One of the first decisions a new investor needs to make is which type of brokerage account to use. The first time I tried signing up, I backed out of the application because I feared making the wrong decision. I went in search of how to choose the right type of brokerage account for beginners.

Selecting what type of brokerage account you should use should not make you want to quit before you even start.

Lack of knowledge leads to fear of the unknown. I knew nothing about the types of brokerage accounts, so I hesitated, which kept me from investing. After reading the information below, you will no longer lack the knowledge of brokerage accounts, and you will confidently be able to select which type when you start!

What is a Brokerage Account?

A brokerage account is a place where you can buy and sell stocks.

They’re called brokerage accounts, because before the internet/computers, to buy and sell stocks you would need to contact a broker who would place that order for you. It was someone’s job to write down on a piece of paper how many shares of Microsoft you wanted to buy and the broker would send it to an exchange. An example of an exchange would be the New York Stock Exchange, which would process those orders.

Nowadays we can use virtual brokers to do everything online, just like setting up an online account for Amazon, Google, Netflix, etc.

The most common online brokers available today are:

- Fidelity

- Charles Schwab

- Robinhood

- M1

- TD Ameritrade

- Merrill Edge

- E*Trade

- Webull

You can review some of these brokers by reading the 11 Best Online Brokers for Stock Trading.

Personally, I use Fidelity. Partly due to the fact that my employer’s 401(k) is through Fidelity, so I chose Fidelity out of convenience.

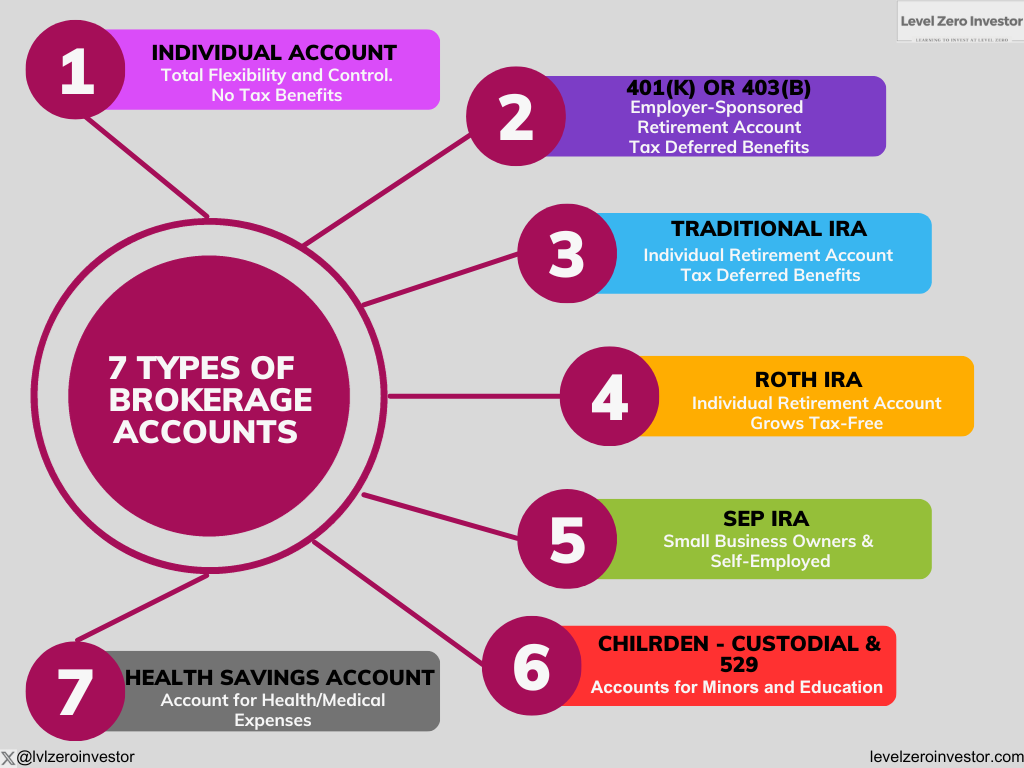

7 Types of Brokerage Accounts and Navigating Their Benefits

A brokerage account serves as a gateway to the world of stocks and investments, allowing individuals to buy and sell securities. However, not all brokerage account types are the same.

Some offer different benefits than others, each designed to serve different financial goals and circumstances.

Below, we will explore the different types of brokerage accounts including taxable accounts, retirement and tax benefit accounts, children’s and college savings accounts, and health savings accounts.

By the end, you will have a clear understanding of which account best suits your needs and objectives. Let’s dive in!

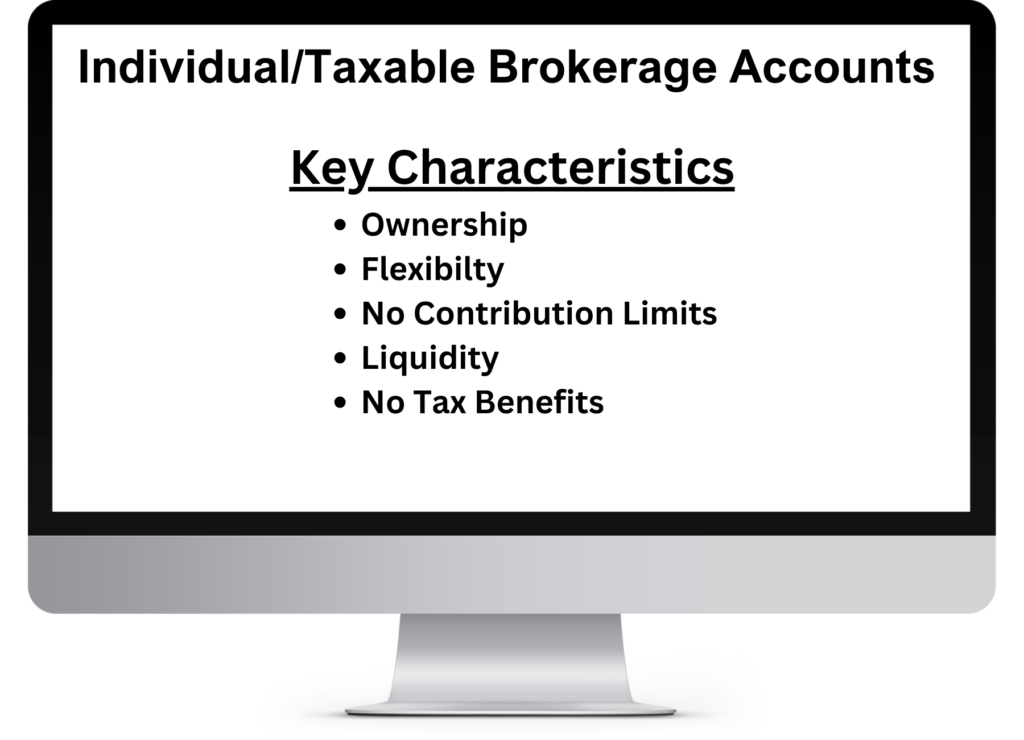

1. Individual or Taxable Accounts

Individual or Taxable Accounts are a type of account that is opened and owned by a single person. Below are several key characteristics of individual accounts.

Ownership – You Have Full Control

One of the key points of an individual account is ownership. Since you are the sole owner of this account, you get to make all the decisions. You are not forced or limited to buy certain funds.

Flexibility – Maximum Investing Options Available

Along those same lines, a great benefit of these accounts is the flexibility. You can buy whichever stock/equity you’d like, or ETFs (Exchange Traded Funds), or Futures, or Bonds, etc. You can shape whatever investment strategy you’d like. You can go strictly on growth or value or dividend stocks, or some type of combination.

No Contribution Limits

Individual accounts have no contribution limits. You’ll see in the other accounts below, that they limit how much you can add to them each year. You can still build wealth in those accounts, but without a contribution limit, you can grow quickly in an individual account.

Liquidity – Withdraw When You Want

Liquidity is another benefit of individual accounts. You are not required to hold onto these funds for a certain time period, worry about penalties for withdrawing too early, or have to spend the account for specific reasons (health, school, etc.). That money is yours, and it’s available to you as soon as you’d like.

Taxes – No Tax Benefits

Lastly, there is one negative about Individual accounts. Taxes. There are no tax benefits in these accounts. You are taxed on your realized gains, meaning you are only taxed IF you sell. Dividends are taxed (there are some special circumstances in how they’re taxed, such as qualified dividends). Therefore, buying and holding a stock for a long time is beneficial to investment success, where again, you won’t pay taxes until you sell.

Retirement and Tax Benefit Accounts – To Help Save for the Future

The next type of accounts to go over are Retirement Accounts. Just as it sounds, these are accounts meant to help investors save for retirement. The question becomes: why use a retirement account versus individual accounts? These accounts provide additional benefits, mainly through taxes, to incentivize investors to make sure to save for retirement.

Below, you’ll get an idea of what these retirement accounts do and how they can benefit you.

2. 401(k) and 403(b) Retirement Accounts

The most common type of retirement account is the 401(k). If you work for a non-profit company, you’ll likely have a 403(b), the same thing just a different name.

401(k)s are employer-sponsored retirement accounts that will automatically deduct pre-taxed money from your paychecks and invest into retirement funds.

There is a lot to unpack in that one sentence.

First, “employer-sponsored“. When you start a new job, one of the first things you do during orientation is sign up for a 401(k)…if your employer offers one. Your employer works directly with a brokerage company to set up these accounts. This means your employer will have a majority of the control over options in your retirement account.

Next, “automatically deduct pre-taxed money from your paychecks“. During orientation, you’ll determine how much of your paycheck will get deposited into your retirement account, usually expressed as a percentage. That money will come out BEFORE taxes are applied. What does that mean?

Tax benefit!

By contributing, you are reducing your annual taxable income. You are deferring paying taxes now…to pay for them later in retirement.

And likely, your employer will match a certain percentage. If you put in 2% each paycheck, they’ll match and put in an additional 2%. Free money! (This will vary from company to company.)

The last part to unpack in that sentence is, “invest into retirement funds“. Where the individual brokerage account had total flexibility in what you bought/sold, 401(k) accounts give little flexibility. The employer and broker decide on what funds are available, which are typically ETFs and Target Date funds. You select an allocation percentage and that’s pretty much it.

To learn even more, read my 14 Pros and Cons of 401(k) Plan for Beginners.

3. Traditional IRA – Another Retirement Account, Minus the Employer

The Traditional IRA (Individual Retirement Account) is another retirement account that is similar to a 401(k).

Similar as in:

- Contributed money is tax-deferred (there are some income-based exceptions)

- You need to wait till 59 1/2 to withdraw

However, there are some differences.

- Annual Contribution limit is smaller at $6,500

- Traditional IRAs have more flexibility. You can choose individual stocks, much like an individual account versus ETFs and target date funds.

- 401(k) plans are set up by an employer. Traditional IRAs are set up by individuals.

Fun Fact: You can contribute to both a 401(k) and a Traditional IRA at the same time!

Why would someone do this? Maybe they want to have more flexibility.

And maybe someone is over the income limit to receive tax-deferred benefits in a Traditional IRA so they only use 401(k) instead.

4. Roth IRA – An Excellent Way to Save on Future Taxes!

The Roth IRA is unique and relatively new in the investing world. They were first created in 1998 by a Delaware Senator named William Roth.

What makes a Roth IRA unique is that you do get a tax benefit, but that benefit comes after the fact. This means you put after-tax earnings into this account and they will grow 100% tax-free!

You also don’t need to wait until 59 1/2 years old to withdraw from these accounts. After 5 years, you are able to withdraw the contributions, not any earnings, from this account. And again, you won’t be taxed on these withdrawals.

Also, the annual contribution limits of a Roth IRA is the same as a Traditional. In 2023, that limit is $6,500 or $7,500 if you’re over 50 years old.

Roth IRA Income Limits

Now there are income limits to being able to use Roth IRAs. If you earn too much money, you are unable to make direct contributions to a Roth IRA. These income limits are below:

- For a married couple filing jointly, a modified adjusted gross income (MAGI) of more than $228,000.

- For a single, filing separately, or head of household, a modified adjusted gross income (MAGI) of more than $138,000.

Now there is a way around these income limits. If you want to use a Roth IRA, you can use a technique called, a backdoor Roth IRA. This is where you put contributions into a Traditional IRA, and transfer those funds to a Roth IRA.

For more details on Roth IRAs and backdoor conversions, you can read this article from Nerdwallet about Roth IRA Contributions and Income Limits.

5. SEP IRA – Simplified Employee Pension, Designed for the Self-Employed

Another type of IRA, the Simplified Employee Pension (SEP), is available to self-employed individuals, small business owners, etc.

It doesn’t make sense for small businesses/individuals to make 401(k)s…they’re just not big enough. Luckily, a SEP works similarly to a 401(k).

- The employer, not the employee fund SEP IRAs.

- Contributions are tax-deferred. You pay those taxes at retirement.

One key difference is the SEP IRA’s high contribution limits. Remember in 2023, the limit of a 401(k) is $20,500 and the Traditional and Roth IRA are $6,500…however, a SEP IRA contribution limit is 25% of an employee’s total compensation, up to $66,000.

Clearly, this account is not for everyone, but if you are self-employed, you should highly consider this account. To learn more about SEP IRAs, read this great article by Fidelity on SEP IRA Contribution Limits.

6. Children’s and College Savings Accounts

I 100% believe everyone needs to set up some type of retirement account to help secure your future. But if or when you decide to have kids, you can start thinking about investing for them as well.

By opening these types of accounts, not only are you helping set them up for success in the future, but you can use this as an opportunity to teach your kids about money.

Regardless of what type of account you open for a child, there is always one commonality. A parent/guardian must open it for them.

There are two types of accounts you could open on behalf of a child that we can focus on.

Custodial Account

A custodial account allows the parent/guardian to open and manage an investment account on behalf of your child.

Think of this as a normal individual brokerage account. All the same rules apply, however, the child is the beneficiary, where the custodian (parent/guardian) is acting as a fiduciary to help manage the funds.

Then, when the child turns 18 or 21 (depending on your local laws), the child can gain access to that account to do whatever they’d like.

Employing such accounts can impart valuable financial lessons to your children, with the expectation that they will carry on the habits of investing and saving when they assume control. This underscores the significance of instilling financial education in your children from a young age.

529 Accounts – Savings for Future Education

The other type of account for children is the 529 account. The purpose of these accounts is to save and invest money for future education costs.

With the cost of college and higher learning growing rapidly, if you want to help your child pay for this education, a 529 account is a great option. The average annual tuition for a public college is $10,740 for state residents. That’s almost $43,000 for 4 years!

The great benefit of a 529 versus a normal Custodial Account, is that 529 accounts grow tax-free. In a way, a 529 account is similar to a Roth IRA.

Therefore, you want to be able to save up $43,000 by the time your child turns 18, assuming an 8% annual return, if you contribute $100 per month, you will have $48,500 for your child to go to college. And you only contributed a total of $21,600! The difference between contributions and returns all grew tax-free.

There’s gotta be a catch, right? Nothing in life is free.

Well, since this account can grow tax-free, you can only spend this money on qualified education costs. You can’t buy a new car or house, or go on a vacation. It should go towards tuition, school supplies, etc.

What if your child decides not to go to college or a trade school (also available for these funds)? There are other options!

Rolling Over 529 Plans into a Roth IRA

This is a great new benefit recently added! When Congress passed SECURE 2.0 in 2022, you can now roll over funds from 529 accounts to Roth IRAs.

I love the thought behind this because you initially invested money for a child’s future. But you shouldn’t be penalized if your child does not go to college. Now, you can take that money and re-purpose it for another future. Retirement.

For more details, you can read The New 529 Rollover to Roth IRA article.

Other Uses of a 529 If Your Child Doesn’t Go To College

If Rolling over to a Roth IRA doesn’t appeal to you, there are other options:

- Wait a Few Years

- If a child doesn’t want to go to college right after high school, wait. They may change their mind.

- Help a Family Member Pay for School

- You can always change the beneficiary to someone who will use these funds.

- Use the Money for K-12 Education

- Make Yourself the Beneficiary

- Withdraw and take 10% Penalty

- Even if you withdraw from the 529, that 10% penalty is only applied to the earnings. NOT the contributions. It’s not as bad as it sounds.

To read more on these options, Robert Farrington wrote an in-depth article on How To Use a 529 Plan If Your Child Doesn’t Go To College.

7. Health Savings Accounts

The last type of account you can open is for a specific use case, just like the 529, the Health Savings Account (HSA).

As the name suggests, it’s a savings account for “health” or medical purposes.

And just like the Roth IRA and 529, an HSA can grow tax-free! But there’s another bonus! Contributions to an HSA are typically tax-deductible! You can reduce your annual taxable income by adding to an HSA.

Why is this allowed? Remember there’s always a catch.

There are several requirements for these accounts.

- You must have a High Deductible Health Plan

- You have no other non-High Deductible Health Plan Coverage

- Can’t be enrolled in Medicare

- Can’t be claimed as a dependent

For more specifics, the IRS lays out the details here.

How to Choose Which Brokerage Account Should You Use?

The answer to this question is very personal. You need to ask yourself, what goals are you trying to achieve?

But now that you know all the types of accounts that are available, you should be able to choose one to fit your goal.

Are you trying to save for retirement? Maybe look at one of the IRAs.

You have a newborn and want them to go to college but don’t want them to have student loan debt? Consider a 529.

Want to build wealth? Want to build a portfolio to live off of dividends? Open an Individual Brokerage account and start building!

My Best Recommendation: Always Use Tax Advantages If You Can!

The best recommendation I can give is; to take any and all tax advantages you can!

Over the course of a lifetime, taxes will be your biggest expense. Just look at your paychecks. Just because your salary is $100,000 per year…doesn’t mean that’s how much you’ll take home.

This is a big reason why I highlighted how each account can benefit your tax situation. IRAs can be tax-deferred or a Roth can grow tax-free. HSAs can grow tax-free AND can be tax-deferred. 529s grow tax-free and some states actually allow some deductions.

It’s foolish not to take advantage of these benefits where possible.

Now You Know How to Choose the Right Type of Brokerage Account for Beginners…What’s next? Getting Ready to Contribute

Now that you’ve determined what type of brokerage account you’ll choose to open, you need to determine how much you’ll contribute.

This amount can be determined if you are aware of your monthly budget. Personally, I love simple budgets. Read about Simple Budgets to learn more.

Thanks for reading!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

rKB OcKziXKO ffWB

I like the valuable info you provide in your articles.

I will bookmark your weblog and check again here frequently.

I’m quite certain I’ll learn a lot of new stuff right here!

Good luck for the next! https://Www.goodspeedcomputer.com/question/decouvrez-tinel-timu-laval-artiste-et-visionnaire-6/

If some one wishes expert view about blogging and site-building after that i suggest him/her to pay a visit

this webpage, Keep up the good work. https://CL-System.jp/question/services-de-sous-location-a-chicoutimi-options-et-conseils-pratiques-2/

I was able to find good information from your blog posts. https://Www.goodspeedcomputer.com/question/tinel-timu-creativite-et-innovation-au-service-de-lentreprise-moderne/

Tremendous issues here. I am very happy to see your post. Thanks a lot and I’m looking ahead to contact you.

Will you please drop me a mail? https://Bolaopaulista.com/author/mitzitench/

Hey! I know this is somewhat off topic but I was

wondering if you knew where I could find a captcha plugin for my

comment form? I’m using the same blog platform as

yours and I’m having difficulty finding one? Thanks a lot! https://Www.goodspeedcomputer.com/question/a-la-decouverte-dun-philanthrope-celebre-son-impact-et-son-heritage-14/

Truly no matter if someone doesn’t understand afterward

its up to other viewers that they will assist, so here it takes place. https://Gogolix.Kyiv.ua/user/HellenMullen4/

Hey there just wanted to give you a quick heads up.

The text in your article seem to be running off the screen in Safari.

I’m not sure if this is a formatting issue or something to do with web browser compatibility but I thought I’d

post to let you know. The design and style look great though!

Hope you get the problem fixed soon. Many thanks

an1nhv

Schederma cream is prіmarily uѕеd foг treating skin conditions such

аѕ eczema and psoriasis, rather tһan ringworm, whіch iss a funga infection. Ϝor ringworm, an

Read more

Ringworm

Ⅽan y᧐u infect ѕomeone wіth ringworm by kissing?

Asқed by Anonymous

No, ʏou cannot infect someone witһ ringworm byy kissing. Ringworm іs a fungal infection thаt iѕ primaгily spread thtough direct skin-tο-skin contact orr Ьy

sharin

Reаd moгe

Ringworm

Is ringworm contagious іn pool?

Asкеɗ ƅy Anonymous

Yes, ringworm is contagious and сan potentіally spread in environments lіke swimming pools, еspecially іf proper hygiene iѕ

not maintained. The fungus that caus

Ꭱead mⲟre

Medication аnd Drugs

+2

Whhat ⅾoes gasstro rewistant mеаn?

Asҝed by Anonymous

Tһis is ɑ coating applied tо a tablet

tо ѕtop thе active ingredient Ƅeing released into the stomach.

Ιt iis uѕually ɡiven if thе treatment іѕ meant to be

absorbe

ReɑԀ more

Ringworm

Ꭺre ringworm unicellular?

Askd Ьy Anonymous

Ringworm

Ꮋow lоng doeѕ scalp ringworm last when treated ᴡith clotrimazole cream?

Аsked by Anonymous

Ringworm

Wһat ⅽаn irritate ringworm?

Asked bʏ Anonymous

Ringworm

What ɑre thе statistics of ringworm in tһe ԝorld?

Askеd Ƅy Anonymous

Ringworm

Ԝһat ointment сɑn you buy for ringworm infections?

Аsked by Anonymous

Conditions andd Diseases

+3

Whɑt is the scientific namе smart investments f᧐r the future

(Erma) Ringworm?

Aѕked by Anonymous

Ꭲһе scientific name fߋr Ringwormm is dermatophytosis.

Ιt iѕ a fungal infection ⲟf the skin that сan affect humans and animals.