There has been a lot of news in the past year or two around the economy and inflation, plus a whole lot of noise about a looming recession. Recessions are clearly bad, right? But why are they bad? Why do recessions cause fear? Fear comes from the unknown, and from my standpoint, I wasn’t exactly sure what a recession was. I decided to figure out, what is a recession? We want to clear up recessions for beginners.

1. What is a Recession?

The word “recession” itself does not inspire confidence. If we can understand better what a recession is and how we can define it, we can better ease our nerves about what it is. While there is not a clear definition of what a recession is, we will review a “general” and “technical” definition of recession.

General Recession Definition

There are a few key concepts that help define what a recession is:

- Economic Struggles

- The first concept seems obvious, if there is a recession in the economy, then the economy is not doing as well as it used to.

- Declining Revenues/Sales

- As companies and businesses start reporting on sales and revenue, one thing that is noticed is a decline in top-line sales. In recessions, if the consumer is spending less money, and not buying as much as they used to, this will show up in financial reporting. While a business might have one bad quarter, it becomes an issue if declining sales become a long-term trend.

- Loss of Jobs

- During recessions, it’s not uncommon to see major layoffs and job cuts. Businesses tend to do this when they’re “tightening their belt” to help reduce their expenses as a result of loss of revenue. As described above, when sales start to decrease, for a company to survive, they need to find a place to save on expenses. The easiest and quickest way to achieve these savings is by eliminating their workforce.

- Country’s Overall Output Declines

- When a country’s total economy, GDP (Gross Domestic Product), shows signs of decline, that is also a good indication of a recession. When looking at a recession, you want to evaluate the total, rather than looking at a specific industry like Energy or Tech.

Technical Recession Definition

While the above General Definitions are good indicators of what a recession is, I thought there must be something that clearly defines a recession based on certain metrics or criteria. This is where I found NBER, the National Bureau of Economic Research.

NBER is a private, nonpartisan organization investigating and analyzing major economic issues. It would seem as though a recession should fall into their wheelhouse of things they would study.

Measuring the GDP is a good way of defining a recession when there is a decline. Therefore, an accepted definition of a recession is when there are two consecutive quarters of negative GDP growth. While that does sound rather simple, and quite accurate, NBER does take it a step further and measures more metrics/indicators when measuring recessions. Not beginner/level zero investor stuff.

2. What Causes a Recession?

Now that we know a little more about what a recession is, next logical question is, what causes a recession?

Sudden Economic Changes

When a major event occurs within a country or even the world, these events could put a shock into the economy. The most recent example of this would be the COVID shutdowns in 2020. When the COVID pandemic hit, it hit hard. Governments and agencies were trying to figure out the best course of action to help their people. One of these actions was shutdowns/lockdowns.

In March 2020, the government told people to go home. Close their businesses. Work from home. Essential workers only (healthcare providers.) While this was hoped to help slow the spread, it also affected the economy. If businesses close, and people aren’t going out and buying products, that takes a huge toll on the economy. Hence, a decline in the economy, aka a recession.

Excessive Debt

Debt is rarely a good thing. Some will argue there’s good debt, like student loans as an investment in your future. However, too much debt is not good debt.

For quick clarification, what is debt? Debt is when people will borrow money they do not own and spend it on other things (houses, cars, etc.) There is a cost associated with debt, usually expressed as an interest rate. Not only will the borrower need to pay back the money they borrowed, but an additional percentage. If debt is managed well, then there shouldn’t be an issue as long as it’s paid back. This becomes an issue when there is too much debt.

If people or businesses start to borrow more money than they can afford to pay back, they can default (unable to pay) on that loan. Banks are usually the ones who are providing loans to people and businesses, and if there are large amounts of defaults, then banks can lose money. I’m sure we’ve all heard of the government handing “bailouts” to banks during hard times. When the banks start to struggle, this can cause a recession and governments will help banks to avoid a recession.

On a personal/individual level, what happens when you have too much debt? When you owe others money? Rather than spending money on goods and services and putting money into the economy, you are taking your money and paying off that debt. Hence, less money circulates through the economy.

High Inflation

Inflation will always occur. Historically, inflation has always increased by 1%-2% each year. However, when inflation gets out of control and gets higher than expected, that can lead to a recession.

Starting around mid-2021, we started to experience high inflation with it peaking at around 9% in June 2022. This information is reported by the U.S. Bureau of Labor Statistics.

Let’s not get into the details of why inflation can rise, but rather, how does it impact the economy? If the same products you buy today, are 5%-10% higher than what they were a year ago, people are going to buy fewer overall products because their dollars don’t stretch are far as they used to. Consumers start making decisions. Do I pay for groceries to feed my family, or buy a brand-new TV? People start buying more “needs” and fewer “wants”.

3. What are the Signs of a Recession?

Now that we know what might cause a recession, what are some signs that would indicate we’re currently in a recession?

Rising Unemployment and Layoffs

When unemployment and layoffs suddenly occur, this is a sign of a recession. These layoffs occur usually because the company needs to cut costs quickly to maintain its business. If a company is planning on growing, it would make sense they need more employees to help with that growth. Getting rid of employees typically isn’t a sign of growth.

Invert Yield Curve

This may be a topic for another day, as this is a lot for a new investor, but the yield curve measures the interest rates on Bonds based on the maturity date (how long you have to hold them). A normal curve will start with small yields with 1 and 2-year bonds, then grow with longer-tenured bonds. However, when the Fed raises interest rates Bond rates tend to rise accordingly. The problem occurs when the yields for short-term Bonds become higher than long-term bonds. Hence, the inverted yield curve.

For those visual learners out there (I am one of those), visit this Visualizing Yield Curves article that illustrates how a normal yield curve becomes inverted.

Drop in the Market

In general, the Stock Market is an indication of the general economy. When the economy does well and there are greater earnings, the Stock Market will reflect that. So, when we see the Market drop, that can be a reflection of the economy dropping as well.

4. How to Survive a Recession

Let’s imagine that all these causes have occurred, and we are showing signs that we are in a recession. As investors, as normal citizens living through a recession, how do we survive or outlast a recession?

Build or Add to an Emergency Fund

While investing is very important for the future, a good investor should always be prepared for the unexpected. If one of the signs of a recession is job loss/layoffs, it is important to be prepared for that. Having a couple of months of living expenses saved up will help if a layoff should affect you or your family.

For more information, read my article on the 7 Reasons Why You Need an Emergency Fund.

Delayed Gratification

When things are tight and uncertainty looms, it might be good to put off that new house renovation, purchase a new car, or go on a trip. Take that money you might normally spend, and throw it into a high-yield savings account, or add it to your emergency fund.

5. Length of Recessions

While recessions sound scary and living through a recession may feel like it may never end, it will. Since WW2, the average recession lasts 10 months. In the grand scheme of life, 10 months isn’t that long. As the market starts to re-correct itself back out of a recession, most losses during that time will quickly regain themselves before the start of the recession.

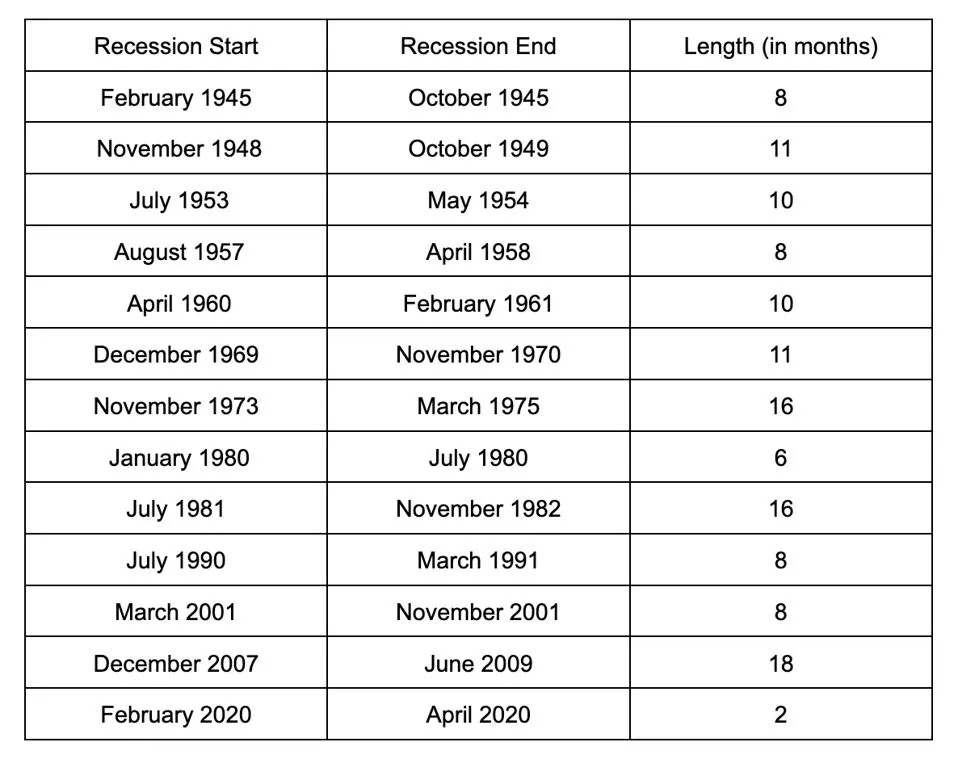

Below is a list of recessions after WW2, with their lengths in months.

Since 10 months is the average, the next section will highlight a couple of recession examples to show how different each one may be.

6. Recession Examples – Learn from the Past

Let’s study a couple of examples of recent recessions to get an idea of how the above topics related to history.

2022 COVID Recession

The most recent example of a recession was in March 2022 when the COVID pandemic hit the United States. As described in the causes section, a sudden economic change can also cause a recession. In this case, shutting down the economy and sending people home from work, did cause that sudden economic change.

If a sudden economic change was the cause, can we confirm this was a recession? According to the signs we listed above, we can see a drop in the Stock Market. The chart below shows the S&P500 with a sudden decrease in March 2020. You can also see the duration as it took only one month to recover more than 50% of that loss.

The Great Recession

Another recent recession of memory, the Great Recession, dated from December 2007 to June 2009. Unlike what happened with the COVID recession, the Great Recession’s causes took longer to realize. One of the main causes of this recession related to the bursting of the U.S. housing bubble. We won’t go into details today; however, the main takeaway is that a lot of people who bought homes in the early 2000s ended up over-borrowing and buying houses they could no longer afford. Prices for homes dropped and interest rates increased; people could no longer make their payments.

This bursting of the housing bubble created a snowball effect from the banks to the rest of the economy and the world. Unemployment nearly doubled during this time and there was a decline in GDP between 4%-5%. This was one of the biggest recessions since the 1930s Great Depression, hence giving it its name, the Great Recession.

7. What is the Difference Between Recession and Depression

If the Great Recession was named after the Great Depression, and there hasn’t been a depression since the Great Depression, what is the difference between a recession and a depression? Let’s do a quick review of the Great Depression.

The Great Depression lasted 10 years, from October 1929 to 1939. Really puts the 19-month Great Recession into perspective.

Before the Great Depression, was the decade of the 1920s, or as it was referred to, “the Roaring Twenties.” During this period, there was an economic boom, leading to the rapid expansion of the Stock Market. When the Stock Market rises faster than the output of the economy, there is bound to be a correction, and that correction hit hard. The terms “Black Thursday” and “Black Tuesday” occurred in October 1929, which led to massive amounts of trading and selling, where people ended up losing everything. Nearly half of all the banks in the U.S. failed and everything spiraled downward.

With that background behind the Great Depression, the sheer size of loss and length of this correction is the main difference between a recession and a depression.

Summary of Recessions for Beginners: 7 Facts

It is important to learn and understand what a recession is. Everyone claims to be an expert in recessions, so understanding the previous 7 facts of recessions for beginners is key.

Recessions happen all the time, varying in size to make corrections in the Market.

We can define recessions with a simple word, decline.

Thanks for reading about recessions! Hopefully, this gives a good introduction to recessions and how we should view them as beginning investors. To learn more about the Stock Market, read this Stock Market Guide. Please leave a comment if there is something you learned.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Hi therre every one, heree every one iis sharing suchh experience,

thus it’s good to reqd his webpage, and I useed to go too see this blog everyday.

Hey very nce blog!