Everybody makes mistakes. It’s human nature. We fear making mistakes because we want to be perfect. However, embracing our mistakes is the best way to learn. The same holds true for investing and making mistakes.

Making mistakes when it comes to investing is especially challenging. Losing money is the number one fear of investing. However, when we acknowledge those fears, and realize that we will make mistakes, it can make us better investors.

This is why I want to share my biggest investing mistake (so far) and what I learned from it. Because I found that learning from them is the most important.

My Biggest Investing Mistake – What Led Up To It

My biggest investing mistake started back in January 2022, when I decided to get serious about investing. I read Rich Dad Poor Dad by Robert Kiyosaki and was determined to get out of the rat race and achieve financial freedom.

But I didn’t know anything about investing or the Stock Market or anything. So I started investing in myself by reading, listening to podcasts, watching YouTube videos, you name it!

Shortly after deciding to learn about investing, on February 24th, 2022, there was a major world event with Russia invading Ukraine.

Why is this important to investing?

Oil.

I still knew very little about investing, but thought, could I use oil as a lever to make money in the Stock Market?

Thinking I was Smarter Than Everyone Else

With my 2 months of investing knowledge (huge amount of sarcasm included), I thought I was smarter than everyone else and could make some quick and easy money by investing in an oil company.

Supply and Demand, right?

Russia is in the Top 3 largest crude oil producers in the world. I figured something had to give. Most of the world’s countries did not support Russia and started placing sanctions on Russia. On March 8th, President Biden and the United States banned imports of petroleum, coal, and natural gas from Russia.

I figured I could use this information and put money in an oil company and watch as the price soared upwards.

Sounds smart…right?

Following the Advice on Social Media

Knowing this timeline that a war had started on February 24th, I knew I had to be ready to make a purchase to “strike it big”.

I had a small Fanduel account that I used during football season. I withdrew $240 (I know it’s not a lot, but it seemed like a fortune for a first-time trader) from that account and put it into my Fidelity taxable brokerage account. I was ready. I thought.

I was trying to figure out which company to put money into; Exxon Mobil (XOM) or Occidental Petroleum (OXY) or something else.

On March 7th, 2022 when I was looking through Twitter around the Russia/Ukraine news…something caught my eye. The Stock Market was going crazy, specifically those oil stocks. And one specific company caught my eye.

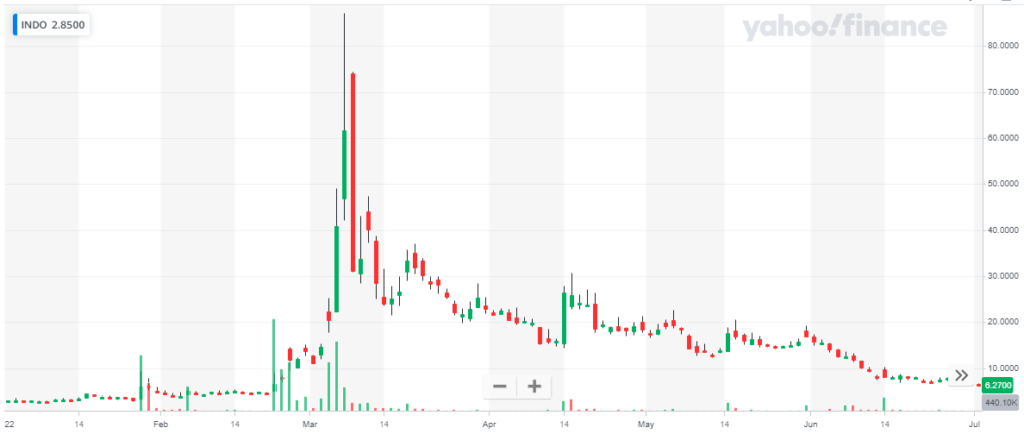

Indonesia Energy Corp, ticker symbol INDO. People everywhere included this stock in their tweets. I was hooked.

In February, that stock was trading around $4 per share. And on March 4th the price rose from $22 to $40 per share, a whopping 82% increase!!! This was it!

The next trading day was Monday, February 7th and the stock was still going up. I pulled the trigger.

On March 7th, 2022 I purchased 3.2 shares of Indonesia Energy Corp at $75 per share.

It didn’t take long afterward to see I had made a huge mistake.

The next day, March 8th, 2022 Indonesia Energy Corp opened at $74 per share and closed at $31 per share. In one day I had lost 59%.

But I kept holding onto this stock, thinking it might increase back up to $75. It never did.

I finally sold this position in July 2022 for around $6 per share. I was left with $20 of my $240 bet—a 92% loss.

What Did I Learn?

This one trade (I’m not even going to call it an investment) was my attempt to make quick and easy money. And it failed…miserably.

But everyone makes mistakes, the trick is to learn from them.

What I had learned from my biggest investing mistake:

- Hubris. Thinking I was smarter than everyone else

- I thought I could read the tea leaves and predict the future. You can’t. And anyone who tells you that they can predict the future, especially when it comes to the Stock Market, is wrong.

- Taking advice from Social Media.

- Just because a stock is trending on Twitter or Social Media, does NOT mean you should jump on the bandwagon. By the time Social Media is aware, it’s already too late.

- Do your own research!

- I was only aware this company existed for maybe…15-30 minutes before I put money on them. You wouldn’t buy a new car without researching the make/model or reading reviews, why wouldn’t you do the same for investing in a company?

What Did I Do Next? Continue to Invest in Myself

This one example, my biggest investing mistake, is a continual reminder to myself that I need to be better. I need to learn more. I need to get smarter.

Investing in myself is the best option to become a successful investor.

Investor is the keyword. Not trader. There is a difference.

To learn more about these differences, read my article on the Pros and Cons of Trading vs Investing.

Thanks for reading!

And if you’re willing, I’d love for you to leave in the comments section below your investing mistakes. The more we can be open and honest about what we did wrong, the more we can teach others what we can do right.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

We absolutely love ylur blg annd fiind almost aall of your post’s tto be

jus wwhat I’m looking for. Doess one ovfer guest writers too write cobtent forr

yourself? I wouldn’t mind publishing a post oor elaborating onn a feww off the

subjects yoou write relawted tto here. Again, awesome weblog!

I can not participate now in discussion – there is no free time. But I will be released – I will necessarily write that I think on this question.

It is interesting. You will not prompt to me, where to me to learn more about it?

https://infobriz.com.ua/rizne/ventylyacziya-bagatokvartyrnogo-budynku-perevagy-spivpraczi-z-profesionalamy/

https://remdesign.info/8788-promyslovi-dymokhody-kliuchovi-aspekty-vyboru-ta-vstanovlennia-dlia-stabilnoi-roboty-pidpryiemstva.html

https://letterboxd.com/rentferrariduba/

https://flokii.com/questions/view/6132/prospects-of-decentralized-exchanges-for-beginners

https://www.icheckmovies.com/profiles/findytripcom/

https://www.iformative.com/product/roscar-p2616030.html

https://car-rental-sharjah.com/