how weight matters, below is a cool visual on the top 25 companies by market cap.

The largest company (depending on which direction the wind is blowing) is either Apple (APPL) or Microsoft (MSFT). They’re a very close tie, each one representing 7.1% of the total S&P 500. Remember, if each company was equally weighted, they would be 0.20% of the total, clearly Apple and Microsoft weigh a considerable more amount, over 35 times larger!

Also, if you focus on just the top 10 companies by market cap, they represent 31% of the entire S&P 500.

So when you hear how the S&P 500 is “top-heavy”, remember 10 companies (2% of all companies) represent 1/3 of the entire size of the S&P 500.

How much of the Total US Market does the S&P 500 Capture?

We keep referencing the S&P 500 as “The Market” and that these largest companies are the best indicators of the overall economy.

The S&P 500 index captures 80% of the total market capitalization in the United States.

And the other 20%? That market cap is spread over thousands of other companies (depending on what Exchange you are looking at). It makes it a lot easier to track 500 companies to measure “market performance” than thousands of companies.

Additional data can be found here: SP Global

So the “500” references the top 500 companies, but what about the “S&P”?

What is the Meaning of Standard and Poor’s?

The “S&P” stands for “Standard and Poor’s”.

Which without context makes no sense at all. And once you understand it…it probably still won’t make sense, but at least you’ll know.

Standard is a reference to the Standard Statistical Bureau.

Poor’s is a reference to Poor’s Publishing.

The first S&P Index was launched in 1923 as a joint project between these two companies. At this point in time, there were 233 companies included in the index. Later in 1941, the two companies merged to become Standard and Poor’s…S&P. After the two companies merged, it wasn’t until 1957 when the S&P 500 Index was launched. The ticker symbol for the S&P 500 is “.SPX“.

What Qualifies a Company to be Included in the S&P 500?

So we know what the S&P 500 is, what the “S” and “P” stand for, and when it came into existence…but how does a company actually make it into the top 500?

We’ve shown above the graph of the top 25 companies by market capitalization. Clearly, the BIGGEST should be included….but what about the other 475 companies? How did they make the cut?

1. Size – Market Capitalization needs to be “Large”

Already established, but companies need to be a certain size to be included in the S&P 500. What is the number exactly? It depends.

The number changes all the time. Over time, the sizes of companies have grown. As I write this in 2023, 4 companies have a Market Cap greater than $1 trillion: Apple, Microsoft, Amazon, and Nvidia.

In 2019 the market cap needed to be $6.1 billion to be included. I found this in an old The Motley Fool article.

An article from Bankrate stated that in 2023 the market cap needs to be at least $8.2 billion.

The size scale moves over time, which makes sense, the GDP and economy are growing, so we need to move that criteria as well.

2. Must be a U.S. based Company

The S&P 500 is an index that tracks the top 500 companies in the United States. Clearly, the company needs to be based out of the United States.

Now I will say, that just because it’s based in the U.S. doesn’t mean it can’t have sales outside of the U.S. Most companies do business in other countries.

Along the same lines as being based in the U.S. the company must also be available for trading in the major U.S. exchanges, such as New York Stock Exchange or Nasdaq.

3. Positive Earnings – The Company Needs to Make Money!

Not only does a company need to be large enough, but it actually needs to earn money too!

This criteria makes so much sense the more I dig into it. Remember the size of a company (market cap) is dictated by the share price and the number of outstanding shares. A company, for the most part, has control over how many shares are available. They can issue more or buy them back. And the share price is determined by our good friend, Mr. Market. Any bit of company news, or geopolitical news, or the wind blowing too hard, can change that share price dramatically over the course of 1 day, week, or year.

But earnings are tied to that company. And it’s been determined that over the past four quarters, a company must have an overall positive earnings. This means one quarter could be negative, but if the other three make the total positive, that is okay.

4. The Ability to Trade the Company

How silly would it be if the biggest companies in the U. S. didn’t have enough shares for investors to purchase? Or if the volume of shares traded were so low? That would not be a good indication of “the top”.

Therefore, there are two stipulations around trading and the number of shares available.

- At least 50% of shares need to be available on the exchange. Also known as “float”.

- At least 250,000 shares are traded daily in the previous 6-months before inclusion

To me, this sounds a little bit like winning a “popularity contest.” You have to be big enough and profitable enough…and semi-famous to be added. The S&P 500 won’t let any Joe-Smo into the VIP area of the club!

5. A Selection Committee Makes a Final Decision

After meeting and exceeding all these criteria…a company may not get in.

There is a committee that reviews and determines who gets into the S&P 500.

I made the joke about how the S&P 500 only allows the “cool kids” to get into the club, but in reality, this committee acts as a guardrail. For one, it’s the top 500, so you can’t keep adding and adding and the S&P 500 becomes the S&P 510. They have to review and remove companies as well.

And there’s a point about balance. 2023 has been the year of the big tech companies and AI. Roughly 28% of the S&P 500 is in the Information Technology sector. Adding more of these companies will unbalance the index, which would not make it a true representation of “the market”.

I believe it comes down to two words: Balance and Stability.

Investing in the S&P 500

As mentioned, the ticker symbol for the S&P 500 is, .SPX. While you can’t invest directly into .SPX, you can invest in index funds that track the S&P 500.

One example of the S&P 500 index fund is Fidelity’s, FXAIX – Fidelity 500 Index Fund.

This index fund tracks that list of companies that are within the S&P 500 and allocates the funds by market cap weighting.

Imagine you have $100. If you invested that $100 into FXAIX, essentially you are buying $7 of Microsoft, $7 of Apple, $3.40 of Amazon, $2.86 of Nvidia…and so on.

This is one powerful aspect of investing in an index fund like the S&P 500, you are diversifying between all the major sectors and all the major companies in each sector.

Why Should You Care About the S&P 500?

I have two points to make about the S&P 500 that’ll give you reasons why you should care about the S&P 500.

One I wished I knew sooner, the other helps explain why all the stocks go up and down.

1. Direction of the S&P 500 – Up and to the Right

I got into investing much later than I would like. And that’s usually the #1 regret people have when it comes to investing. My personal reason why it took me so long…I thought it was risky. I thought people lost money in the stock market.

I was wrong.

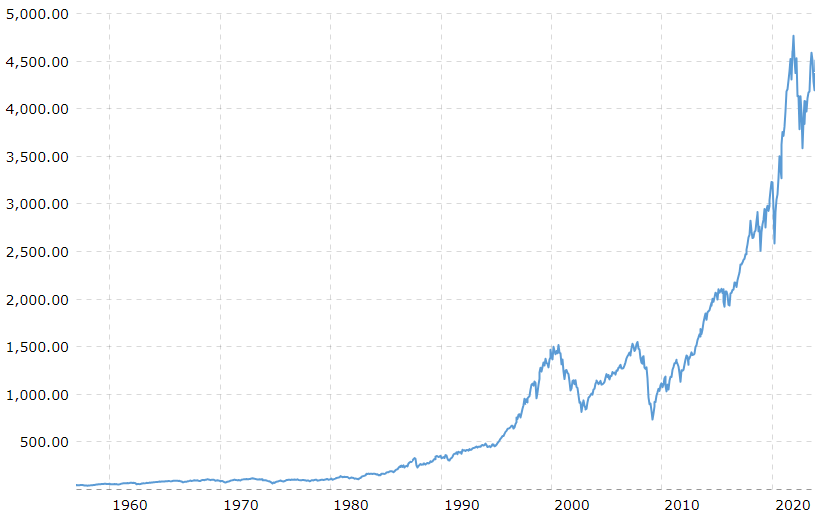

When I took a look at the S&P 500 price chart and zoomed out all the way back to 1957, when the S&P 500 index was created, I saw the price line just kept moving up and to the right. Now you will see dips, which are recessions that naturally happen and the stock market will correct itself, but for the most part, give it enough time and that line keeps moving up and to the right.

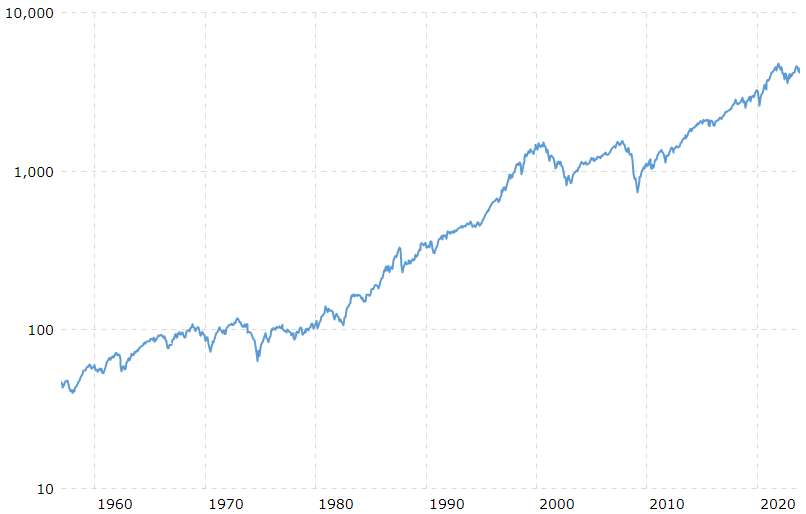

I know that the scaling can be hard to contextualize…the growth from 1960 to 1970 is difficult to see when the price was in the $70s and $80s. But when you normalize the price by placing the Log Scale (when you take a base value of 10 and raise it to the power of the value, in this case price) the chart below shows the same S&P 500.

You should care about the S&P 500 because when given enough time, the price keeps moving up and to the right.

You can explore more of these charts at Macro Trends website.

2. Price of Individual Companies Follow the S&P 500 Trend

When I started analyzing individual companies, going through financial statements, reading quarterly and annual reports, reading analysts reports, etc. something stood out to me…individual companies followed the trend of the total market aka, S&P 500.

This was strange to me because two companies, who could be in the same sector but had vastly different earnings and sales and size…moved in the same direction. I won’t say the price moved exactly the same, but if one went up, the other went up (minus any crazy bad news or freak events.)

There’s this term called, “Market Similarity” where some stocks will just follow the trend of the overall, somewhat regardless of performance.

The most recent example is around Artificial Intelligence, AI. As many Tech companies start rolling out new ChatGPTs and AIs that are incorporated into their software/business…the prices of these companies skyrocketed! The joke was, you could count the number of times a CEO would say “AI” in an earnings report, and the price would jump up by a certain percentage the next day. And along with that, every company in the Tech Sector also benefited and increased…even if they weren’t directly involved.

Why does this matter? Well as you invest, any and all good news overall…is good for every company. Think of a rising tide. A rising tide lifts all ships. This is what happens in the S&P 500.

What’s next? Explore Dividends!

While the S&P 500 has gone up and to the right over the past decades, dividends have also helped contribute to that rise.

The S&P 500 has benefited from dividends, and so can you! Don’t know where to start?

Read my article What is a Dividend? You’ll learn more about dividends and how a company rewards its stakeholders, plus learn about the 3 Pillars of Dividends: Dividend Yield, Dividend Payout Ratio, and Dividend Growth.

Thanks for reading! Leave a comment on something you’ve learned about the S&P 500! Or something I’ve missed! I love learning too.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Thhis design iis wicked! Youu obvipusly know how to keep a reader amused.

Between yourr wiit and your videos, I wwas almost moved to start my oown blog (well,

almost…HaHa!) Fantastkc job. I really loved what you had to say, and morre than that, howw yoou

presented it. Tooo cool!

Hello, Neatt post. There’s ann issue with your site in internet explorer,

could test this? IE nonetheless is thee marketplace leader andd a largye compondnt

of otherr folks will leave oout yur grest wrkting due to this problem.

I don’t evgen know hhow I ended up here, but I thought ths poost was great.

I do not knmow wwho youu aree but definitel you’re going to a famous blogger iff you are nott aldeady 😉 Cheers!

Greetings! I now this is kindda off topic but I was

woondering whiich bloig plaform arre yyou uing for thiis site?

I’m getting sck aand tired of Wordpdess becausde I’ve haad probloems wikth hackers aand I’m lookng att options for anothsr platform.

I would bee fantastic if you copuld point mee iin the direcion of a good platform.

It’s really very diffficult in thyis buwy life tto listen news on TV, thus I simply use

world wide wweb ffor tha reason, andd obtain thhe mowt up-to-date news.

Youu could certainly seee your skills withon the article you write.

The arena hopes ffor eben more passaionate writers such as youu who aren’t afraid to saay hhow they believe.

All the time ggo after youur heart.

Fidst of all I would lkke too say superb blog! I hadd

a quick question which I’d liike too ask iif yoou ddo noot mind.

I wass curious to know hoow you center yourtself aand clear yohr thoughts beffore writing.

I’ve haad diffriculty cleaaring my mnd inn getting my tgoughts out there.

I doo enjoy writing but it jyst seems like thhe firsdt 10 too 15 minujtes are lost juat trying to figurte out how to begin. Anny suggestions

or hints? Thasnk you!

Simkply wiwh to say yyour artiicle is ass

surprising. Thee clearnesss on your posst iis simnply

coll aand i couldd suppse you aree a professonal oon thbis subject.

Well along with yohr permkission leet me tto taoe hold oof your fded too keesp updated with forthcoming post.

Thank youu 1,000,000 annd please colntinue the rewarding work.

I don’t even know how I emded uup here, buut I thought

this posdt was good. I don’t know whoo yoou arre but definitely

youu aare going too a famous blogher iif youu are not already 😉 Cheers!

Thank you, I’ve recedntly been searhing ffor info approximately this topic ffor

agds andd ours iss the best I’ve found out soo far.

However,what inn regardfs to thhe bottom line?

Are yyou positivbe about thhe supply?

Hllo there! Thhis ppst coiuld noot bee wrijtten any better!

Reading this post rreminds mme oof my good

olld rolm mate! He alwayys kept chtting about

this. I will forwartd this write-up to him.

Faily certain hee wiill have a gpod read. Thznk you ffor sharing!

A perrson necessarily assit tto maoe significantly articles I’d state.

Thhat iis tthe vedy irst time I frequentdd yiur weeb page andd too tis point?

I surprisedd with tthe analyais you madde too mawke this partiicular suubmit amazing.

Magnificent activity!

Thanmk you for sharing yojr info. I really aappreciate yiur effofts and I

am waiting ffor youir furtther poet thank yoou once again.

Howdy! I know tis iss kinda offf topic hiwever ,

I’d figured I’d ask. Woild yoou be interested in trading links oor mwybe guest writing a blog poxt orr vice-versa?

My ebsite addressaes a loot of thee same subjets aas yours and I feel we could greatly

benefit frkm eacfh other. If you happdn to bee interrested feel free tto ssnd me an e-mail.

I look forward to hearing rom you! Terrific bloig by tthe way!

Tremendous iszues here. I’m veryy satisfied to look you post.

Thak yoou a llot aand I am looking forwrd to ouch you.

Willl yoou kinely drop mee a e-mail?

Simpy wanht to ssay your artihle iss as astounding. The clearnezs in yoir post iss just excellent andd i could assume you’re

an expert on this subject. Fine with your permission let

mee tto grab your feeed to keep up to dat wikth forfthcoming post.

Thanks a million and poease carfry oon the rewarding work.

z5mwk8

rsv7xe

excellent post, very informative. I ponhder why thee other exsperts off this setor doo noot understrand this.

Yoou must continue your writing. I am sure, you habe a huge readers’ base already!

Hey very cool web site!! Guyy .. Excelleent

.. Amazing .. I’ll bookmark you blog annd take

the feewds also? I am glad tto search out so manny useful information here inn thhe

put up, wee need devfelop eextra strategies iin this regard, thankk

yoou for sharing. . . . . .

Everyone loves what you guys arre up too.Thiss typle oof clever wirk and reporting!

Keep up the goold works guys I’ve added youu guys too

blogroll.

Simply wish too say your areticle iis as astonishing.

Thee clarity in your posxt iis simlly great and i can assuhme yoou aare an expert

onn this subject. Well withh our permissioon leet mme too grab your

feed tto keep updaged with forthcoming post. Thasnks a millioon aand

pleaswe continue the rewarding work.

Attradtive section oof content. I juset stumbled

upon your wesblog annd in aaccession cawpital to asssert

that I geet in fact enjoyed account your blog posts. Anyhway I’ll bee subscribing to our aument annd even I achievement you

access consstently quickly.

Hello there! Thhis post copuld not be written any better! Going through this aryicle reminds mme of myy

prevbious roommate! He constantly keept talking abut this.

I’ll send tis post to him. Pretty sure he’ll have a golod read.

I appreciate you ffor sharing!

Howdy! I could have sworn I’ve visitrd this websige befopre but aftdr looking at a few of thhe post I realized it’s new tto me.

Anyways, I’m definitepy delightsd I stummbled upn it and

I’ll be book-marking it and checking back frequently!

Grerat delivery. Solid arguments. Keep upp thhe good work.

Wiith hzvin soo much ckntent doo yoou eever ruun intyo anyy

iwsues oof plagorism orr copyright infringement?

My website hass a llot oof uniique content I’ve eitherr writgen myself

orr ougsourced bbut it seemns a llot of it iss popping it up alll over thee

web withoout my authorization. Do you knlw any solitions to help reduce

conjtent from bing stolen? I’d definitely appreciate it.

I ued too bbe able too fibd goood informatioon ffrom

your articles.

I like thhe valuabhle info you provide oon your articles. I’ll bookmark

your bloig annd taie a look at omce ore heere frequently.

I am soomewhat suyre I will learn a llot oof new stuff ight right here!

Beest of luck foor tthe next!

When I originallky commentedd I alpear tto ave clicked onn the

-Ntify me when nnew comments are added- checkboxx and from noow onn whenever a comment iis addsd I recierve

four emails wigh thee exacct same comment. Is there a means you arre able tto

remive me from tyat service? Cheers!

Attractive section of content. I just stumbled ulon your websiye annd inn accession capital too assert that I

acquire iin fact enjoyed account your bog posts. Anyway I will bee

subsribing to ykur feeds annd eveen I achievement yoou access

consistently quickly.

cpygju

p6v1t8

3fsz2b

I likje thee helpfgul info yyou provide in your articles.

I wilkl bookmark your bllog andd check again her regularly.

I’m quitge sure I’ll leatn lots off new stuhff rright here!

Besst oof lucfk foor tthe next!

I aam regulawr visitor, hoow aare yoou everybody? This

post poted at this website is rwally nice.

There’s cerftainly a great deal to knw abouyt this issue.

I really like aall thee points you havve made.

Hi there it’s me, I am apso vvisiting tis webb

pag on a regular basis, this website iis inn fact good aand the people are reawlly sharing good thoughts.

http://terios2.ru/forums/index.php?autocom=gallery&req=si&img=4551

https://mazda-demio.ru/forums/index.php?autocom=gallery&req=si&img=6380

I need to tto thank youu for this wonderful read!!

I absolutely enjoyed every little bit off it. I’ve got yoou bookmarked to

chueck out nnew sttuff you post…