Investing is all about buying and accumulating assets, and then watching them grow over time. One type of asset is a dividend-paying stock. But what do you do with a dividend? I heard this term (I thought they were referencing coffee) called DRIP Investing and quickly asked, “What is DRIP Investing?”

Most people ignore dividends…at first. They’re SOOOOO small (insert eye roll here). Well, let’s take Apple for example. If you own one share of Apple, your annual dividend payment will be $0.96. What am I going to do with $0.96? Not much. But as you gain more shares and own 100 shares of Apple, your annual dividends will be $96. Now you’ve piqued my interest. I could go out and spend it…OR I could take that money and buy even more shares of Apple! My dividend…earned more shares? It’s too good to be true, right?

While receiving dividends is great, early on in my investing career I plan on never spending that dividend. Instead, I’ll DRIP. Let’s go over what is DRIP Investing and why and how we DRIP.

What is DRIP Investing?

DRIP, Dividend ReInvestment Plan.

As it is spelled out, DRIP is a plan where you take the dividends you receive from a company, and reinvest back into that company.

Once you receive the dividend payment, the money will be spent to buy more shares of that company. The amount of shares purchased is based on the payment and current share price.

Depending on your broker, this is usually an automatic process. You won’t know you’ve DRIPed until it’s too late!

Well, you need to enroll in DRIP, so you probably do know. But the ease and convenience of this cannot be beat.

Why Should You DRIP?

Why would I reinvest my dividends versus spending or putting them into my bank account?

Remember earlier, that I mentioned a big part of investing is about buying and accumulating assets.

My Goal: Buy more assets.

When you DRIP, your assets end up buying more assets. The money from your investment…bought you more of that investment. Technically, you bought more assets without spending a dime. By DRIPing, you accumulate more shares quickly.

Your money…is making you more money…

How to DRIP

Is there anything you need to do to DRIP?

Yes.

But don’t worry, it’s painless.

Assuming you are using a broker like Fidelity, Charles Schwab, etc. they have options to manage your dividends.

Your two options are:

- Place dividends in cash management fund/core account.

- Reinvest back into equity/stock.

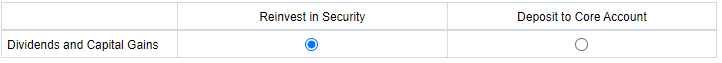

Below is a snapshot of Fidelity’s Manage Your Dividends Options. There are only two options as described. Pretty simple.

If you select to reinvest, the day you receive the dividend payment, your broker will automatically purchase however many shares it can based on the dividend amount.

Example of DRIP

Now we have a basic understanding of DRIP, let’s see how it works with a practical example.

In this example, we’ll use Procter and Gamble (ticker symbol PG), which is a Dividend King (means they’ve increased their dividend payment 50 years in a row.) They pay a quarterly dividend of $0.94 per share or $3.76 annualized. This comes out to a dividend yield of 2.57%. For this exercise, we’ll say their share price is $150. We’ll also keep the share price constant through time just to emphasize the power of the reinvested dividend.

| Share Price | Quarterly Dividend Payment | Dividend Yield | |

|---|---|---|---|

| Procter and Gamble | $150 | $0.94 | 2.57% |

If at 20 years old, you buy 10 shares of Procter and Gamble for a total of $1,500. The first quarterly dividend comes in, and you get paid $9.40 (10 x $0.94). You reinvest that money and purchase 0.063 shares ($9.40 / $150). You now own 10.063 shares.

It doesn’t seem like a lot, right?

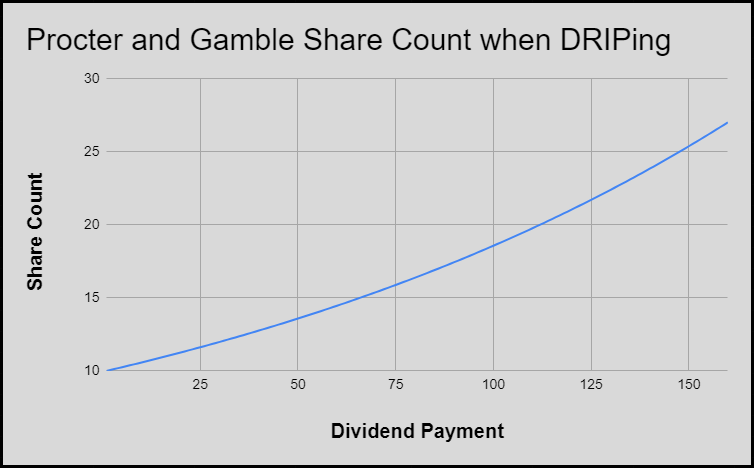

Well, keep DRIPing for the next 40 years. Assuming the share price and dividend payment doesn’t change and you never contribute any more money, after 40 years you’ll own 27 shares of Procter and Gamble. You did nothing on this investment. But those 27 shares are now worth $4,050, a 170% gain.

And you’ll notice in the graph below, that share count does not increase in a straight line. That line is curving upwards. This compounding effect is when those reinvested shares, buy more shares, which results in higher dividend payments each quarter.

And let’s not forget, 100% of this gain came from reinvesting dividends. There was a one-time initial contribution of $1,500 that led to a $4,050 value.

When Should I Stop DRIP Investing?

Okay, great, reinvesting our dividends is a great way to buy more assets and generate wealth.

But…I eventually want to spend those dividends. When can I stop DRIP and start spending my dividends?

Never.

Haha just kidding. Kind of.

The short answer is, when you’re ready to retire. Or when you’re done accumulating.

How do you know when that is? When you’re able to live off of your investments. In theory, once your annual dividends equal your income, you could live off of your dividends. Then you would stop DRIP and just receive.

However, like all things related to personal finance…this answer can be…personal.

Maybe you have a need for cash. Maybe you’ve fallen under financial hardships and you need help supplementing your income. Or maybe there’s an event or big purchase you have planned and you want to use your dividends to pay for it. Another reason could be to add diversification to your portfolio, or you need to rebalance if one account grows too large.

There’s no “one size fits all” when it comes to DRIP. However, ideally, you want to give your investments as much TIME as possible for compounding.

What’s next? Explore More About Dividends!

Reinvesting your dividends can accelerate the accumulation of assets. Check!

Contribute. Invest. Reinvesting. Compound. Wait. Hold.

Do this and it’s a sure-fire tactic for building wealth.

If you’ve read this article, and are still curious to know more about dividends, read my article What is a Dividend? You’ll learn more about dividends and how a company rewards its stakeholders, plus learn about the 3 Pillars of Dividends: dividend yield, dividend payout ratio, and dividend growth.

Thanks for reading! Please leave a comment below to tell me that you’re DRIPin’ too!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Great post, Brett! Essential reading for any investor planning to snowball his wealth over time.

I know some may find DRIP a boring investment strategy, but that is exactly why I love it! Buy and forget. DCA on autopilot. It’s simple, yet powerful.

You’re absolutely right! Just sit back and let your money make more money. What more could one ask for?

Keep DRIPing!

wjgi74

b4b72u