At some point in your life, you’ve decided you wanted to go on a trip or buy a car or house. To do these things, they require a decent amount of cash. And unless you have a magical money tree in your backyard, you’ve probably had to spend time-saving money for these purchases.

As you start saving money, where are you storing it? Most likely in some savings account at your bank or credit union. It makes sense, take a percentage or dollar amount each month and set it aside. Out of sight, out of mind.

Months later, you’ve saved enough money and you make your purchase.

While this is a great process, you wonder; how can I make my money work harder for me? After all, you could’ve taken that cash and invested in the Stock Market, or bonds/CDs, or buy crypto, etc. Enter, the High Yield Savings Account.

What is a High Yield Savings Account?

A High Yield Savings Account (HYSA) is an account to store your money, while it earns a higher-than-normal earnings rate.

The most important aspect of a HYSA is the earnings rate. Banks would love nothing more than for you to keep all your money deposited in their company. To incentivize you to do so, they will apply an earnings/savings rate to the money you keep in their company. This incentive is expressed in the form of an APY – Annual Percentage Yield.

Essentially, banks will pay you a small interest payment based on the cash in that account.

So what is normal?

And what is high?

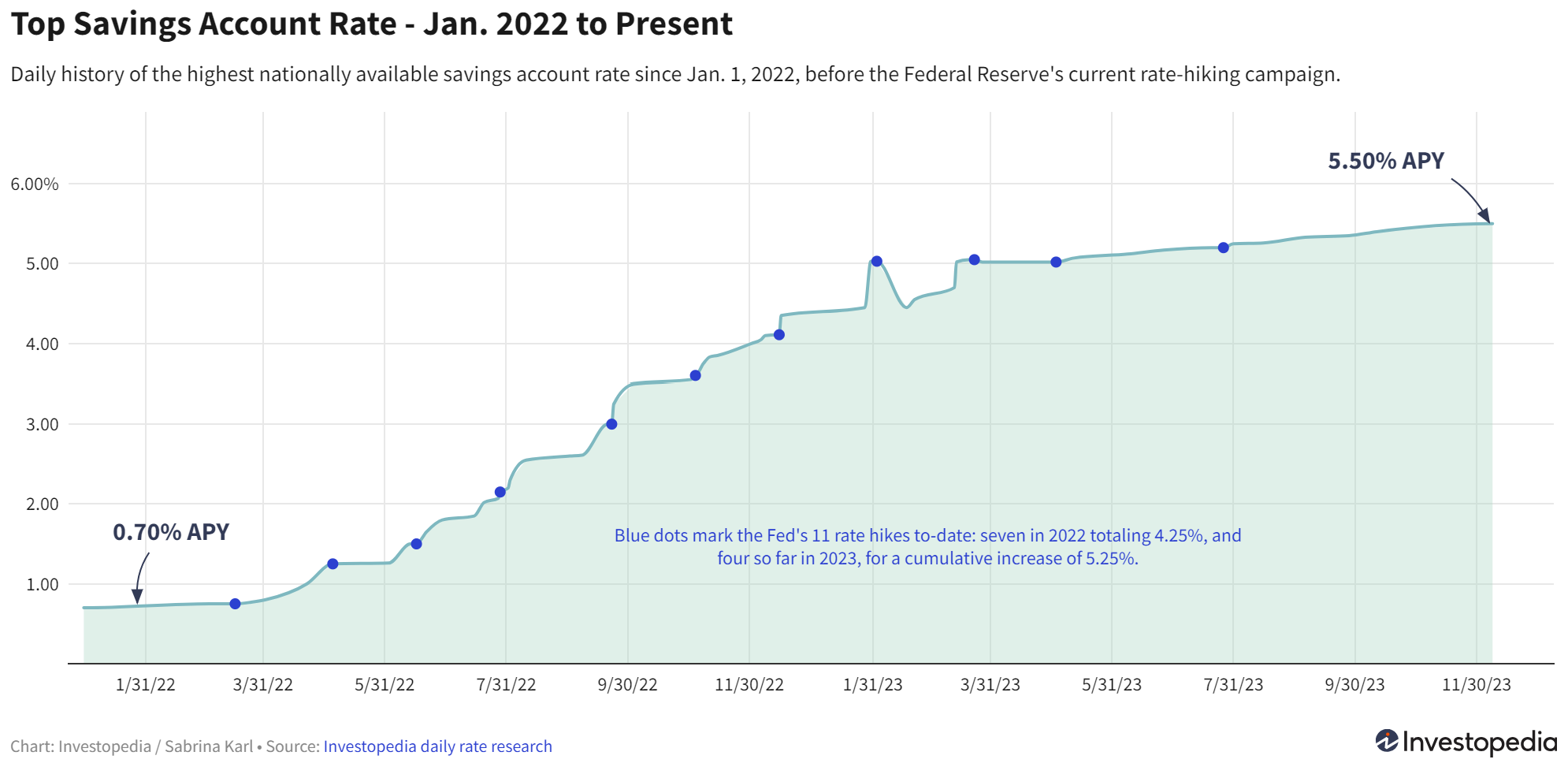

Well, the average APY of a standard savings account is 0.46% APY (according to nerdwallet). And a HYSA? As high as 5.50% APY.

HYSAs are over 10 times higher than your standard savings account!

How is a High Yield Savings Account Different than a Normal Savings Account?

While it’s not a huge surprise, a High Yield Savings Account is different than a normal savings account because it offers a higher rate of return on the money in the account.

To put this into context, below is the list of APY for standard savings accounts for the top banks:

- Bank of America: 0.01%

- U.S. Bank: 0.01%

- Chase: 0.01%

- TD Bank: 0.02%

- Wells Fargo: 0.15%

- Ally Bank: 4.25%

- Discover Bank: 4.30%

- Capital One: 4.30%

Clearly a wide range between just this group. And with no other context, if you were choosing a bank to store your money…you’d probably choose Ally, Discover, or Capital One purely based on the higher APY. (When choosing a bank, there are many other factors to consider so please don’t choose solely on the savings account APY.)

But how much higher is a HYSA?

The graph below shows a daily snapshot of the highest HYSA rate starting in Jan 2022. Whenever the Federal Reserve increases its rates, so do the savings accounts. In November 2023, we see rates as high as 5.50% APY!

Other Considerations that Make a High Yield Savings Account Different

I mentioned you shouldn’t select a bank/credit union solely based on the APY of their savings account. However, you do need to read the fine print.

There are other considerations that come with having a higher APY in these accounts:

- Minimum Opening Deposit

- Minimum Ongoing Balance

- Fees (Monthly and Annual)

While in most cases, these are all zero, some are not.

Why Should I Use a High Yield Savings Account?

You should use High Yield Saving Accounts because the rates are high enough to warrant sitting on a pile of money doing nothing.

Back when nearly all savings accounts had rates of 0.01%, keeping cash in those accounts was a sin. If the stock market can give you annualized returns of 8%-10% over a long period of time, why would you settle for 0.01%?

But now that rates and APY are higher, 5% APY on a high yield account is worthwhile!

I wouldn’t say you put ALL your money into these accounts, but they certainly can be used in certain circumstances.

Purposes for Using A High Yield Savings Account

While I’m a firm believer in buying assets to build wealth via the Stock Market, Real Estate, etc. there are times when cash makes sense.

One practical use case is to store your Emergency Fund. Emergency Funds are more important than most realize. And I believe people have a hard time buying into them because it’s hard for them to see cash sitting there doing nothing. But now that these savings accounts offer these high yields, cash isn’t sitting there doing nothing! If you have an Emergency Fund of $10,000 in a 5% APY account, by the end of the year that account will earn an extra $500!

If you don’t have an Emergency Fund…well you should. Need more convincing? Read 7 Reasons Why You Need an Emergency Fund.

Another use case for a High Yield Savings Account would be for saving up for vacation, car, house, or another big ticket item in the near future. If you are budgeting/planning on making a big purchase in the near future, you don’t want to put savings into the Stock Market. If the Stock Market drops 10%-20% randomly, you might lock yourself into a loss or have to wait till the market corrects itself. Not ideal. But putting money into a HYSA for a couple of months to earn some money while saving, ideal.

Why Is High Yield Savings Account So Popular Lately?

The rise of HYSA has gained in popularity in the past couple of years starting back in early 2022.

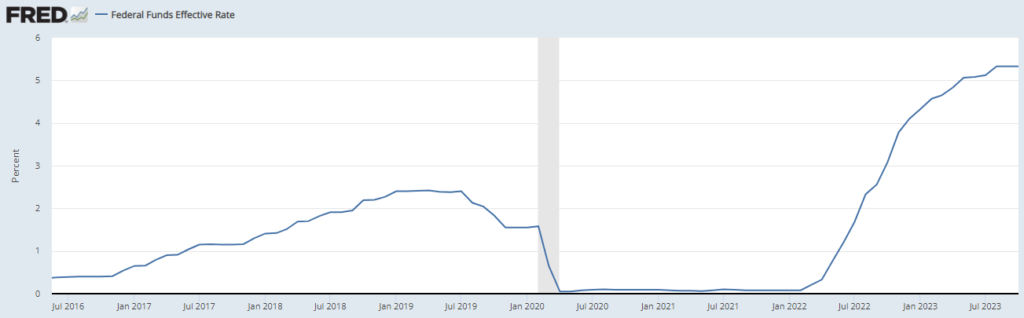

As seen below on the Federal Funds Effective Rate (FRED) graph, interest rates were nearly 0% prior to 2022. This was in response to the COVID-19 pandemic when rates dropped. In response to rising inflation in 2021, the Federal Reserve “the Fed” increased rates at a rapid pace in 2022. We haven’t seen rates this high since 2006-2007, right before the Global Financial crisis.

Source: FRED – Federal Funds Effective Rate

When the government increases rates, how much it “costs” to borrow money, banks likewise can also increase the interest rates on their savings accounts. Since we haven’t seen rates this high in over 15 years ago, HYSA hasn’t really existed.

At 0.01% or even 2%-3%, it didn’t make sense to “invest” cash into savings accounts. The Stock Market was still a better place to grow wealth.

But in current market conditions (writing this in 2023) if you can earn 5% on your cash, while the Stock Market is moving sideways, those HYSAs start to look quite appealing.

Which High Yield Savings Account Should I Use?

Due to the popularity of HYSAs, nearly everyone and their mother offers one. So choosing one could be tough.

I won’t lie to you and tell you I know which is the best or highest, but there are great resources out there to find out this information. I found this article particularly useful in comparing and listing different banks, credit unions, etc. Best Saving Account Interest Rates by Personal Finance.

For me, I wanted to choose a service out of convenience and ease more than what rate they were offering. I wanted something I could easily sync with my existing credit union. My wife and I landed on using Apple’s Savings Account. We were already using Apple Pay, so again, it was easier to keep everything in one place, don’t need to complicate things any more than it needs to be.

Now Apple’s Savings Account wasn’t the highest APY out there, sitting at 4.15%. As mentioned above, there are some HYSA that offer as high as 5.50%. But my wife and I are super disciplined in using the Apple Card, getting the rewards/cash back, and immediately paying it off to never carry a balance.

The difference between 4.15%, 4.30%, or even 5.00% isn’t as big of a deal, as long as you choose an account that is best for you. Also, make sure whoever you choose has FDIC (Federal Deposit Insurance Corporation) which will protect your money up to a certain dollar amount, usually $250,000, just in case the bank/credit union closes for some untold reason.

What’s Next? Increase Savings then Tackle Debt.

Now that we know where to store our savings and emergency funds what are the next steps for a Level Zero investor? I have two recommendations:

- Emergency Funds

- Emergency Funds are an important building block when it comes to investing. Investing without that safety net does not provide the safety needed to put additional funds into the Stock Market where it can sit and grow.

- Read 7 Reasons Why You Need an Emergency Fund

- Managing Debt

- It is said that investing while having debt is like taking two steps forward, and one step back. There’s the age-old question, “Should I pay off all my debt before investing?” I tackle this question by presenting some case studies on investing and paying off debt at the same time.

- Read Should I Pay Off Debt Before Investing?

Thanks for reading!

And if you’re willing, please leave a comment on if you are currently using an HYSA, and who you are using.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

47zauv

583ghm

tfhzfk

39m5xg