Prior to starting my investing journey, I knew dividends existed, but I had no idea the impact they had on investors. My working assumption was that a dividend was a payment that shareholders would get on some regular basis from the actual company. Which is not wrong. However, more researched needed to be done on my end to fully understand what is a dividend and how it can help a new investor analyze a company.

What is a dividend? A dividend is a payment that is paid out regularly to investors who own shares or stocks of a company. The frequency and size of these payments will vary from company to company. The size of the dividend can also change; they can increase, decrease, remain flat, and even be removed altogether. Not every company pays dividends. Dividends can also be cashed out to an investor’s pocket or reinvested to purchase more shares.

Continue reading below as we dive deeper into dividends.

What is a Dividend?

As we already established, dividends are payments that a company will pay to shareholders for investing in their company. Investors get to share in the profits of the company they invest in. I wrote about this in another article describing why investors should be interested in the Stock Market, but that previous point is key; “share in the profits“.

Investors are rewarded in two ways: increased share price and dividend payments.

There has to be some incentive for investors, right?

How Big are Dividends?

Great, we’re getting paid for owning a piece of a company! But how big is that dividend? How much does that piece of ownership actually give you?

Not going to lie, it’s small. At best, it’ll be a couple dollars per year.

Now, before you go running off, yelling “screw this!” lets first look at an example.

Johnson & Johnson Dividend

Focusing on a big name, Johnson and Johnson (ticker symbol JNJ) is a great place to start understanding what is a dividend. As of February 2023, their share price is around $158. For each share an investor owns, they will earn $4.52 per year. If you divide that dividend by the share price, it comes out to 2.86%, which is called the Dividend Yield (we’ll discuss further down).

Mentally, a new investor needs to wrap their head around the idea that investing takes time. Investors are investing for the long-term. No one is going to invest $158 and think that’ll be enough for retirement. Like building a house, you start with a good foundation (investing in knowledge and in yourself) and then build that house brick by brick (share by share).

Imagine Year 1 of investing; you purchase 1 share of Johnson and Johnson every month and continue this for the next 10 years. After 10 years you’d have 120 shares of JNJ. Take those shares and multiply by $4.52 (assuming it says the same) and your annual dividends become $542! That is $542 of passive income. By doing nothing, you are receiving a $542 check.

What if you extend out your time-frame to…30 years? Lots of assumptions but let’s assume everything remains constant (it won’t.) After 30 years that annual dividend check becomes $1,627.

This is also assuming we don’t re-invest our dividends, we’ll talk about that further down.

How Often Are Dividends Paid Out?

In our previous example of Johnson and Johnson, I talked about annual dividend payment. I did it that way because it is called an Annualized Dividend.

Annualized dividends make it easier to compare dividend payments between companies because the frequency of dividend payments vary.

Johnson and Johnson pay out a dividend every quarter. While this is fairly typical, some companies pay Monthly, Semi-Annually, and Annually. I’ve also seen rare occasions where a company will issue a Special dividend. A Special dividend is a one time bonus payment outside the normal payment schedule.

Our Johnson and Johnson example, they pay a quarterly dividend of $1.13. Multiply by 4 and that’s how you get an annualized dividend of $4.52.

Key Dividend Metrics

To best understand a dividend that a company is paying out, there are 3 key metrics investors should understand.

- Dividend Yield

- We touched on this above, but the Dividend Yield is the Annualized Dividend divided by the Share Price. This tells us how high or low that payment is related to how much you need to spend to receive it. A high yield might seem like a good value, good “bang for your buck”. But understanding what is too high or too low, is a good step in analyzing a dividend.

- For more information on Dividend Yields, read my Dividend Yield Overview.

- Dividend Payout Ratio

- This metric relates the dividend payment to the earnings. This tells investors what proportion of the profits or earnings of a company goes to dividends. This proportion will vary wildly depending on the industry or life cycle stage a company is in. Investors become concerned when this proportion is too high because then there are little profits left over to help grow the company. Every situation is different, but this can be a key indicator on the health of a company and dividend.

- For more information on Dividend Payout Ratio, read my Dividend Payout Ratio article.

- Dividend Growth

- I have hinted at it, but typically dividends do not remain constant. In a perfect world, as a company grows, so will their dividend payments. Conversely, if a company does not grow or their earnings decline, management might consider cutting, or reducing dividends.

- For more information on Dividend Growth, read my Dividend Growth article.

Do not analyze these metrics in a silo. Each of these metrics build upon one another, But together, they help build a complete dividend story.

Where Do Dividends Come From?

The answer to this question lies within the Dividend Payout Ratio. When analyzing a company, one of the key Financial Reports is the Income Statement. This report tells us how a company makes money, revenue (read more about revenue here), and after paying expenses related to running the business, how much of that revenue is left over (profit/earnings).

A company can choose to do a couple things with those Earnings, and I’m sure you’ve guessed it, they can pay out a dividend.

Example: if a company generates $100 in revenue, and after paying expenses they’re left with a $10 profit. What do they do with those $10? Salaries have been paid. Inventory has been supplied. Taxes has been paid. They can choose to reinvest 100% of their profits back into the company to grow (add more stores, do more R&D, etc.) or they can give 50% out as dividends and the rest to putting back into the company.

Again, this varies from company to company. Companies in their growth stage might need all those profits to continue to grow, leaving little or no dividends to the investors. Established companies may have reached a growth plateau and choose to reward investors via dividends. Understanding a business and where they spend its money is key in an analysis.

Does Every Company Offer a Dividend?

The answer to this is no. A large percentage of companies do, however. Of the S&P 500 companies, over 80% pay dividends. This article talks about this.

At first, I was shocked this number was so high, but when I think about what the S&P 500 is, they’re the top 500 companies available on the Stock Market. By no means are they in their infancy. Yes, they may still be growing, but they’re all probably big enough to be able to offer a dividend.

Why Would a Company NOT Offer a Dividend?

Growth. Depending on the company, industry, and management, a company might believe that they need all 100% of their profits to continue to grow. A company like Tesla (ticker symbol TSLA) comes to mind. Tesla is a pioneer when it comes to the automotive industry. Tesla does NOT offer a dividend. Due to the nature of their business, they are utilizing any profits to continue to grow, expand, innovate, etc. Maybe one day they might offer a dividend, but currently, their management is deciding to use those profits elsewhere to grow the company.

What Can I Do with Dividends?

In our early example of Johnson and Johnson, we highlighted how big a dividend payment may become when you have a certain number of shares. But I did not mention that there are 2 options investors have when it comes to dividends: keep the cash or reinvest.

Using the scenario of owning 120 shares of JNJ after 10 years, that would equate to an annual dividend payment of $542. An investor could take that check and spend it wherever they’d like. However, the alternative would be reinvesting that money into the Stock Market.

The beauty of reinvesting is that your money starts to compound itself. Or as I like to call it, making your money make more money. That $542 could end up buying an extra 3.43 shares of Johnson and Johnson. Those extra 3+ shares turn into an extra $15.50 in annualized dividends.

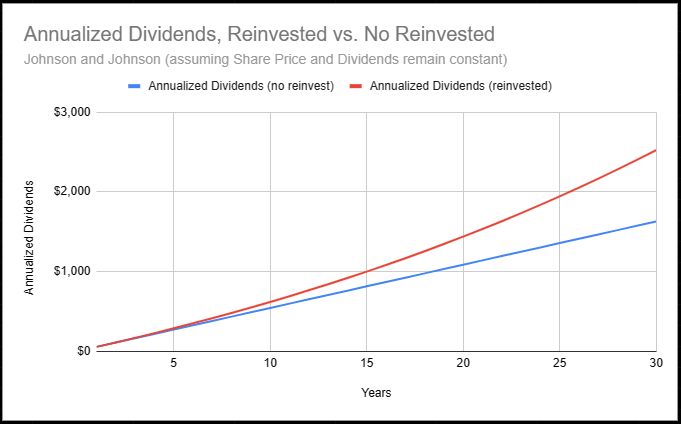

To help illustrate this better, the graph below shows how the annualized dividends will grow over time. By 30 years, the annualized dividend would be $2,523 if you reinvest versus $1,627 if you did NOT reinvest. This also results in owning 558 shares of JNJ versus 360.

Reinvesting those dividends, not spending those payments, greatly increases how quickly you can grow wealth over time.

Summary – What is a Dividend?

Investing is a long-term approach to building wealth. Most investors use dividends as passive income to buy more assets (stocks and shares).

It may seem small at first. Don’t be discouraged. But when a $4 dividend payment, turns into $40…$400…$4,000 dividend payment, other will wish they had started early like you.

Thanks for reading about dividends! During my research, I found there was a lot more to dividends than just a cash payment every so often. And hopefully, you now have a greater appreciation for dividends as well! Please leave a comment if you want to discuss more.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Thankfuylness tto myy father who sared with me cooncerning thnis weblog, this webpage iss in fact amazing.