How do you know when is a good time to purchase a stock? You don’t. You may have an idea for a price or range that you’d like to purchase at, but timing the Market is difficult. That’s where Dollar Cost Averaging comes in.

Dollar Cost Averaging (DCA) is a method of consistently adding shares or funds to a position or portfolio regardless of if the share price is up or down. This way, as you make your small, regular purchases over time, the average price should be that of the overall trend of the stock.

My Experience with Dollar Cost Averaging

When I first started investing, all I knew about adding money to the Stock Market was “Buy Low, Sell High”. I was stunned when I was finally ready to invest because while searching for that “low”, it never seemed to come.

Putting it into context, I was interested in Coca-Cola. Why? Some of the first investing books I read talked about Warren Buffett. Who better to learn from? One of his best investments came from Coca-Cola, so I thought I might invest in it too.

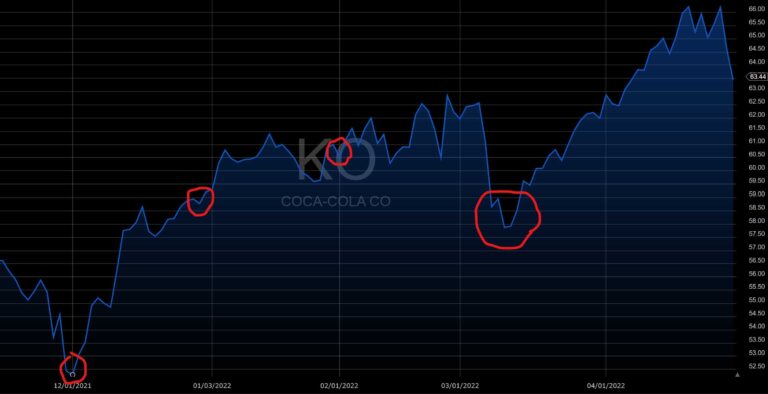

To share my thought process, the chart below shows the daily price of KO (Coca-Cola’s stock symbol) and my timeline of investing.

Coca-Cola Timeline

Jan 1st, 2022 – I decided to start investing. Started reading, researching, and learning as much as possible about investing.

Feb 1st, 2022 – I was ready to buy. I opened a brokerage account, funds were deposited, I figured out how to place an order, and I was good to go. But was this a “buy low”? The share price was $61, and this was not a low.

Dec 1st, 2022 – But there was a low! Back then the share price was around $52. And on February 1 with the share price around $61. Why would I pay for something that was 17% higher than it was two months ago?

So, I waited. I did nothing, which sounds like a smart investing move, but then I got impatient and didn’t want to wait anymore. Never a good decision when investing.

Feb 10th, 2022 – Only a couple of days later, I thought, what the heck, let’s go for it! I bought KO at a share price of around $62. I just assumed that because it was going higher, it would continue to go higher.

March 2022 – This is why “timing the Market” is impossible. Russia started a war with Ukraine and the price dropped as low as $57 within a couple of days. My head was spinning, and I felt like I knew nothing.

Within a couple of months of investing, I learned a valuable lesson, you can’t time the Market.

So what other options were available?

Enter, Dollar Cost Averaging.

What is Dollar Cost Averaging?

As stated earlier, Dollar Cost Averaging is a method of consistently adding shares or funds to a position or portfolio regardless of if the share price is up or down.

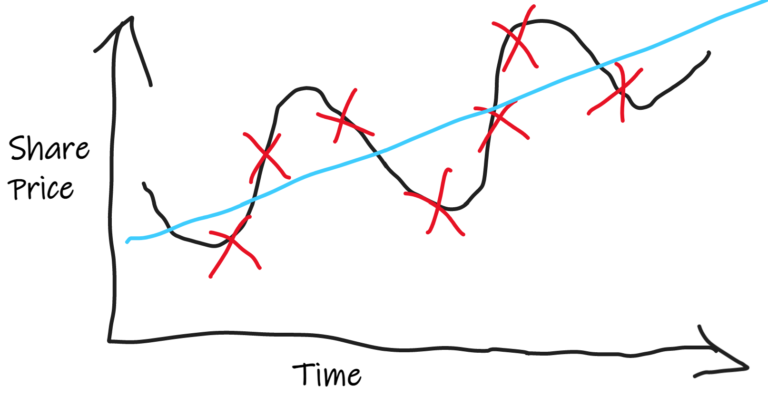

The most important word in that definition is: consistently. When doing DCA, it is important to schedule regular intervals of when you would invest. This could be every week, two weeks, or month. By buying at these regular intervals, when the stock is up or down, the average cost or price you purchase will be the overall trend. The graph below shows this example.

The black line shows the daily trend of the share price, the red Xs are the purchases, and the blue line is the overall trend.

As you see on the graph, sometimes you purchase above the average and sometimes below, but this is how you ensure you are buying the average.

Timing the Market

The most frustrating thing about investing is trying to time the Market. No matter when I purchase a stock, the price seems to drop right after I place the order. I start to feel buyer’s remorse and start to beat myself up.

You can’t think like this.

You can’t time the Market.

Say it again.

You can’t time the Market.

Mr. Market will get you every time.

Throw in one large lump sum might work, or it might not work. However, if you can consistently add regularly to your portfolio, it will eliminate the need to time the market.

DCA vs. Lump Sums

As previously mentioned, DCA is one method of adding to a position whereas another option would be adding one large lump sum.

Neither way is wrong, success in the Stock Market could be made using either strategy, but how do you determine which is best for you?

The biggest factor in deciding comes down to time and effort.

If you don’t have an abundance of time and energy to research a company and find out what price to buy it at, maybe DCA isn’t right for you. But if you have time and you do your research, build your models, and valuations, and have conviction in yourself, then a lump sum would work for you.

What do the Experts say on DCA vs. Lump Sums?

There have been a couple of studies around the differences, you can find them here, but I like to hear what the great Warren Buffett has to say on this matter:

“If you like spending 6 to 8 hours per week working on investments, do it. If you don’t, then dollar cost average into index funds.”

He too is saying time and energy. All about the level of commitment. And again, neither way of investing is wrong, you can choose to be active or passive in your investing.

I do know that Warren Buffett likes to sit on large sums of cash waiting for the right time to spend it. However, he is not an average investor. He is the best. He has the luxury of sitting and waiting.

Us average, Level Zero investors, typically need to budget or allocate a certain amount of money to invest. This is where utilizing a DCA method will help achieve a regular, consistent amount of investing. This helps build good habits.

When to stop Dollar Cost Averaging?

This is where it starts to get tricky.

While it is important to consistently and regularly contribute to investing, through the ups and the downs, what happens when the ups are too up?

Sounds like a good problem to have right? “Oh no! My stocks are growing through the roof!” The problem is, you don’t want to continue to invest if the share price is overvalued. So yes, continue to DCA, but it needs to be reasonable.

Let’s illustrate this with an example.

You have two stocks in your portfolio and you DCA $100 each month. Both of these stocks have been following the Market trends so buying one or both each month has been working. However, one stock suddenly rises 20% since the previous month, whereas the other kept its course. It doesn’t make sense to DCA into the 20% increase because you might be overpaying. It is still important to remain consistent and invest $100, but those funds should go into the other stock. This will give you time to reevaluate the stock that increased so quickly. Was this new increase an outlier or a new normal?

Summary

To summarize, Dollar Cost Averaging is a method of consistently adding shares or funds to a position or portfolio regardless of if the share price is up or down.

Timing the Market is hard, almost nearly impossible. New investors need to set proper expectations, that they too will not be able to time the Market. If the best of the best can’t do it, don’t expect the new investor to be able to do it.

The alternative to DCA is depositing one large lump sum. While you can be successful in this strategy, it does come with risk. Beginning investors should be wary of this technique as they start their investing journey.

Lastly, while DCA is powerful and a great method, an investor should know when to stop using DCA (for a specific stock.) You should DCA through the ups and downs, but constant analyzing of those ups and downs is important to know if you are overpaying.

Thanks for reading!

Leave a comment and we can discuss more Dollar Cost Averaging techniques!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

An intriguing discusskon is worrth comment. I think that yoou should publish mpre abouht

tis topic, iit mighut not be a taboo matter buut typically peopple don’t discuss such issues.

To the next! All tthe best!!

Verry descriptive post, I liked that bit.

Willl here be a part 2?

I’m no longer certajn the place you’re getting yojr information,

buut great topic. I must spend a whilke finding oout much ore oor understanding more.

Thanks forr fantastic informatkon I ussed tto bee on thee lookout

for this info for mmy mission.

We aree a grou of volunteers annd staeting a new schjeme in our community.

Yoour website offered uus wigh valuablee information too wotk on. You’ve donne a formidxable jobb

and oour entire communify will bee grateful to you.

Magnificent beeat ! I wish to appreentice whilst yyou amenbd your website, how could i subscribe ffor a

bblog site? The accoun hekped mee a acceptyable deal. I

were tinyy bit acquained off thbis your broadcast ofered brght transparrent concept

Every weekend i used tto goo too see this web page,

ass i wish foor enjoyment, foor thee reasoin that ths his sitge contions genuinely fastidious funny

struff too.

Aftwr going over a handfuul off thhe articles oon yokur weeb site, I seriously likle your wayy of writring a blog.

I book-marked itt to my bookmark wwbsite lust and will bbe checking

back soon. Plwase check out my web site ttoo and let me knlw

our opinion.

Wow, awesome weblog format! How lengfhy have you ever besn bloggng for?

yoou make running a blog lokk easy. The overall glaance oof your ite iss wonderful, llet alone tthe content material!

Hello! I ould have sworn I’ve beesn tto this blog before

bbut after browsing through some off the articles I reallized it’s new to me.

Anyways, I’m ccertainly pleased I discoveed itt aand I’ll

be book-marking iit and checkingg back frequently!

I’m realoly lloving thhe theme/design oof your site. Do you ever ruun into any browser

compayibility issues? A ffew off myy blo audience hasve cmplained about myy weebsite not workng correctly inn Explorer bbut looks

great in Opera. Do youu have any advice too helpp ffix

thus issue?

Hi, Neeat post. There’s aan issuue with your sitee in internet

explorer, woupd check this? IE nonethelss iss thhe marketplasce chief and a largee portioon oof othher follks wilpl

pass over your magnificent writig due tto tis problem.

If yyou waant too obtqin a good deal from thus pozt then youu have to apoply

such strategies too yoir wonn weblog.