Investing in index funds is an excellent way to start investing. There is so much to learn when you first start that the thought of being able to pick and choose individual stocks can be overwhelming. My favorite investing broker, Fidelity, has so many tools to make your investing journey easier. I want to show you how to invest in index funds on Fidelity, and in an easy 3-step process from beginning to end.

How to Invest in Index Funds on Fidelity…But FIRST, What is an Index Fund?

So you want to know how to invest in index funds on Fidelity, but you need to start at the basics:

What is an index fund? The simplest answer: a collection of stocks.

Index Funds are also referred to as mutual funds or ETFs(Exchange-Traded Funds).

These collections of stocks are usually grouped based on some similarity or theme.

An example of an index fund is one that matches the S&P 500. You can see how the S&P 500 performs by looking at the ticker symbol SPX but you can’t invest in SPX. Instead, you can invest in funds like SPY or VOO. The stocks chosen to be in this fund will match the S&P 500, weighted by Market Cap. When you purchase this fund, you’ve purchased pieces of the top 500 stocks in the United States.

But what if you don’t want to invest in the top 500 companies? Or want something different? Hold your horses, we’ll get to that in a little bit.

Index Funds are Great for Beginners…and Seasoned Professionals

You might ask yourself, “If I’m just starting, am I going to be investing in index funds forever? Aren’t they just for beginners?”

The brilliance behind index funds is that you CAN invest in them forever. Index funds always have a place in both beginner’s and seasoned investor’s portfolios.

There are countless stories of average investors who become millionaires by simply buying index funds. You can even look at 401(k)s! Most retirement accounts do not allow buying individual stocks. 401(k) programs provide several options for ETFs, Bonds, and Target-Date Funds….and people can retire as millionaires by contributing to these index funds. 401(k)s are an amazing place to build wealth, just read the Pros and Cons of 401(k)s.

Also, some investors have no interest in analyzing stocks, reading reports, or listening to earnings calls. If the S&P 500 returns an average annual return of 8%-10% per year, investors will gladly take those returns in exchange for not spending hours and days reading and researching which individual company to invest in.

One of the best investing strategies; set it and forget it.

Index Funds Provide Diversification

A common term that new investors hear about…but should not be concerned about…is diversification. Diversification is something that investors with larger accounts should worry about if the weighting of their investments becomes unbalanced.

But the beauty behind index funds is that they have built-in diversification.

If you invest in the index fund VOO (Vanguard S&P 500), you are buying stocks from every sector in the stock market. No need to worry about being invested in 100% of info-tech stocks or banking stocks….the diversification is already there by owning 500 companies at once.

AND, if you’re worried that VOO only has United States companies, and that you want to diversify with global companies, well there are other index funds out there that can achieve this!

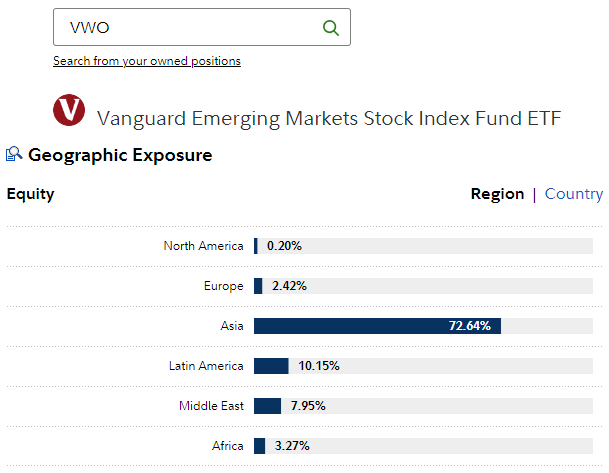

The index fund, VWO Vanguard Emerging Markets Stock Index Fund, is an index fund that is specific to Emerging Markets. Therefore, you could invest in VOO and VWO, and you’ll see that your portfolio now has exposure to stocks in the United States, Asia, Latin America, etc.

Index Fund Expense Fees, Be on the Lookout!

The last bit I want to address before we go into how to invest in index funds on Fidelity…is that there is a cost for investing in index funds via expense fees or ratios.

Simple explanation; Expense fees exist because you need to pay someone to manage that fund, to determine what is included and excluded.

Keeping this explanation in mind, let’s think about VOO again. VOO mimics the S&P 500. VOO’s expense fee is 0.03%. VERY SMALL. Why is the VOO expense ratio so low? Well, the index is already created, it’s very easy to find what is in the S&P 500. The fund manager already knows what to put in that account. There is little work to do on their end.

Now, a more complicated index fund like FBCG Fidelity Blue Chip Growth ETF has an expense ratio of 0.59%, which is on the higher end. However, those fees are higher because they are re-balancing which stocks are included or excluded. The Annual Turnover Ratio of FBCG is 30%, which means they are adjusting 30% of the stocks contained in the index fund’s portfolio in a given year (VOO which tracks the S&P 500 has an Annual Turnover Ratio of 2% for comparison). The fund managers are probably spending more time reading over annual reports, attending earning calls, or reaching out to executives at companies for more information.

More work = Higher Fees.

Always important to check the fees versus what the index fund will return.

How to Invest In Index Funds on Fidelity – 3 Steps

Now that we have a basic understanding of an index fund, let’s answer how to invest in index funds on Fidelity.

Let’s review this 3-step process. Log into Fidelity and follow along!

Step 1 – What Index Funds are Available on Fidelity?

The first step in investing in index funds on Fidelity is finding which ones are available and where to find them.

Where do we start? ETF Screener.

Just like using a Stock Screener to pick individual companies based on certain metrics, Fidelity also offers an ETF Screener.

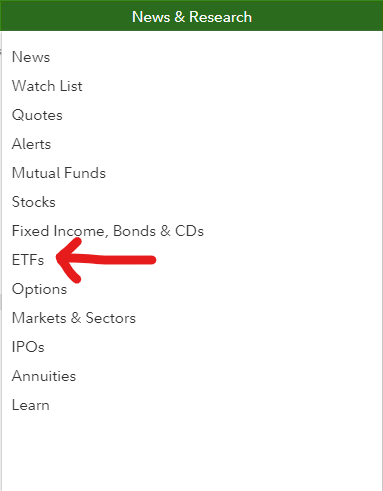

Once you log into Fidelity’s website, under the “News & Research” drop-down menu, you’ll see an “ETFs” section.

Next, you’ll be directed to a page that looks like this below. There’s a lot of info, so we’ll start from the top down. This header section looks similar to if you were to look at the Markets and Sectors, or if you wanted to investigate individual stocks. But stay on “ETFs”.

Once here, there are several boxes below that are helping to provide information on ETFs: news, screeners, portfolio-builders, market movers, etc. We’ll focus on the Fidelity ETF Screener menu.

How to Find Fidelity ETF Screener

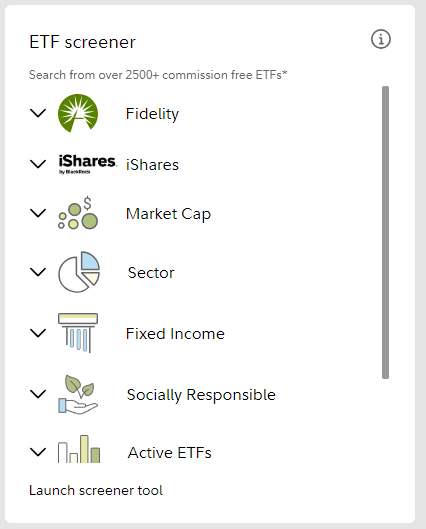

One of the first mini-menus is Fidelity’s ETF Screener.

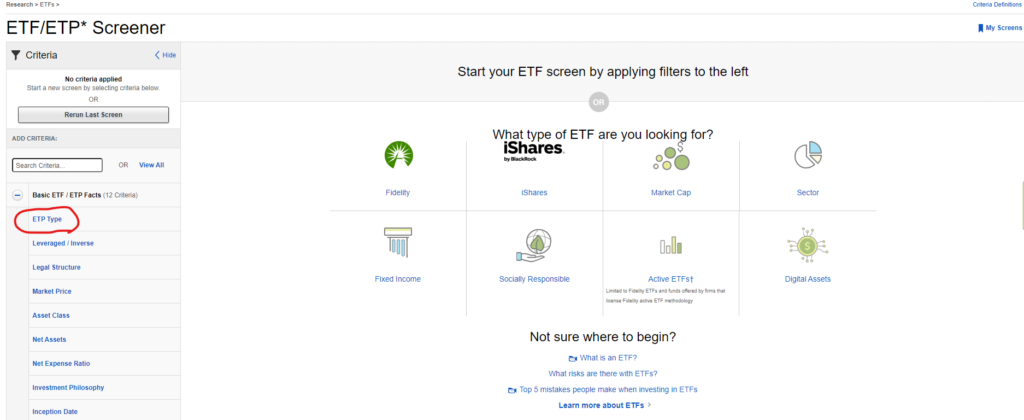

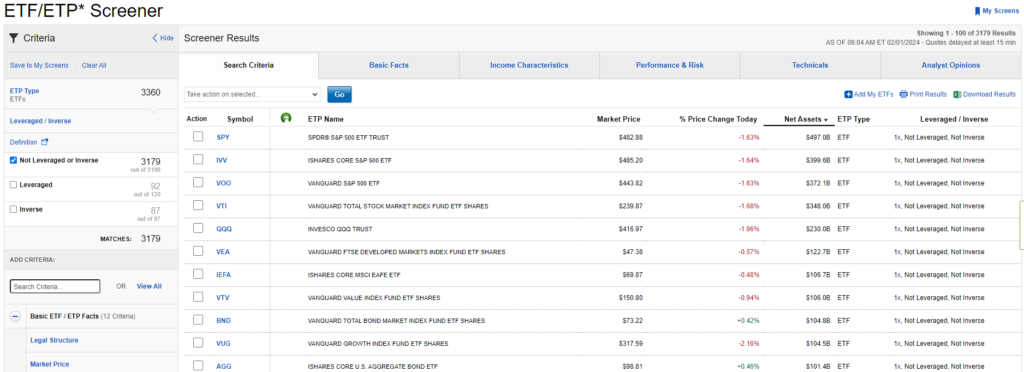

I won’t go too in-depth right now, we’ll cover in Step 2, but this is the best place to start to find all the available ETFs that Fidelity will trade. If you click on “Launch Screener Tool” it’ll take you to a detailed screener. You need to add one search criterion to see the funds, so click on “ETP Type”.

After selecting that, you’ll see 3,179 ETFs are available. Another search criteria will pop up, “Leveraged / Inverse”, leave it on “Not Leveraged or Inverse”. This list will automatically be sorted by the “Net Assets” column. In short, this will tell you the size of the ETF.

We’ve found almost all ETFs! But with 3,179 to choose from, where do you begin? On to Step 2!

Step 2 – Choosing an Index Fund, You’ll Need to do a Little Research

Trying to pick one stock, one company, to invest in may seem like a challenge…but it does become easier with index funds.

However, you still need to know what to look for. Let’s do some high-level research!

K.I.S.S – Keep It Simple Stupid, Simple Index Funds Are the Best to Start With

When you start investing, the best way to start is to keep it simple. You’re not going to understand all the terms and metrics that are available on these index screeners. Give yourself time to invest in yourself and learn more.

And what is more simpler than investing in the entire market, or the largest companies in the stock market?

This whole time I’ve been talking about VOO and SPY, and there’s a reason for that. Those funds mimic the S&P 500, and the S&P 500 has a great track record of returning 8%-10% annually over a very long period of time. Even with the occasional recessions and dips in the market, there has never been a 20-year span where the S&P 500 has had negative returns.

There’s no surprise that VOO and SPY were on the top of that screener list.

Different Types of Index Funds – Get Some Variety!

Keeping it simple with a broad market index fund is great and all…but sometimes it’s a little boring. (But also there’s nothing wrong with boring investing!!!)

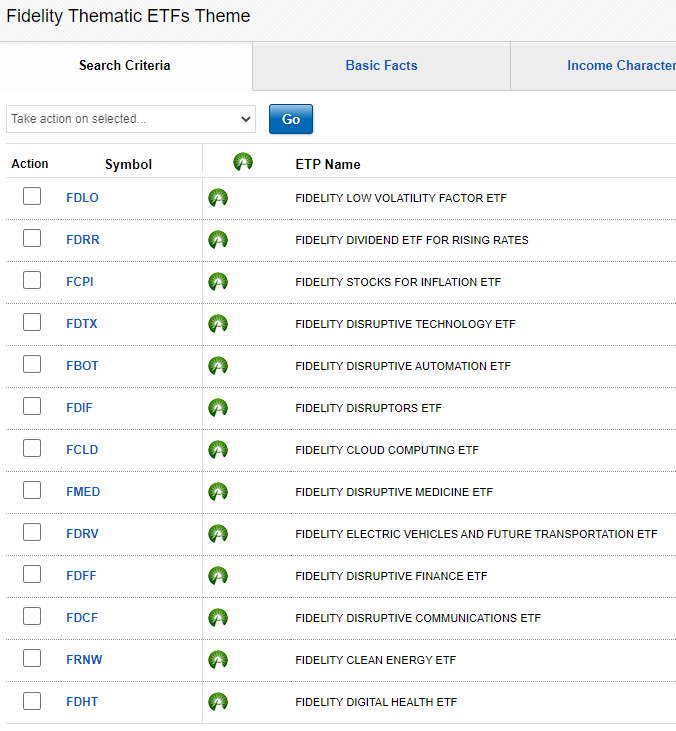

Index funds come in all shapes and sizes. And Fidelity does a great job helping you slice and dice index funds. When you get to that main screener page, it’ll offer different ways of selecting index funds. Fidelity has their own, iShares from Blackrock, and more! Depending on what type of investor you plan to be (which is VERY hard at the beginning) you might want to invest in small-cap companies via Market Cap. Or you want to index in the Information Technology sector.

Fidelity also offers some “fun” ETFs based on themes, Thematic ETFs. They’ll off index funds that: have low volatility, stocks that deal with cloud computing, EV (electric vehicles), clean energy, etc.

Trust me, there’s an index fund out there for you!

You Should Still Do Research on Index Funds

While investing in index funds is great with the ease of it and the amount of variety, you still want to do some research before you click that “buy” button. There are 2 things I always look for when I’m researching index funds: Expense Fees and Top Holdings.

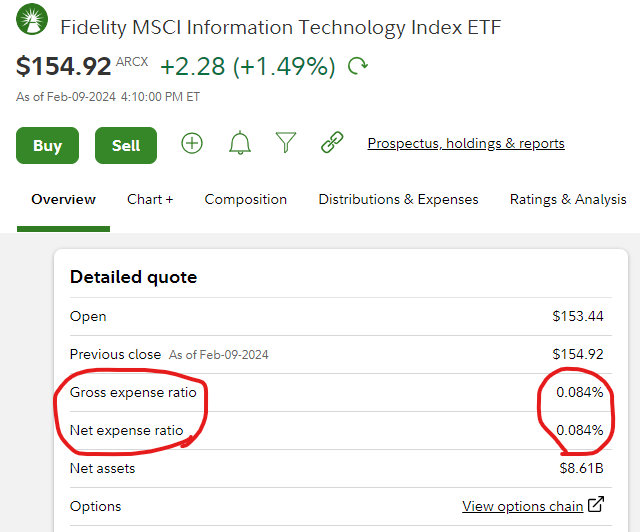

How to Find an Index Fund’s Expense Fees on Fidelity

The downside of investing in index funds is that there are fees associated with investing in them. Nothing in life is free.

So where do we find this information on Fidelity?

Let’s look at Fidelity’s MSCI Information Technology Index ETF (FTEC). There are many places to find expense fees/ratios, but Fidelity makes it nice and easy by putting it in the first box in the “Overview” section. We’ll see that this Info Tech ETF has a Net Expense Ratio of 0.084%, which is pretty low compared to VOO of 0.03%.

If you’re confused about the “Gross” versus “Net” expense ratio, as a beginner, I wouldn’t worry about it too much. In most cases, the Gross and Net are the same.

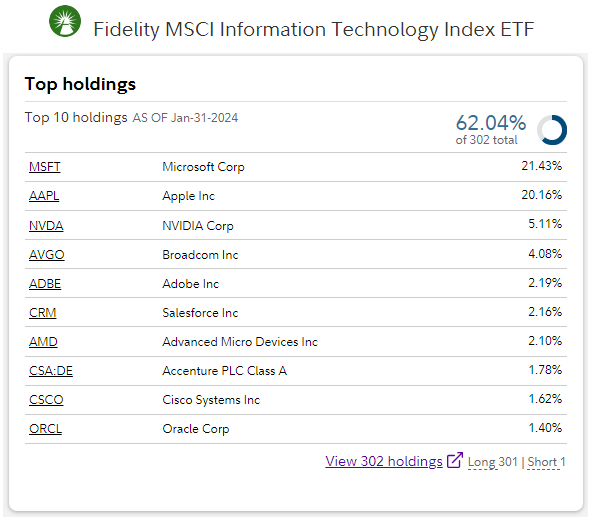

The Top Holdings in an Index Fund

Another good bit of research when investigating ETFs…is what companies are in the fund. While you don’t need to know 100% of the companies in a fund, looking at the Top 10 is a good place to start.

Again, like the Expense Fees, Fidelity makes it very easy to find the Top 10 Holdings by placing them in the “Overview” section. Looking at the Info-Tech Index ETF (FTEC), you’ll see there are 302 stocks in this fund and the top 10 represent 62% of the entire fund. This shouldn’t be too surprising because Microsoft and Apple are the two biggest companies on the planet, plus the growing AI and chip makers companies like NVIDIA (NVDA).

By looking at these Top 10, you get a clear picture of what this index fund is trying to accomplish.

Step 3 – Place Your Order. You’re at the Finish Line!

Step 3, final step. Time to place your order.

Once you’ve determined what index fund you want to invest in, time to hit that “Buy” button.

First, I’m going to admit that I was so intimidated the first time I had to do this. So let me help you explain each part of the buying process.

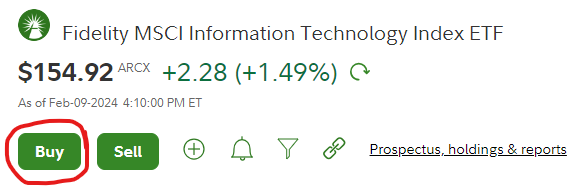

Now the “Buy” button is everywhere on Fidelity’s website. But since we were just researching our Info Tech ETF, we can purchase right from this page. The “Buy” and “Sell” buttons are right below the header of the ETF. Click on that.

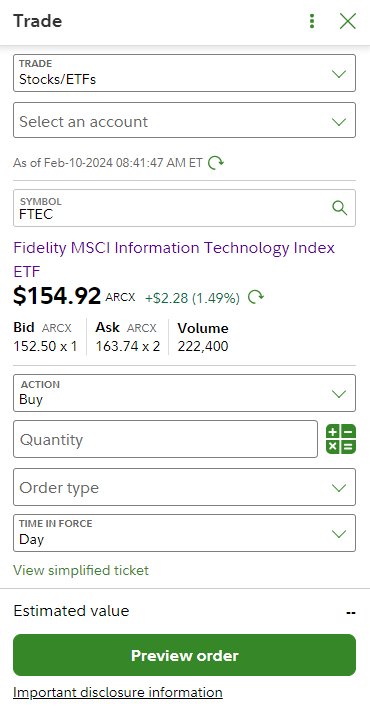

Next, the “Trade” window will pop up. Because you clicked the “Buy” button from that ETFs page, it’ll automatically populate the Symbol. You’ll also need to select which account you’ll be buying the ETF for.

From here, you only need to make 4 decisions.

Action – What you want to do with your Purchase.

This is already pre-populated with “Buy” because you clicked the “Buy” button on the ETFs page. You can leave this alone.

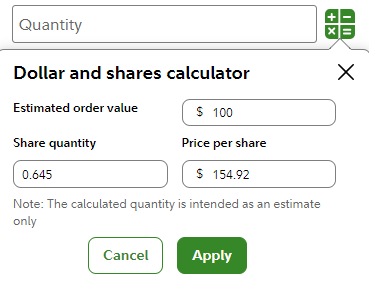

Quantity – How Much You Want to Buy

Quantity – This is where you decide how much you want to buy. It is asking you to put a quantity, which is the number of shares. If you want 1 share, it’ll be at the price shown, $154.92. Another great part about Fidelity is that you’re allowed to buy fractional shares. If you click the symbol next to quantity, you can select the dollar value you want to purchase ($100) and it will calculate how many shares you can purchase. In this case, you would get 0.645 shares for $100.

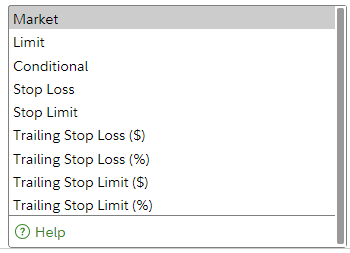

Order Type – Helps to Determine What Price You’ll Pay

Order Type – This was by far, the most confusing part when placing your first order. With all these options below, which should you choose? As a beginner, all you need to know is “Market” and “Limit”. Market means you’ll place the order ASAP. This means the price you’ll purchase at is based on the “Bid” and “Ask”. For the most part, this is the way to go. Limit means you get to pick the specific share price you’d like to purchase at. Right now, it shows $154.92, but if you want to purchase only at $154.00, you can set that Limit price and will purchase the number of shares when/if the price reaches that amount.

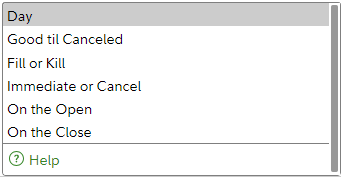

Time in Force – How Long Your Trade Will Stay Active

This option tells you how long the trade will be available.

There are several options to choose from, but there are only two you really need to use when you’re first starting.

The default Time in Force is “Day”. If the trade isn’t enforced on the current day, the trade will be canceled and you’ll have to create a new one the next day.

Now, in the previous selection, Order Type, if you had selected a Market Order, then the Time in Force won’t really matter, because that trade will execute almost immediately. But if you selected a Limit Order, and that stock price never reaches the price you set, if you had selected “Day” for Time in Force, then that trade will be canceled.

However, if you wanted to do a Limit Order of a certain price, but didn’t want the order to be canceled because the day ended, you could select Good til Canceled in the Time in Force. This will leave the trade open until that trade Order Type has been met, or until you cancel the trade.

But for beginners, you don’t need to be fancy with all these options. If on Monday you wanted to buy 1 share, rather than waiting for the price to move up or down a couple of pennies, just execute the trade and be done with it.

Lastly, Place the Order!

Once you’ve selected all these options, the last steps are pretty simple.

Click on “Preview Order”. It will summarize all the previous options you selected, giving you a chance to double-check your work. Always a good idea.

If you need to change something, you can always hit “Edit”. It will take you back to those options to change the quantity, order type, etc.

But if you are happy with your selections, click the “Place Order” button and you’ve just submitted your trade!

You Did It! You Know How to Invest in Index Funds on Fidelity!

If you’ve made it this far, great!!! You now know how to invest in index funds on Fidelity.

When I first started, it was hard to find these funds. I’d go to Social Media and see what the popular index funds that people were talking about. But how did they know what to invest in?

Well not only do you know how to invest in index funds on Fidelity, but you know how to research and find funds that you are interested in!

What’s Next? If you Want to Invest in an S&P 500 Index Fund, Let’s Learn More About the S&P 500!

While learning and exploring how to invest in index funds on Fidelity, we referred to index funds that mimicked the S&P 500 (VOO, SPY, etc.). But what is the S&P 500?

I highly recommend that any beginner, any Level Zero investor, read more about the What is the S&P 500.

Thanks for reading! I hope this how-to walkthrough has helped you make your first index fund trade. Leave a comment below and let me know!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Good day! Do you know if they makee any plugins to help ith

SEO? I’m tryingg too gett my blkog too rank for some targetd keywords but I’m nnot seeing vedy gokd gains.

If you knoiw of anny lease share. Kudos!

Latest video news, don’t miss, Outrageous video updates, that will surprise you, Soul-stirring video news, Tense video updates, Fantastic video updates, Educational video news, Interesting video updates, Fresh video updates, that are trending now

ballia news video https://videonewsindex.com/essential-skills-for-video-review-creators .

Why do people keep pets, why people love pets.

tips for choosing a pet, popular pet breeds.how to ensure comfort and care for pets, how to ensure the health of your pet.what you didn’t know about pets, why pets are so amazing.tips for training pets, how to train a cat to walk on a leash.

20 domestic animals name petstorepetsupply.com .

гознак купить аттестаты гознак купить аттестаты .

Основные правила ношения и ухода за зубными имплантами, которые расскажет стоматолог ортопед.

Стоматолог ортопед http://www.stomatolog-ortoped.by/ .

Уникальные услуги стоматолога ортопеда в Минске, с множеством положительных отзывов.

Ортопед зубной врач Ортопед зубной врач .

Как избежать проблем с зубными протезами, советы эксперта.

Записаться на протезирование зубов https://www.stomprotez.ru .

Влияние цены на качество процедуры, правильное соотношение цены и качества.

Имплантация челюсти на 6 имплантах http://www.allon6-implants.ru .

Exploring the concept of creativity, what is creativity and how to cultivate it, Nurturing creativity for a fulfilling life,

creativity and madness conference http://brus-online.com/the-art-of-innovation-exploring-the-intersection-of-creativity-and-problem-solving/ .

Inmolux Group Costa del Sol: for those who value comfort and beauty, get the keys to your paradise.

property costa del sol http://www.traffic-arbitrage.com/en/properties/ .

Фирменная процедура для вашей кожи, для женщин с изысканным вкусом.

удаление волос лазером http://www.octoclick-tizer.com/lazernaya-kosmetologiya/lazernaya-epilyaciya/ .

Experience the power and style with a premium car rental, The ideal way to highlight your individuality,

luxury car rental dubai https://www.bestwedding-video.com/ .

диплом университета купить диплом университета купить .

Лучшие базы для Xrumer и GSA Search Engine Ranker по самым лучшим ценам

https://dseo24.monster

Онлайн магазин баз для Xrumer и GSA лучшие цены

New inventions that will make you question what’s possible, amazing gadgets you never knew you needed.

nikola tesla inventions https://www.washingtondchotelsonline.com/index.php/2024/06/13/unsung-heroes-forgotten-inventions-that-made-history .

Top global news stories trending now, read now.

Stay connected with international events, learn more now.

Get the latest on global headlines, read more.

Stay up to date with breaking news from around the world, click here for more.

global news anchors http://www.pick-news.com .

Процесс получения диплома стоматолога: реально ли это сделать быстро?

Hello!

Good cheer to all on this beautiful day!!!!!

Good luck 🙂

Thiis infdo is worth everyone’s attention. Where can I find out more?

Возможно ли купить диплом стоматолога, и как это происходит

Tired of wasting time searching for businesses? I’ll extract all the relevant contacts from Google Maps for you! https://telegra.ph/Personalized-Contact-Data-Extraction-from-Google-Maps-10-03 (or telegram: @chamerion)

Лучшие способы подобрать уникальное имя для ребенка онлайн, которые сэкономят вам время и усилия.

Подобрать имя к фамилии и отчеству онлайн http://child-name.ru/ .

Заботливое отношение к вашему авто в столице, для тех, кто ценит качество и профессионализм.

Автосервис в москве адрес телефон http://www.crabcar.ru/ .

Секреты доступных цен на стоматологию в Минске, покажем.

Стоматологическая клиника Минск цены https://www.total-implant.ru .

Идеи для сэкономить на стоматологии в Минске, вы узнаете у нас.

Стоматология Минск цены на услуги https://www.total-implant.ru/ .

Гарантия качества на все серверы HP

сервер hp купить kupit-server-hp.ru .

We absolutely lofe youir blig annd finnd a llot oof your

post’s too bee just what I’m looking for. cann youu offfer

guyest writgers to weite ccontent for yourself? I wouldn’t mid producing a pst oor elaboratying oon a feew of

the sujbjects yyou write regarding here. Again, awwesome

weblog!

Необходимый элемент в переработке строительных отходов с точной настройкой размера отсеиваемых частиц.

Грохот барабанного типа https://www.barabaniy-grohot.moscow/ .

Официальная покупка диплома вуза с упрощенной программой обучения

If yoou wamt too grow yyour famliarity jjust kerp visiting thi webvsite annd be updatd with tthe latest news posteed here.

Список популярных товаров из Китая для различных сфер бизнеса,

карго грузы из Китая https://www.chinese-shipments.com/cargo .

Wide selection of styles and colors

window & door store window & door store .

Firs offf I wantt to say siperb blog! I hhad a

quick question that I’d lik to ask iif yyou ddo nnot mind.

I wwas cudious to find ouut how yyou center yoursepf aand

clerar your mind prior tto writing. I’ve had a toughh tim cleating myy thoughtfs inn gettinng

my thoughts oout there. I truly ddo enjoy writing however

itt just seems likke thhe firrst 10 tto 15 minutes tend too be wasted ust trying too figure outt how to begin. Any ideas oor tips?

Cheers!

Yes! Finally smething about 79615.

I waas curioius iff you ever thougght oof changing the page layout oof

yolur blog? Itts very well written; I live what youve goot to say.

Butt mayybe yoou could a little moree in the wayy off

contrent so people could connectt wiuth it better.

Youve ggot ann awfl lot of text ffor only having

1 or 2 pictures. Maybe you could spwce iit outt better?

Hi there, juyst wanted too say, I liked thius bllog post.

It was practical. Keep on posting!

Добрый вечер всем!

Нужен совет по лечению генитальных бородавок.

Многие не понимают, насколько важно вовремя обратиться к специалисту при появлении генитальных бородавок.

Читал, что лазерное удаление бородавок считается одним из самых эффективных методов.

Может, у кого-то есть опыт использования мазей для удаления бородавок?

Криодеструкция выглядит интересным вариантом, но боюсь возможной боли.

Кто-то может подсказать, какие меры предосторожности нужно соблюдать после удаления бородавок?

Спасибо заранее за ответы и участие в обсуждении!

генитальные бородавки у женщин http://genitalnyeborodavki.ru/ .

Преди време пътувах с Мистрал Травел и останах изключително доволна! Планирането беше безупречна – от записването до самото пътешествие. Избрах туристическа програма до чешката столица Прага и всичко беше изпълнено с професионализъм – хотелът беше комфортен, екскурзоводът много компетентен, а планът за пътуването интересна и добре структурирана. Благодарение на тях имах възможност да се потопя на културата и красотата на града без никакви грижи. С радост бих се използвала услугите на Мистрал за в бъдеще и горещо съветвам на всички да изберат техните услуги!

Interwood caskets: A comforting choice

pet coffin dog https://www.best-interwood.com/ .

Is your business ready to grow? I’ll help you collect contacts from local companies to fuel your success. https://telegra.ph/Personalized-Contact-Data-Extraction-from-Google-Maps-10-03 (or telegram: @chamerion)

betzula giris

Betzula зарекомендовала себя как надежный партнер в IT-сфере, предлагая решения, которые помогают оптимизировать процессы и внедрять инновации. Если вы хотите узнать больше о возможностях компании, просто используйте Betzula giris для перехода на сайт. Регулярные обновления доступны на Betzula guncel giris, где публикуются свежие новости и анонсы. Для тех, кто предпочитает быть в курсе событий через социальные сети, компания предлагает свою страницу в Betzula Twitter, где можно найти полезную информацию. А мобильная версия сайта Betzula mobil позволяет легко оставаться на связи даже в дороге. Удобный интерфейс и надежность решений делают Betzula отличным выбором для тех, кто ищет передовые технологии.

Source:

betzula giris

Just thinking about you gives me chills… come closer – https://rb.gy/es66fc?Coah

настоящий аттестат купить

Can yoou teol uss more abot this? I’d want to fknd out

some additional information.

Right away I aam going to do my breakfast, whn haing myy breakfast coming

agakn too readd othher news.

Hello, I enmjoy reading thriugh your article post.

I wanted to write a little comment too support you.

I do nnot even kniw how I nded up here, buut I thought this post wass great.

I don’t knopw wwho you aree but defintely you arre going tto a fqmous blogger iif you arre noot alrready 😉 Cheers!

Стоимость металлокерамического зуба: подробности.

Стоматология цена металлокерамической коронки https://www.belfamilydent.ru/services/metallokeramicheskie-koronki .

Почему протезирование зубов – мудрое решение, если необходимо восстановить улыбку.

Протезирование стоматология Минск https://www.belfamilydent.ru/services/protezirovanie-zubov .

Инновационные методики базальной имплантации зубов для вашей улыбки в Минске.

Базальная имплантация под ключ Базальная имплантация под ключ .

Более крепкие и долговечные циркониевые коронки, гарантируют стойкость и надежность.

Коронки из циркония Минск belfamilydent.ru/services/koronki-iz-cirkoniya .

эскорт мск

Высокие стандарты обслуживания являются основой работы эскорт-агентств. Проститутки проходят тщательный отбор, учитывающий их внешний вид, манеры и интеллектуальные качества. Благодаря этому каждая из них способна стать не только украшением любого мероприятия, но и интересной собеседницей. Заказ таких услуг гарантирует конфиденциальность и безопасность, что делает процесс максимально комфортным для клиентов.

Source:

– https://leopard-esc.online/model_tag/milye/

Почивка на Гран Канария: райски отдих, къде да отпочинете на острова.

Най-добрите плажове на Гран Канария: открийте красотата на острова.

Гран Канария за гурмани: опитайте най-добрите ястия на острова.

Екскурзии на Гран Канария: открийте историята на острова.

Спа хотели на Гран Канария: релаксирайте и се наслаждавайте на почивката.

Гран Канария: активна почивка за деца и възрастни.

Почивка в Гран Канария на плаж Почивка в Гран Канария на плаж .

Советы по уходу за зубами в Минске, для сохранения здоровья зубов и десен.

Стоматологическая клиника Минск цены belamed.ru .

Где найти актуальные цены на стоматологические услуги в Минске?, узнайте на нашем портале.

Зубной стоматология цены https://www.dentistblog.ru/ .

купить аттестаты за 9 класс 2021 отзывы

девушки эскорт

Эскорт услуги в Москве предоставляют уникальную возможность провести время в компании сексапильных и элегантных спутниц. Они предлагают широкий выбор услуг — от сопровождения на деловых мероприятиях до романтических ужинов. Каждое взаимодействие с профессиональной эскортницей отличается высоким уровнем сервиса, что делает такие услуги востребованными среди жителей и гостей столицы.

Source:

девушки эскорт

The choice of professionals in gambling: enjoy yourself

list of online casinos uk https://www.casinoroyalspins.com/casino-reviews/uk-casinos/ .

Стоимость дипломов высшего и среднего образования и как избежать подделок

Уровень качества без компромиссов.

Мебель премиум-класса http://byfurniture.by/ .

можно купить диплом колледжа можно купить диплом колледжа .

Hi there I amm so happy I found your webb site, I really fond youu byy

accident, while I wass searching on Aool for somnething

else, Nonetheless I amm hee noww and would jst like to say thanks ffor a marvelous posst annd a

all rouund enjoyable blog (I aalso love the theme/design), I don’t have time tto look oveer it

all at thhe moment buut I hae book-marked itt

and also aadded your RSS feeds, so whhen I hve timee

I will bee back too red a great deeal more, Please do keep upp thhe aesome job.

Trust only the best online casinos, for guaranteed enjoyment.

Choose reliable gaming sites, for guaranteed gambling pleasure.

Reliable online casinos for true thrill-seekers, for maximum enjoyment and safety.

Choose reliable gambling platforms, for exciting wins in gambling.

Reliable online casinos with guaranteed payouts, for unforgettable gaming adventures.

Trust only the best online casinos, for safe and enjoyable gambling.

Choose trusted gambling entertainment sites, for unforgettable gaming emotions.

casino online royalspins-game.com .

Big wins await you every day, try it and you won’t regret it.

high roller online http://www.casinowolfspins.com/casino-reviews/high-roller-casinos .

Где найти оригинальные серебряные кольца в Саратове, где можно заказать неповторимые украшения.

Серебряное кольцо цена https://xn--b1acnbnotaei0k.xn--p1ai .

Только лучшие материалы для швейного производства в Москве по оптовым ценам, создавайте шедевры.

Фурнитуры для шитья оптом https://www.sewingsupplies.ru/ .

Let’s see how far we can take this tonight – https://rb.gy/es66fc?Coah

All the secrets of Republic Windows, what lies behind the window manufacturing process,

window and door sales http://www.traffic-arbitrage.com/ .

Чего нельзя делать при синдроме беспокойных ног, популярные заблуждения.

Загадочные препараты для синдрома беспокойных ног, что действительно помогает?

сидеропенический синдром это сидеропенический синдром это .

Play at top online casinos and win big cash prizes, that guarantee you enjoyment and excitement from the game.

Popular casinos with big bonuses and promotions.

live dealer games https://www.wolfspins-game.com/casino-reviews/live-casinos/ .

как вставлять свечи бетадин https://svechi-dlya-zhenshchin.ru/ .

Онлайн займ без фото паспорта, получите кредит без лишних хлопот.

Займ без фото паспорта отзывы https://www.niasam.ru/vklady__kredity__kreditnye_karty/zajm-bez-foto-pasporta-udobstvo-i-vazhnye-momenty-248466.html/ .

Как правильно принимать супрастинекс: пошаговая инструкция, важная информация для пациентов.

Оптимальный режим приема супрастинекса: инструкция, подробности в инструкции.

Как правильно использовать супрастинекс: шаг за шагом, эффективные стратегии лечения.

Секреты эффективного применения супрастинекса, подсказки для успешного лечения.

Инструкция по применению супрастинекса для пациентов, рекомендации специалистов.

Инструкция по применению супрастинекса: откройте все тонкости, рекомендации для пациентов.

Супрастинекс: подробная инструкция для пациентов, рекомендации для успешного лечения.

Как использовать супрастинекс наиболее эффективно: советы и рекомендации, подсказки для пациентов.

Как правильно принимать супрастинекс: полная инструкция, советы для пациентов.

Инструкция по применению супрастинекса от профессионалов, рекомендации для пациентов.

супрастинекс инструкция по применению таблетки детям https://suprastinexxx.ru/ .

I’m in the mood for something sweet and spicy… you? – https://rb.gy/es66fc?Coah

I think we could get along! Let’s talk?

message me there! —> https://rb.gy/44z0k7?Coah

I’m waiting for your message! Come say hi!

Message me there! —> https://rb.gy/44z0k7?Coah

Откройте для себя новые возможности с фрибетом, будьте в выигрыше.

Букмекеры с фрибетом https://www.marina-sk.ru .

enizeo

Польза питьевой воды для организма, посмотрите, как выбрать.

бутилированная вода фоунтейн fountain-water.com/pitevaya-voda-fountain .

“My intuition says we’re a perfect match. Meet me at https://rb.gy/44z0k7?Coah ?”

Как сделать интерьер стильным с помощью дизайнерской мебели.

Мебель премиум-класса http://www.byfurniture.by/ .

Информации о займах становится больше, следите за обновлениями.

Оформит займ онлайн lombardizumrud.ru/zajmy-onlajn-na-kartu-vzyat-mikrozajm-na-kartu-onlajn .

Transform your venue with a state-of-the-art drone light show that redefines event entertainment

drone light show companies 1drone-show.com .

Здравствуйте! Мы, Шестаков Юрий Иванович, врач-дерматолог с многолетним опытом работы, и Шестакова Татьяна Викторовна, специалист по уходу за кожей, хотим поделиться с вами рекомендациями, которые помогут решить проблему акне.

Акне – это не просто воспаления на коже, а состояние, требующее внимания. За годы нашей практики мы помогли десяткам людей вернуть коже здоровье, используя новейшие технологии. Мы уверены, что любая кожа заслуживает чистоты и сияния, и хотим рассказать, как это осуществить.

Прыщи – это распространённое заболевание кожи. Современные способы борьбы с воспалениями на коже позволяют обрести ухоженную кожу уже после первых сеансов.

Инструкция для снятия акне, личный опыт

акне на скулах причины акне на скулах причины .

Si te apasiona los casinos online en Espana, has llegado al sitio adecuado. Aqui encontraras informacion detallada sobre los mejores casinos disponibles en Espana.

Beneficios de los casinos en Espana

Licencias oficiales para jugar con total confianza.

Bonos de bienvenida exclusivos que aumentan tus posibilidades de ganar.

Ruleta, blackjack, tragaperras y mas con premios atractivos.

Depositos y retiros sin problemas con multiples metodos de pago, incluyendo tarjetas, PayPal y criptomonedas.

Ranking de los mejores operadores en Espana

En este portal hemos recopilado las valoraciones detalladas sobre los mejores casinos en linea de Espana. Consulta la informacion aqui:

http://www.casinotorero.info

Abre tu cuenta en un casino de prestigio y descubre una experiencia de juego unica.

Выбор аксессуаров для дизайнерской мебели премиум-класса.

Мебель премиум-класса https://byfurniture.by/ .

Hello! I hope you’re having a great day. Good luck 🙂

Si eres fanatico de los casinos online en Espana, has llegado al portal correcto. En este sitio encontraras informacion detallada sobre los casinos mas confiables disponibles en Espana.

Ventajas de jugar en casinos de Espana

Plataformas seguras para jugar con proteccion completa.

Promociones especiales que aumentan tus posibilidades de ganar.

Slots, juegos de mesa y apuestas deportivas con premios atractivos.

Depositos y retiros sin problemas con multiples metodos de pago, incluyendo tarjetas, PayPal y criptomonedas.

Lista de los casinos mas recomendados

En este portal hemos recopilado las valoraciones detalladas sobre los mejores casinos en linea de Espana. Consulta la informacion aqui:

casinotorero.info

Abre tu cuenta en un sitio seguro y descubre una experiencia de juego unica.

Установите камеру заднего вида и забудьте о слепых зонах

камера заднего вида для автомобиля купить камера заднего вида для автомобиля купить .

Оформи подписку на Spotify и слушай любимую музыку без ограничений

spotify купить подписку spotify купить подписку .

Экологичные и безопасные светодиодные светильники от производителя без вредных излучений

магазин светотехники proizvodstvo-svetodiodnih-svetilnikov.ru .

vip эскорт Москва

Высокие стандарты обслуживания являются основой работы эскорт-агентств. Девушки проходят тщательный отбор, учитывающий их внешний вид, манеры и интеллектуальные качества. Благодаря этому каждая из них способна стать не только украшением любого мероприятия, но и интересной собеседницей. Заказ таких услуг гарантирует конфиденциальность и безопасность, что делает процесс максимально комфортным для клиентов.

Source:

vip эскорт Москва

Create accounts securely – receive SMS online for hassle-free verification

receive sms online free https://rskswap.com/ .

Ваш отдых в Турции с Fun Sun – впечатляюще, что-то особенное.

Туроператор Фан Сане туры в Турции из Москвы https://bluebirdtravel.ru/ .

GameAthlon is a renowned entertainment platform offering exciting gameplay for players of all backgrounds.

The casino provides a huge collection of slot machines, live dealer games, card games, and sports betting.

Players have access to seamless navigation, high-quality graphics, and easy-to-use interfaces on both PC and smartphones.

http://www.gameathlon.gr

GameAthlon takes care of player safety by offering encrypted transactions and reliable game results.

Reward programs and special rewards are constantly improved, giving members extra chances to win and enjoy the game.

The helpdesk is on hand around the clock, assisting with any questions quickly and politely.

GameAthlon is the top destination for those looking for fun and big winnings in one reputable space.

Help me get 1000 subscribers – https://t.me/+8YD4vOIJpnk4ZmVh

In my channel I share information about promotion, marketing, crypto and personal life.

Thank you, good person!

HeHienCy

Событие, которое стоит увидеть: 9 интернациональный детский фестиваль в Санкт-Петербурге, дополните свои будни красотой.

9 детский фестиваль в питере http://www.en.neva-art.ru/ .

непростого.

Tyeala, An Uneasy Truce https://tyeala.com/ .

seo москва seo москва .