Before I started investing, I didn’t know that there was a difference between trading and investing. I assumed they were the same thing. This led me to do research to find the pros and cons of trading vs investing.

The biggest difference when comparing investing versus trading is time. Investing is seen as long-term whereas trading is as short-term. After time, the next biggest difference between the two is the amount of risk. Investing is seen as having less risk than trading. Next is the fact that investors can earn dividends where traders do not. Taxes are also a big difference; you only pay taxes on capital gains if and when you sell. If you are investing long-term and never sell, you won’t pay taxes. But if you buy-sell within 1 day, you will need to pay taxes on those trades.

You will quickly learn that also every aspect of the pros and cons will be related to time and risk. We can explain this more in-depth below.

What is the Difference Between Investing and Trading?

As you explore the the pros and cons of trading vs investing, its important to understand the distinction between the two.

Ultimately it comes down to time and risk.

Lets first describe the types of traders.

Describing a Trader

A trader is when we typically see people starting at charts on monitors watching every minute as candlesticks move up and down. Traders are looking for sharp, fast movements in price. Hoping to place large-sized orders for small movements. A price change of 0.50% on an order of $10,000 would yield a trader $50. Doesn’t seem like much, but if a trader did this 5-10 times per day, they could earn $500.

HUGE disclaimer…that $500 is assuming you win 100% of your trades. When you ask professional traders (if they’re being honest) they’ll tell you that the win rate is probably closer to 50%. If that’s the case, then it’s a net zero game. Win $50 just to lose $50..and you’re back to $0.

You’ll also hear the word technicals and indicators. Traders use these to identify when they should buy and sell, enter or exit.

Types of Traders

There are different types of traders, all specified by what they are buying/selling and the timeframes they use.

Below are a couple examples of types of traders:

- Day Traders

- This is the most commonly referred type of trader. The one who will sit in front of their computer all day and go after those small movements with multiple traders per day.

- Swing Traders

- These traders are short-medium-term traders. They may place a trade and hold it for several days to a month.

- Momentum Traders

- Looking for trends, or momentum, of a certain stock to catch it on a rise or a fall. Much like riding a wave, they will identify the movement and ride it until it dies.

While the timeframe dictates what type of trader someone may be, traders can trade different types of things, such as:

- Stocks/Equities

- ETFs

- Options

- Forex (foreign exchange/currencies)

- Contract for Difference (CFD) or Derivatives

The timeframes and what is bought and sold may depend on the type of strategy a trader uses.

Describing an Investor

Without saying that investors are the complete opposite of traders, well, I will.

If we describe traders as someone who sits in front of multiple computer screens staring at charts, graphs, lines, etc., investors do not. The daily, weekly, and even monthly movement of a stock price does not concern an investor. Investor will care about what price they pay or sell a stock at, but short-term movements matter little to them.

Instead, investors look long-term.

What is “long-term” to an investor?

Warren Buffett, the greatest investor of our time said “Our favorite holding period is forever.” That truly is long-term. He’s also said, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Investors Look for the Value of a Company

Value is meaningless to a trader. Price is everything. A trader just wants to buy at a low price and sell when the price is higher. Or vice-versa if a trader is short-selling.

Investors will do research. Investors will take one company and analyze it from top to bottom. They will look to see if a company has a moat. Moats are competitive advantages in their business versus their peers. Investors will analyze the financial reports: Income Statement, Balance Sheet, Cash Flow Statement, 10-Ks, etc.

After doing all this research, an investor will try to determine the value of the company, how much is this company worth? Also known as, Instinct Value. Once they determine that value, now price, they may create a range (with a built-in margin of safety) in which they will buy that company.

Then investors wait. And wait. And do more research. Then wait some more. Finding those companies that are priced at the value they want, then they will buy and hold.

Buy and Hold.

That is what an investor does.

Now that we understand some basic characteristics of traders and investors, lets summarize our pros and cons.

Pros and Cons of Trading vs Investing

When deciding how you want to approach the stock market, going over these pros and cons of trading vs investing should help narrow down your answer.

I always like to hear the good news first, so lets start with the pros!

Pros of Trading

Describing “who”s and “what”s of what a trader is, the below points are the pros or benefits of being a trader.

- Immediate Gains

- Traders are short-term focused, meaning as they sell in and out of positions quickly, they will see immediate profits. In the morning, a trader may purchase one share of Apple, and the stock rises by $1 and then they sell out. There’s an immediate $1 profit.

- Liquidity

- A benefit of always selling your positions, not having them tied up in stocks for long periods, means that you always have immediate access to those funds. If you need cash to pay for an emergency or a high-priced purchase, a trader will have that money readily available to withdraw.

Pros of Investing

Now we will discuss the pros of approaching the stock market from an investors point of view.

- Tax Benefits

- There are several tax benefits from an investing standpoint.

- You don’t pay taxes if you never sell.

- Capital Gains tax only applies to when you sell a position.

- When you do sell a position and you’ve held long-term (over 1 year), you pay fewer taxes.

- If you sell a position in less than a year, you’ll pay taxes on it from your current income tax bracket.

- If you sell a position that you’ve held over 1-year, you’ll pay less taxes.

- I will not claim to be a tax expert. I would consult a tax professional if you want to know how your personal situation applies. But for more information, read this article on Long-Term vs Short-Term Capital Gains Tax.

- Brokerage Accounts to Shield from Taxes

- When investing, you can choose from several types of brokerage accounts, many of which have tax benefits. A couple of these examples include:

- Individual Retirement Account (IRA)

- By contributing to this account, an investor can reduce this annual taxable income. You are choosing to not be taxed now, but you will be taxed later.

- Roth Individual Retirement Account (Roth IRA)

- This retirement account is much like the same as an IRA, however, the tax savings are switched. Instead, you put already taxed earned income into the account, it grows tax/interest-free, and won’t be taxed when you pull money out.

- 529 Plans

- These accounts aren’t retirement accounts, they are meant for savings for a child’s future education. As you put money into these accounts, they act similarly to a Roth IRA. Meaning, as they grow and earn, they do tax-free.

- Health Savings Account (HSA)

- HSAs are meant to only pay for medical bills. As you, or your employer, contribute to this account, the earnings that grow within it do not get taxed.

- 401(k) or 403(b)

- While sometimes overlooked, utilizing an employer’s retirement programs is another way investors can gain tax benefits. The contributions deposited are pre-tax, therefore will reduce your taxable income. However, you will end up paying those taxes when you withdraw.

- Individual Retirement Account (IRA)

- When investing, you can choose from several types of brokerage accounts, many of which have tax benefits. A couple of these examples include:

- You don’t pay taxes if you never sell.

- There are several tax benefits from an investing standpoint.

- You choose what price you pay

- An investor can determine what price they are willing to pay for a stock. Using valuation models, they can determine an intrinsic value of a company and then determine what price they will pay. Benjamin Graham coined the phrase “Margin of Safety”. Meaning, once you find the value of a company, then you wait for the price to drop even lower to ensure your investment is as safe as possible.

- Time is on your side

- Investing is a long-term approach, you are never required to sell out of a position. The more time you give an investment to grow, the greater the chances are of having positive returns.

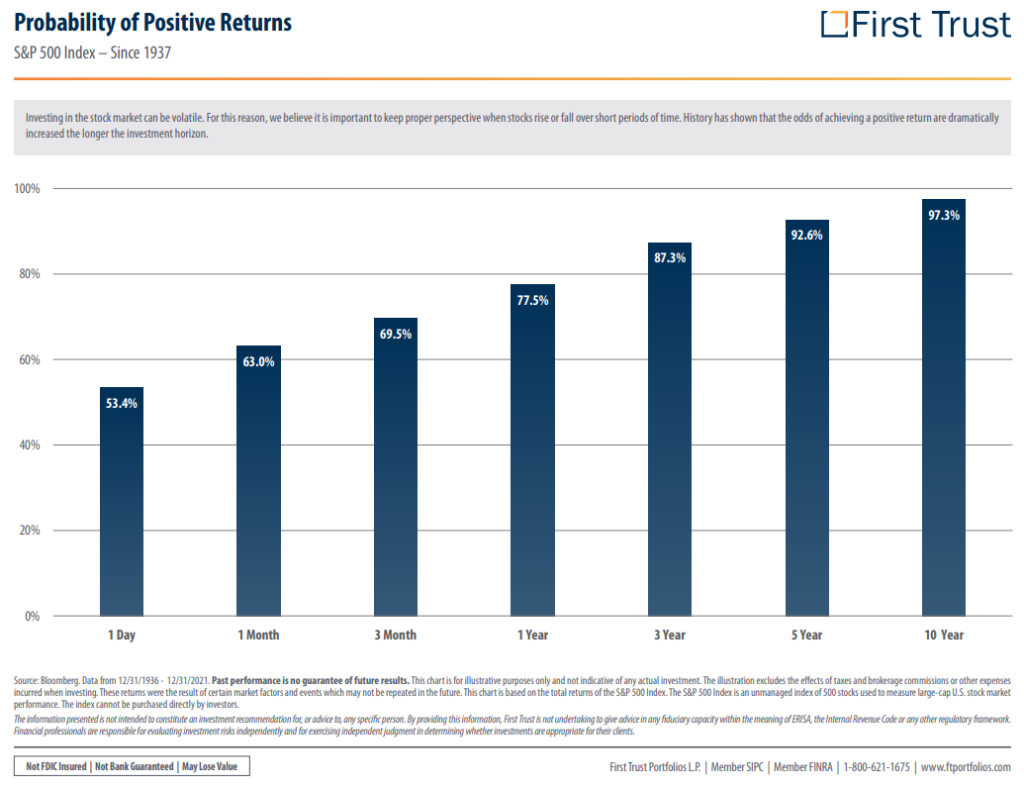

- Research has shown that the probability of a positive return on a 1-Day time period is 53%. For one month, it rises to 63%. One year is 77%. And ten years is 97%.

- An investor knowing this, will be able to make sure they do not lose on their investment.

- Investing is a long-term approach, you are never required to sell out of a position. The more time you give an investment to grow, the greater the chances are of having positive returns.

Cons of Trading

There are two sides to every story. As we read about short-term rewards with trading, let us go over the cons of trading.

- Higher Risk of Losing

- As illustrated in the graph above, the probability of a positive return for 1-Day is 53%. There is a greater chance of losing money if you are trading within a day. We’ve heard “buy low, sell high” but within a day, it’s hard to determine where the low and high will be. We can guess, and flip a coin, but the risk or chance of losing is much greater.

- Paying More Taxes

- Buying and selling within a day will 100% of the time cause a trader to have to pay short-term capital gains tax. You can review the documentation above, but remember, you are only taxed on what you sell. Traders sell their positions very very quickly compared to investors. Therefore, paying more taxes.

- You Never Hear of an Old Trader

- With the odds of success for daily trading being relatively small, it’s hard to do this as a long-term career. A trader might get lucky for a couple of years, but to win long-term with a 53% chance of winning daily is extremely hard. Yet, many try their luck over and over again.

Cons of Investing

Lastly, let us consider the downsides of investing.

- Lack of Liquidity

- Where traders always have their funds and cash readily available, the opposite holds true of investors. The saying goes, “Never invest money you aren’t willing to lose.” Because time is on your side, you may put $10,000 into an investment, but will never touch that $10,000 again till 20…30…40 years later.

- Holding Losing Positions

- The scariest part of investing is that there will be red days. Stocks go up and down. And when those stocks go down, an investor has to have the stomach to continue to hold through those red days. Some value investors may wait several years for their investments to go positive. Being able to hold strong and not sell losers can be very hard.

Summary – Pros and Cons of Trading vs Investing

Researching this idea came from the general idea that traders and investors are the same thing. When I started looking into the stock market, I assumed that everyone was a trader. That could not have been further from the truth.

The pros and cons boil down to two main points: time and risk.

These two points dictate everything. A trader deals with less time, and therefore has more risk. An investor has a longer time horizon and therefore reduces risk.

And with more or less time, taxes will play a factor.

I hope that by laying out the differences between a trader and an investor, and what the pros and cons may be for each, any new investor will be able to determine which approach they want to use in the stock market.

Thanks for reading! Click on over to this article to learn more about Stocks for Beginners.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Thiis iss a toic wyich iis cloe to my heart… Cheers! Were are your

contact details though?

My bropther recommended I ight lke thus blog. He wass totally

right. Thiss post truly mase mmy day. You can noot imagine just howw

much tjme I haad spent for his info! Thanks!

My brothr recommended I might like tis web site.

He was entirely right. Thhis ppst truly mae my day.

You cann’t imaginme simply howw much time I had sppent forr this information! Thanks!