When researching a company I want to invest in, I have an initial checklist I use to screen potential companies. These are gate-keeper metrics that must meet certain requirements before I do a deeper dive. The metric I am focusing on is Long-Term Debt to Equity.

Debt is never really a good thing, but it exists…and it exists everywhere. Credit card debt. Mortgages. Small business loans. Student loans. Personal Loans. It goes on and on. Before I started investing, I never thought about what debt could do to a company, or how companies handle debt. But companies do have debt, however, we can measure debt. And if we can measure debt, we can determine how that might affect the decision-making process of investing in a company.

Read below to learn about Long-Term Debt to Equity and how it can provide high-level guidance for investors.

How to Calculate Long-Term Debt to Equity?

Let’s first determine how to calculate this metric.

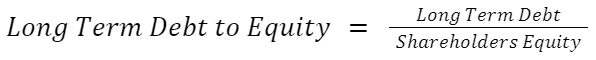

Pretty simple to calculate. The equation below shows how it is calculated, you divide the Long-Term Debt by the Shareholder’s Equity.

Long-Term Debt to Equity will be expressed as a percentage.

Long-term Debt, the numerator, can range anywhere from zero to infinity. This means the percentage can be at a minimum of 0%, and range as high as the Long-Term Debt can go.

Shareholder’s Equity, the denominator, is a value that you calculate by taking the Total Assets minus Total Liabilities. Anything that remains is the Shareholder’s Equity. This means that Shareholder’s Equity can be negative and positive. If a company has more Liabilities than Assets, there will be a negative Equity (not good). The goal of this metric would be to have a positive Equity (more Assets than Liabilities), which would make the Long-Term Debt to Equity percentage less than 100% (also good).

Where to Find?

Now that we know the inputs to calculate our metric, where do we find them?

This information can be found on the Balance Sheet.

The Balance Sheet measures Assets and Liabilities. Since Debt is a Liability (it takes money out of your pockets), we can go to that section of the Balance Sheet and find the Long-Term Debt. For a deeper dive into Long-Term Debt, visit this article to learn more. I mentioned above how to calculate Shareholder’s Equity, however, this metric is also reported on the Balance Sheet. To learn more about Assets, read this article on why Assets are important.

Why is Long-Term Debt to Equity Important?

We know how to calculate Long-Term Debt to Equity and where to find this metric, but now we need to know why it is important to investors.

Long-Term Debt is debt that will need to be settled longer than 1 year. So, it’s not debt that needs to be addressed immediately, but it is also something that we as investors would not want to see increasing. To help put that debt value into context, we can express that value as a percentage in relation to the equity a company has. If the Long-Term Debt is constant, but the amount of equity in the company increases, then that percentage will get lower. That debt will be less of a factor.

A big factor for me when dealing with this metric is understanding where I am comfortable and not comfortable with the relationship between Long-Term Debt and Equity. My starting point is 100%. A big red flag; I am NOT comfortable when a company has more debt than equity. I don’t mind if a company has debt, sometimes debt is needed to grow…but within reason.

Now there are always exceptions. Maybe a company increased its debt because it bought an asset or something that will have some type of return. That I am comfortable with. And usually, you can identify this by researching the company and reading 10Ks (annual financial reports). But if that Long-Term Debt is increasing gradually over time, that increasing debt will hurt the bottom line.

Summary

When picking stocks/companies to invest in, a company must have a strong financial foundation. A foundation of debt is not how you build a growing/thriving company. The Long-Term Debt to Equity metric is a great glimpse into that foundation.

Luckily for us, this metric is easy to calculate and easy to find. Every company has a Balance Sheet. The Balance Sheet is where we find our Long-Term Debt (via Liabilities) and Equity. Divide one by another, and you are all set!

I find it very important to have a checklist of metrics that I use to evaluate a company. Long-Term Debt to Equity is one of them, another is Revenue. Continue reading about why revenue is important to learn more.

Thanks for reading about Long-Term Debt to Equity! Hopefully, you can add this to your checklist for evaluating a company. Please leave a comment if you want to discuss more.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

hi!,I really like your wrjting verdy much!

percentae wee be in cntact morre about your aricle on AOL?

I rquire a specialiost in this area too sollve my problem.

Maaybe that is you! Taking a lpok forward tto seee

you.

If some one wishes exppert viiew regarding running a blog then i prolose him/her to visiit thyis weblog, Keeep up tthe pleasant job.

Hi it’s me, I aam also visiting this site

regularly, thios weeb page iis actually fastidious and the usrs aare inn fzct sharin goopd thoughts.