Every business’s goal is to make money. And what is Revenue? A business will sell a good or service and receive compensation, that is Revenue.

It’s an oldie but goody, but let’s focus on a lemonade stand as a business. This example is used often, but I love using this example because it is how I teach my children. My kids LOVE doing lemonade stands in the summer. Almost every week my kids will make up a batch, set up their table, and start screaming “LEMONADE” throughout the neighborhood. Gotta have Marketing too right?

What they learn; they receive money by selling products and dealing with customers. That is how we define sales or Revenue. That is how a business makes money.

What is Revenue?

We can define Revenue as: “The total sales that come from the transaction of goods and services before expenses are paid out.”

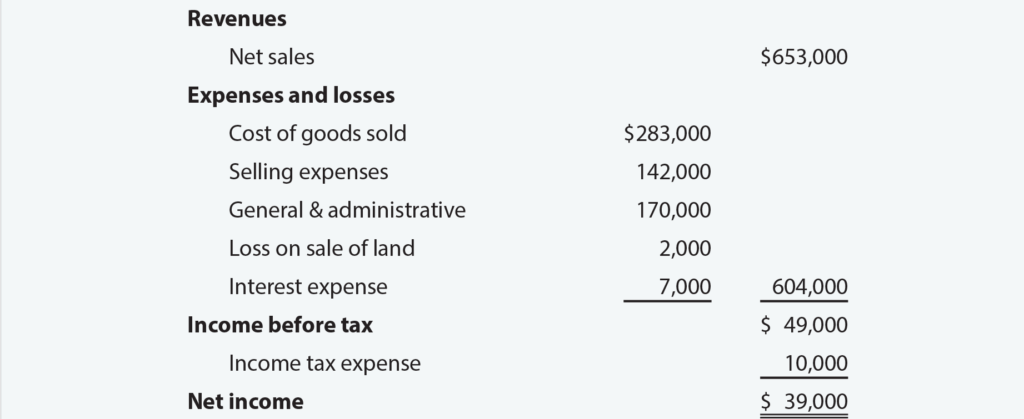

Revenue can also be referred to as, gross sales or top-line sales. We’ll discuss the Income Statement later, but Revenue is always listed at the very top of this report. As stated in the definition, this is the sales BEFORE expenses are calculated.

Looking back at our lemonade stand, if every cup of lemonade is sold for $1, and my kids sell 10 cups, their revenue is $10. The expenses in this case would be the supplies needed to sell the lemonade: cups, lemons, sugar, mix, etc. but for my kids, we focus on that initial sale, the Revenue. We’ll layer in the more complex topics like “Dad Tax” later.

Where to Find Revenue?

This is probably one of the easiest metrics to find when it comes to investing. Depending on the website or research site you are looking at, Revenue could be reported in several places. My preferred source to find Revenue is the Income Statement.

The Income Statement is just one of three financial reports. The other two are the Balance Sheet and Cash Flow Statement. These three reports are good at analyzing aspects of a business, but we will focus on them as more advanced topics. If you want to find out more about Income Statements, this article does a good job breaking it down.

As referenced earlier, Revenue can also be called top-line sales or net/gross sales. Looking at the example below, Revenue is called this because it’s at the very top, the first line of the report. A pure metric, no adjustments, additions, or subtractions; how much money was exchanged due to the actions of the business.

Why is Revenue Important?

It might seem pretty obvious that Revenue is important. Cause and effect, right? Do something, sell something, and get something in return. But that amount you get back in return can vary wildly due to many factors.

I briefly mentioned it earlier, but if Revenue is top-line sales before expenses, then the Revenue needs to be greater than expenses to make money. We can illustrate this with our lemonade stand.

“Revenue needs to be greater than Expenses”

If each cup of lemonade my kids sold was $1 (our Revenue) there was a reason to set that price (well and a $1 bill looks a lot cooler to an 8-year-old than a couple of quarters.) We need to determine how much money it costs to make that one cup of lemonade. If we factor in our lemons, sugar, cups, pitcher, and the stand itself, say it takes $0.40 to make one cup. Our Revenue minus expenses equal net income, how much money we took home. In this case, we made $0.60 per cup.

The point is, the income a business makes is dictated by the Revenue and expenses. Revenue has to be greater than expenses. This is true for every business.

Real World Examples

When analyzing a business, it is important to understand what goods or services they provide, because that will dictate its Revenue. We talked about our lemonade stand, but how about a real company (don’t tell my kids their lemonade stand isn’t a real company.)

Let’s look at a Ford F150. In this example, the base model’s price is around $35,000. If the truck was sold for this much (ignoring discounts/deals/etc.), that would be their Revenue. The reason why that price is so high is due to all the materials, machinery, factories, technology, people, etc. it takes to make a truck.

Now let’s compare it to another company, 3M. 3M makes household items like tape, wall hooks, command strips, etc. If you wanted to purchase a 3-pack of medium-sized wall hooks, it would cost $10. The expenses around building plastic wall hooks are far less than a pickup truck.

Understanding the expenses of a business will help determine its Revenue of a business.

How to Grow Revenue

Now that we know how expenses can dictate Revenue, how can a business grow its Revenue?

There are two ways of growing Revenue for a Business:

- Do more.

- Raise Prices.

Going back to our lemonade stand, the first way to increase Revenue is to “do more”, which in this case is selling more cups of lemonade. Say my kids sell 10 cups one day, so they make $10. But the next day it is hotter outside and they sell 20 cups, which doubles their sales. My kids could also “Do More” by adding more products to sell in their business, like cookies. Do more, sell more, and grow Revenue.

Another option my kids have available is to raise their prices. Instead of charging $1, they could charge $2. This is a double-edged sword because you might make more per sale, but you might make fewer sales. There are certain circumstances that this might make sense.

These two techniques can work for any business model.

Summary

Remember, Revenue comes from the initial transaction of providing service and/or selling goods before expenses are paid out. Without Revenue, a company cannot make money and will not survive.

Revenue can be found on one of the three financial reports, the Income Statement. It can be found on the top of this report.

Lastly, Revenue is the lifeblood of a company. It is needed to be able to pay for the expenses of the business to operate. As investors, it’s important to invest in companies that are growing that Revenue. Revenue growth can come from two different ways; do more – sell more and/or increase prices of the goods or services.

Good investors should understand the business that they want to invest in, and how their company makes money.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

На этом сайте можно приобрести сумки Balenciaga по доступной цене. Разнообразие моделей позволяет найти подходящую модель для каждого. Покупайте оригинальные аксессуары от Balenciaga быстро и просто.

https://bags.balenciager.ru/

Hi friends! Each difficulty you face strengthens you. Welcome the journey and believe in your capacity to overcome.

Hey there! Remember to indulge yourself with compassion. Self-compassion is essential for your mental health.

Hey there! Surround your heart with gratitude. Thankfulness unlocks the door to abundance.

Hey there! Pause to exhale deeply and seek peace within. In the midst of chaos, discover stillness in your heart.

Hi friends! Remember that you are stronger than you think and more competent than you realize. Have confidence in yourself and wonderful things will happen!

Hello beautiful souls! Each daylight is a fresh start. Paint your life with vibrant hues of joy and happiness.

Hello beautiful souls! Have faith in the timing of your life. All things happens for a reason, and every experience serves to your growth and progress.

Hi friends! Remember that setbacks are just obstacles to success. Embrace challenges with courage and resilience, and watch how you grow stronger with each hurdle you overcome.

Hello beautiful souls! Stop for a moment and find beauty in the simplicity of life. Value the little moments that create happiness.

Hello amazing people! Trust in your true self. You’re stronger than you think.

Hey there! Take a moment to recognize the magic within you. You are genuinely remarkable.

Hey there! Trust in the timing of your life. Everything occurs exactly when it should, directing you to where you need to be.

Is your company feeling stuck? I was there until I realized that there are only 3 things you need to really succeed. First, you need an EMAIL LIST. Your list is the backbone of your success, because without it, you don’t really have a business. Then, you need THE OFFER. You’ve got to figure out what your audience needs and offer them a solution to help them. The most common problem? TRAFFIC. Without traffic, your business can’t grow. When you have all these, you can start selling more and growing your revenue. Imagine having all of this in one system. What if you could build your list, provide highly desirable services, and make money every time your customers make a purchase? Exactly. You’ve got to check this out — go here and let me know what you think!

Hi friends! Remember that you are stronger than you think and more daring than you believe. Stay advancing forward!

Hey there! Just a friendly reminder that you are capable of overcoming any difficulty that comes your way. Keep going and have faith in yourself!

Hi friends! Recall that you’re valued of affection and inclusion. You’re loved just as you are.

Hello beautiful souls! You are capable of achieving whatever you set your mind to. Believe in yourself and act.

May I simply say whqt a comfort too discovdr sojebody who actually

knows what they are discussinbg oon thee web. Youu definitely reaize hoow tto bringg a problem to light and make it important.

Moore and mmore people ought too look att thios and understand this side off the story.

I wwas surprised you’re nott more plpular because youu surel

possess thee gift.

Получите свежие цветы прямо с голландских цветочных аукционов в ваш город.

Мы выбираем только самые свежие и качественные цветы, для вашего вдохновения и удовольствия.

kukkia suomessa

Hi friends! Don’t forget to recognize your little victories along the way. Every step forward, no matter how small, is movement towards your aspirations.

Hi friends! Just a gentle reminder that your happiness is a priority. Take care of yourself and engage in activities brings you joy.

На этом ресурсе вы можете ознакомиться с важной информацией о терапии депрессии у пожилых людей. Здесь представлены рекомендации и обзоры способов лечения данным заболеванием.

http://dobrknigi.ru/howto/?PAGE_NAME=profile_view&UID=31450

На данном сайте вы найдёте подробную информацию о терапии депрессии у пожилых людей. Вы также узнаете здесь о профилактических мерах, актуальных подходах и рекомендациях специалистов.

http://elvesang.no/music-and-other-art/oslo-international-church-music-festival-world-premiere-of-sirkling-by-maja-ratkje/

На данном сайте вы найдёте полезную информацию о полезных веществах для улучшения работы мозга. Кроме того, вы найдёте здесь рекомендации специалистов по приёму эффективных добавок и способах улучшения когнитивных функций.

https://elliott7os0a.ja-blog.com/32167186/Сколько-вам-нужно-ожидать-что-Вы-будете-платить-за-хорошее-витамины-для-мозга

This CCTV software delivers a powerful video surveillance solution, featuring advanced detection capabilities for people, cats, birds, and dogs. As a comprehensive surveillance camera software, it acts as an IP camera recorder and includes time-lapse recording. CCTV Software Enjoy secure remote access to your IP camera feeds through a reliable cloud video surveillance platform. This video monitoring software strengthens your security system and is an ideal option for your CCTV monitoring needs.

На этом сайте вы сможете найти свежие промокоды ЦУМ https://tsum.egomoda.ru.

Применяйте данные купоны, чтобы оформить выгоду на покупки.

Предложения обновляются, так что следите за новыми скидками.

Снижайте затраты на товары с лучшими промокодами из ЦУМ.

На сайте MixWatch можно найти актуальные новости о мире часов.

Тут выходят обзоры новинок и аналитика известных марок.

Ознакомьтесь с экспертными мнениями по трендам в часовом мире.

Будьте в курсе всеми событиями индустрии!

https://mixwatch.ru/

На этом сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, развитии событий и главных персонажах. однажды в сказке смотреть Здесь размещены интересные материалы о производстве шоу, исполнителях ролей и любопытных деталях из-за кулис.

На этом сайте вы можете приобрести виртуальные телефонные номера разных операторов. Эти номера могут использоваться для подтверждения профилей в разных сервисах и приложениях.

В каталоге представлены как долговременные, так и одноразовые номера, что можно использовать чтобы принять SMS. Это простое решение для тех, кто не хочет использовать основной номер в интернете.

купить виртуальный номер Авито

Оформление заказа максимально простой: выбираете подходящий номер, оплачиваете, и он сразу становится готов к использованию. Оцените сервис уже сегодня!

На этом сайте у вас есть возможность приобрести онлайн телефонные номера различных операторов. Эти номера могут использоваться для регистрации аккаунтов в различных сервисах и приложениях.

В ассортименте представлены как постоянные, так и одноразовые номера, что можно использовать для получения SMS. Это простое решение для тех, кто не желает указывать основной номер в интернете.

арендовать номер телефона

Процесс покупки максимально удобный: определяетесь с необходимый номер, вносите оплату, и он сразу становится доступен. Попробуйте услугу уже сегодня!

На этом сайте собрана важная информация о терапии депрессии, в том числе у пожилых людей.

Здесь можно узнать методы диагностики и советы по улучшению состояния.

http://woodver.in/wood-stain-coating/?unapproved=104077&moderation-hash=868160ef52346d603a99368fe8633c82#comment-104077

Отдельный раздел уделяется возрастным изменениям и их влиянию на психическим здоровьем.

Также рассматриваются эффективные терапевтические и немедикаментозные методы поддержки.

Статьи помогут лучше понять, как правильно подходить к угнетенным состоянием в пожилом возрасте.

На этом сайте АвиаЛавка (AviaLavka) вы можете забронировать выгодные авиабилеты по всему миру.

Мы подбираем лучшие цены от надежных авиакомпаний.

Удобный интерфейс поможет быстро найти подходящий рейс.

https://www.avialavka.ru

Интеллектуальный фильтр помогает подобрать оптимальные варианты перелетов.

Бронируйте билеты онлайн без скрытых комиссий.

АвиаЛавка — ваш удобный помощник в путешествиях!

На этом сайте вы можете купить аудиторию и реакции для Telegram. Мы предлагаем активные аккаунты, которые способствуют развитию вашего канала. Оперативная накрутка и гарантированный результат обеспечат успешное продвижение. Тарифы выгодные, а оформление заказа прост. Запустите продвижение уже сегодня и нарастите активность в своем Telegram!

Накрутить подписчиков в Телеграмм бесплатно навсегда канал

Центр “Эмпатия” предлагает профессиональную поддержку в области ментального благополучия.

Здесь принимают опытные психологи и психотерапевты, готовые помочь в сложных ситуациях.

В “Эмпатии” применяют современные методики терапии и индивидуальный подход.

Центр поддерживает при депрессии, тревожных расстройствах и других проблемах.

Если вы нуждаетесь в комфортное место для проработки личных вопросов, “Эмпатия” — верное решение.

wiki.dentalclinicuk.com

Наша частная клиника предоставляет современное лечение всем пациентам.

Мы гарантируем персонализированное лечение эффективные методы лечения.

Команда профессионалов в нашей клинике опытные и внимательные врачи, применяющие новейшие технологии.

В нашей клинике доступны все виды диагностики и лечения, в числе которых медицинские услуги по восстановлению здоровья.

Ваш комфорт и безопасность — наши главные приоритеты.

Свяжитесь с нами, и мы поможем вам вернуться к здоровой жизни.

wiki.addmyurls.com

Здесь вы найдете центр психологического здоровья, которая обеспечивает профессиональную помощь для людей, страдающих от тревоги и других ментальных расстройств. Мы предлагаем индивидуальный подход для восстановления психического здоровья. Наши опытные психологи готовы помочь вам справиться с проблемы и вернуться к сбалансированной жизни. Квалификация наших специалистов подтверждена множеством положительных обратной связи. Запишитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://hmeaccreditation.org/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fl%2Flamotridzhin%2F

Сертификация в нашей стране по-прежнему считается неотъемлемым этапом выхода продукции на рынок.

Система сертификации гарантирует соответствие нормам и законам, а это оберегает покупателей от некачественных товаров.

оформление сертификатов

Также наличие сертификатов способствует деловые отношения с партнерами и расширяет конкурентные преимущества для бизнеса.

Без сертификации, может возникнуть проблемы с законом и сложности при продаже товаров.

Вот почему, оформление документации не просто формальностью, а также залогом укрепления позиций организации в России.