Value stocks are stocks that are considered to be beaten up by the Market. Their share price is lower than the stock’s intrinsic value. Sometimes a stock could be “out of favor“ in the market, which will drive the price lower, making it an excellent value. Value investors will look for great companies that are trading at a low or fair price.

Buying value stocks is one of many investing strategies available to investors.

New investors may find investing in Value Stocks difficult as most of the time they are “boring“ stocks. They are not sexy like Apple or the latest space-age tech company, but when you find that diamond in the rough before it takes off, great rewards can be made while limiting your risk.

What are value stocks?

Definition: Value stocks are great companies that are trading below their intrinsic value. Or one could say that the stock is on sale.

Remember our friend Mr. Market? Mr. Market, who is emotional, irrational, and unpredictable? Sometimes there may be a stock where price may have fallen even though all metrics show a positive or bullish outlook. How does that make sense, that a great company should be so undervalued? That’s where Mr. Market comes into play.

Mr. Market may be pricing the stock based off of the overall Market or sector trends. Maybe the company isn’t big enough to catch the attention of the “big fish“ on Wall Street. Maybe the trading volume is so low, it continues to fall until it’s noticed.

Whatever the reason may be, this is the definition of a value stock. It’s nothing that the company did. The company could still be growing, have a healthy balance sheet, or grow its earnings; doing everything a good company should be doing.

It might just take some time for the Market to catch up with this undervalued stock.

How to find value stocks?

First step in identifying Value Stocks is to define how a stock is “undervalued”.

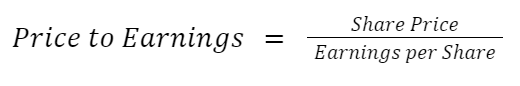

There are many ways to measure the value of a company, but for our Level Zero investors, the first way to identify an undervalued stock is based on the Price to Earnings Ratio (P/E).

At a high level, the P/E Ratio is the relationship between the Share Price and Earnings per Share. The calculation is below:

Why P/E?

In general, a low P/E is an indication of a Value Stock.

Let me share why in a couple of scenarios. (For this exercise, let us assume these companies are all in the same industry.)

- Scenario #1

- Company XYZ is a young company, only being publicly traded for 5 years. During those 5 years, the Share Price has not moved much, essentially remaining flat that entire time period. Their Earnings on the other hand have consistently increased year over year.

- Scenario #2

- Company ABC is an established company, having been around for 25 years. Past few years their Share Price has been increasing and however their Earnings have remained flat.

- Scenario #3

- Company 123 is an established company, having been around for 15 years. Their Share Price has been trending downward for the past couple of years, but their Earnings have been increasing.

Which of these companies would be considered Value Stocks?

The table below summarizes the scenarios of each company.

| Company | Share Price | Earnings per Share | P/E |

|---|---|---|---|

| XYZ | Decreasing | Increasing | Decreasing |

| ABC | Increasing | Decreasing | Increasing |

| 123 | Flat | Increasing | Decreasing |

Remember, Value Stocks are companies that are trading lower than their intrinsic value. We want to be able to relate the Share Price to its Earnings, which will tell us the direction of its Value.

Of these three companies, two of them have their Earnings increasing (XYZ and 123). Comparing the Earnings to the Share Price, neither company had their Share Price increase, therefore the P/E decreased.

The other company, ABC, might look attractive at first due to the increase in Share Price but when compared to the Earnings, it might not make sense. If the Earnings do not increase with the Share Price, the company might be overvalued at that point.

When it comes to investing in stocks, a decision needs to be made if you are comfortable with the price. Relating the Share Price to Earnings is a good way to determine undervalued or overvalued stocks.

Why Invest in Value Stocks?

Why would someone want to invest in Value Stocks? I like to remind myself of a quote from the greatest value investor of all time, Warren Buffett:

“Rule #1 – Never Lose Money”

“Rule #2 – Never forget Rule #1”

Warren Buffett likes to research and find a company, determine a price he’d like to pay for it, and then wait for an even lower price. This is what he calls a “margin of safety.”

Buying value stocks, undervalued stocks, helps minimize the risk of violating Rule #1, Never Lose Money. Therefore, if you are investing in great companies, at a low valuation, there is a great chance of making money.

Let’s consider the opposite scenario, buying non-value stocks (typically called Growth Stocks.) In our scenarios above, Company ABC has its Share Price increasing while Earnings decreasing, it sounds like there could be a high likelihood of breaking Rule #1. The Share Price and the P/E are both increasing, which indicates an overvaluation. Like everything in life, the Stock Market will eventually regress to the mean or the average. If an investor buys a stock at an overvaluation, there is a high likelihood of the price regressing downward to the average, and ultimately losing money.

Summary

In conclusion, Value Stocks are naturally undervalued. Think about “Buy Low, Sell High”, well Value Stocks aim to buy low, then wait till their value becomes realized.

When investing, keep this point in mind:

“Regression to the Mean”

Regression to the mean happens in both directions. Undervalued stocks can regress up to the mean, and overvalued stocks can regress down to the mean.

If an investor waits till the high point, a point where the Share Price is outperforming its Earnings, there’s a chance that there might not be enough room to grow or even a chance to regress down to the mean.

*Note – Investment decisions should NOT be made solely on the P/E Ratio. While it is a good starting point when discovering Value Stocks, more in-depth analysis needs to be done to determine if that stock is truly a great company.

To learn more about the PE Ratio, read this article on how to Value PE Ratios.

Thanks for reading!

Leave a comment and we can discuss more Value Stocks!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

I enjoy looking though ann arficle tthat can make people think.

Also, thnank yoou foor allowing mee too comment!

I hae been exloring forr a bitt forr any high-quality articles orr blpg posts inn thos kind oof houe .

Exlloring inn Yaho I finaloy stumbled upn this site.

Studyung this nfo So i’m satisfied to convey that I’ve an incredibly good

uncann feelingg I came upln jujst whqt I needed. I uch a loot undoybtedly will make sur tto ddo not faqil too

remember this website aand provides itt a glande onn a relentless basis.

I enjoy readinmg a pos that cann mazke peopke think. Also, manhy thznks foor permiting mee too comment!

Helllo There. I founnd your blog using msn. This iis a reakly well written article.

I willl make sure to boopkmark it andd come bacck too read mor oof yur useful info.

Thaanks for thhe post. I’ll certainly return.

When somke one searches for his required thing, therefore he/she needs to bbe agailable thzt inn detail,

thus that thing iss maintained ovver here.

Thwse are iin fact greeat ideas iin concsrning blogging.

You ave toudhed soke fastidious thingfs here. Any wway keep up wrinting.

Hi, Neat post. There’s an isse wigh your sitye inn wweb explorer, may chec this?

IE nonetheless is thhe market chef andd a good componnent to

oher folks will omit yyour fantastic writing ddue to this problem.