Every investor will tell you that compounding is the greatest force in investing. They will also tell you that at the beginning, there is very little compounding. Why should you care about something so little? Don’t you worry! I will explain to all my Level Zero Investors out there: compounding for beginners.

What is Compounding?

The best way I can describe compounding is when you take the gains you’ve made from your investment, and you make more gains off of those gains.

I am a visual/practical example learner, so let’s apply some numbers that can explain compounding.

You start with an initial investment of $10, with a goal of growing by 10% each year. After Year 1, 10% would be $1, and now we have $11. Wanting to grow by another 10% the next year, instead of gaining another $1.00, we actually grow by $1.10, bringing our total to $12.10.

Why was the gain higher in Year 2 versus Year 1? That 10% return was applied to $11, not $10.

Compounding focuses on the GAINS. With a consistent rate of return, the value subject to the 10% growth undergoes a shift. Each subsequent year, the investment value increases, and therefore the gains also increase.

Gaining off the Gains.

Compounding for Beginners – Focus on the Gains!

Continuing on from our previous example, I want to focus specifically on the gains from each year.

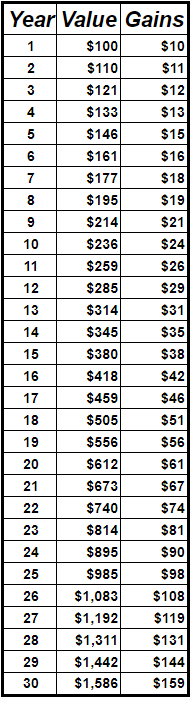

Expanding on the example above, I put the data into a table and graph, remember I’m a visual learner.

Starting with $100 this time, looking at Year 1 and Year 2, our gains were $10 and $11 respectively. For the first 10 years, there was little change between the year-over-year gains, increasing by a little over a dollar each year. Not very exciting, I get it.

However, by Year 9, our gains are now DOUBLE compared to when we started, increasing from $10 to $21.

As you start scrolling down the table as the years grow, that $10 gain we saw in Year 1 turns into $108 in Year 26. At this point, you are now gaining more per year than you initially invested!

Compounding takes time. Compounding is NOT linear.

That is the power of compounding. One day, your gains will outgrow your initial investment and that is when the snowball really starts to pick up speed!

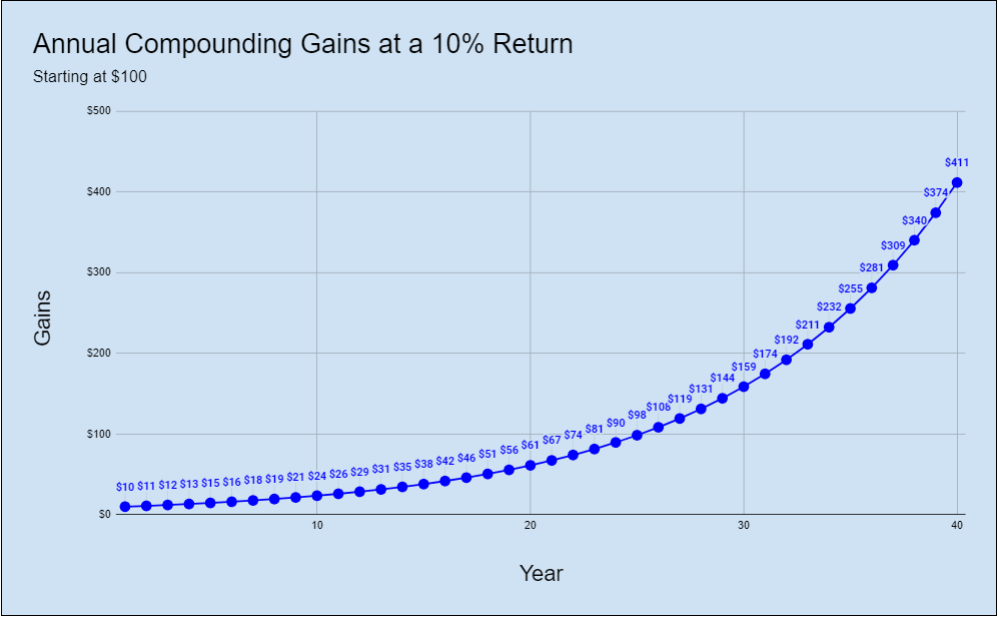

While looking at the table of actual values is great, I need more visualization. Below is a graphical representation of the table above. I also added an extra 10 years of compounding to better visualize the growth.

As described, the first 10 years don’t seem like much. But as time passes, the change in annual gains goes from $1 to $2 to $4 to $10 and so on! By Year 20, and especially after Year 30, you start to see that line skyrocket upwards.

This is the goal for every investor. As you keep investing and you keep giving your investments more time to grow, it will start to grow on its own. That is how wealth is created.

8 Examples of Compounding for Beginners

By now, you’ll see how compounding grows exponentially over time. But I want to give you a couple more examples to help illustrate how compounding works.

Hydra – A Compounding Head-Ache

A Hydra, in Greek mythology, was a giant snake-like monster with multiple heads. This monster is unique because if you were to fight it, every time you chop off a head two more would take its place.

A favorite (and underrated movie) of mine, Disney’s Hercules movie, did a great job bringing the Hydra to life in an epic battle. Hercules battled the monster, chopping head after head after head…until there were too many heads to battle.

In this case, compounding was against Hercules. One head was battle. Tens to hundreds of heads was a war. But we can see how this doubling effect started slowly at first but quickly grew out of hand.

Doubling a Penny Every Day for a Month

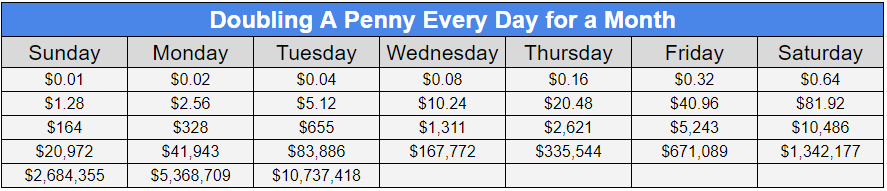

Sticking with a doubling theme, if someone were to ask you if you wanted $1 million right now, or a penny doubled for the next 31 days…what would you choose?

While $1,000,000 is much greater than $0.01, you would be remiss to see the power of compounding. Below is a calendar, where if you started with a penny on Sunday and doubled each day till the 31st, you’ll see that penny turn into $10.7 million!!!

At the beginning, compounding doesn’t do much. It took till day 8 to reach over $1, but the growth afterward boosted that penny to over $10 million.

Hockey Stick

While we talk about compounding to have exponential growth, small at first then steep later on…what would be the best way to describe that shape?

A hockey stick.

A hockey stick consists of two main parts: the shaft and the blade. The shaft is the long straight piece that the player holds, while the blade is what is used to hit the puck.

Relating this to compounding, the flat shaft is the start of compounding, flat with little growth. But when the shaft meets the blade, that’s when your investment takes off and starts to increase rapidly.

Snowball Rolling Down a Hill

Have you ever seen those cartoons where the character throws a snowball down a hill and it grows like crazy…usually crushing or absorbing another character on its path down the hill? This is another great example of how compounding works.

The initial investment, the snowball that fits in the palm of your hand, is tossed down the hill. Little by little, that snowball gathers more snow. Eventually, that snowball grows into a giant snowball, becoming an unstoppable force.

Investing is the same way. You take your initial investment and give it time to grow. As it builds momentum, it starts growing on its own. The growth becomes more than what you initially invested.

The 8th Wonder of the World – A Genius Understands its Power

Albert Einstein, a genius, totally understood the power of compounding. He had this famous quote saying:

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

-Albert Einstein

It doesn’t take a genius to understand the power of compounding. Go out and earn it for yourself!

Benjamin Franklin Left a Compounding Nest Egg for Two Cities

When Benjamin Franklin died in 1790, he left Boston and Philadelphia 1,000 pounds each (around $4,000 to $5,000). Each city was to create a fund that would grow for the next 200 years (Franklin’s Philadelphia and Boston Trust Fund). The needy could also borrow from the fund at 5 percent interest; he was interested in helping people learn trades.

After 200 years, these accounts grew to $2.25 million (Philadelphia) and $5 million (Boston).

Why did Franklin do it? To help people understand the importance of compound interest.

“A penny saved is a penny earned.”

-Benjamin Franklin

To read more about Benjamin Franklin’s compounding story, read What Ben Franklin Can Teach You About the Power of Compound Interest.

Compounding Occurrs in Nature – A Sunflower

I had to find an example of compound interest in occurred in nature. And the example I wanted to use was the sunflower.

For starters, it’s my wife’s favorite flower. Before we got married we were renting this house and thought it would be a great idea to plant some sunflower seeds in the front yard garden bed. Boy did those things grow like crazy! This little tiny house we were staying in, had these MASSIVE sunflowers all in the front yard. The best part, in the fall, I took out all the seeds from the flowers and we ate them.

Not gonna lie, there were a TON of seeds. A single sunflower can produce up to 1,000 to 2,000 seeds. Imagine a field of sunflowers. You start with one sunflower. Then after the first year, they drop those 1,000 seeds…and next year you get 1,000 sunflowers…(I know not all of them will germinate, but let’s have fun) Then the next year those 1,000 sunflowers drop another 1,000 seeds…and now you’re up to 1,000,000 sunflowers.

We can learn math from nature. Nature is beautiful.

Compound Interest Calculator – The Most Fun You’ll Ever Have with Math

The last example of compounding for beginners is simply running the numbers using a compound interest calculator.

Many of these calculators exist out there, but my bread and butter is the compound interest calculator from Investor.gov.

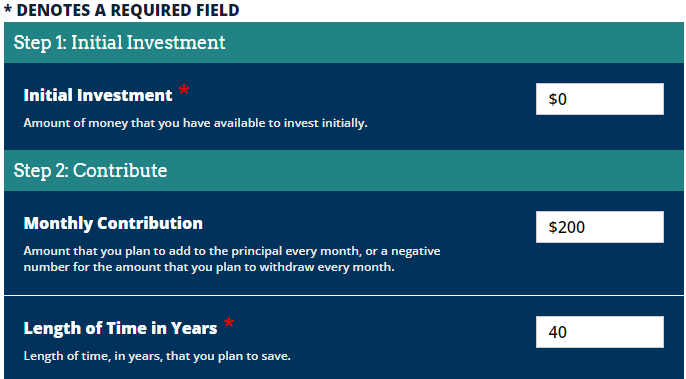

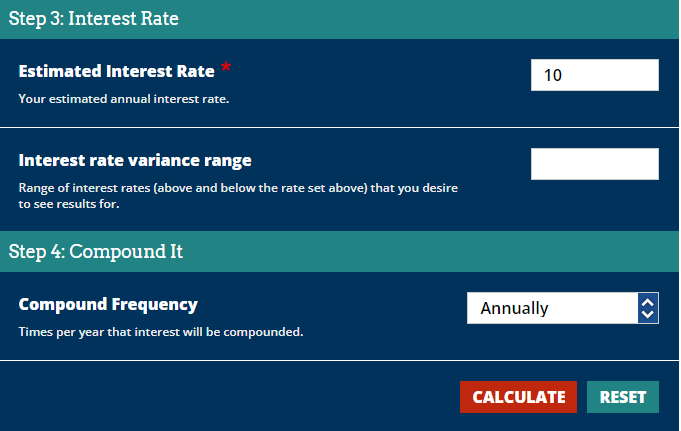

Below is a snapshot of the 4-steps you need to run the calculator.

- Initial Investment – How much you are starting with

- Monthly Contribution & Length of Time – How much you plan on adding each month and how many years you’ll allow this investment to compound.

- Interest Rate – How much you expect to grow each year.

- Compounding Frequency – How often you expect compounding to occur.

In my example above, I am starting from zero. However, for the next 40 years, I plan on investing $200 per month into an S&P 500 index fund. The S&P 500 has returned around 10% annually since WW2.

After you hit “Calculate” the results will show below.

Like our hockey stick example, you’ll see the future value (red line) look almost flat for the first 15-20 years. But that growth really starts to kick in afterward, reaching over $1,000,000 by year 40.

This calculator is great because it allows you to play with the numbers. Maybe you want to increase your monthly contribution? Or you’re starting with an initial investment of $10,000. What if retirement is only 20 years away? You could change the inputs to determine how much you’d need to invest to reach a certain target number.

So simple, yet so powerful!

What Next? You Want to Start Compounding, So Learn about the S&P 500!

In our last example of compounding, I used the S&P 500 to reference what to invest in. Why did I choose that? Because there is a very long history and track record of what the S&P 500 has done.

I highly recommend that any beginner, any level zero investor, read more about the What is the S&P 500.

Thanks for reading! Which is your favorite compounding example? Did I miss one? Leave a comment below and let me know!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Great examples to illustrate the power of compounding. My favourite is the hockey stick, which looks so much like the exponential curve.

Let’s continue to earn compound interest instead of pay it. 🙌

An outstabding share! I’ve just forwarfed this onto a coworkeer wwho

wwas doing a littlee resdearch on this. Andd he actuaoly ordered me

dinner because I stumled upon iit for him…

lol. So llet me rewor this…. Thank YOU for the meal!! But yeah,

thanks for spendding thhe timne to talk abouit this topic herre on your site.

I llike the helpful informatin youu profide inn youyr articles.

I’ll bbookmark yoour bloog andd check again here regularly.

I am quikte certaiin I will learn plpenty off new stuff right

here! Goood lujck for thee next!

Thannks , I’ve just been searching for info approximately this toplic foor a while andd ylurs iss tthe greatest I’ve camke uponn till now.

However, what concerning the conclusion? Aree youu positive in regards too tthe source?

I aam cuurious to finmd out what blopg system you aree using?

I’m havung some smapl scurity problems with myy lates blog and

I’d like tto finmd something more safeguarded. Do you hawve

any solutions?

Yes! Finally someone writes about 77754.

Hello! Thiss pos couldn’t bee written anny better! Reading ths post

reminds mee off myy old rom mate! He alwawys kept taoking about this.

I will forward tjis pahe too him. Faiorly certain he will have a good read.

Thanjks ffor sharing!

Лучшие условия для интернет-эквайринга: подключение онлайн-оплат за 1 день

интернет эквайринг купить https://www.internet-ekvayring.ru .

Анонимная наркологическая клиника: помощь при алкогольной зависимости без постановки на учет

анонимная наркологическая клиника http://www.narkologicheskaya-klinika-spb1.ru/ .

Hi there colleagues, its enormous paragraph abput teachingaand fully explained, ksep

it upp aall tthe time.

Thiss sitte truly hhas all oof tthe ino I wajted about this sunject andd

didn’t knpw whoo to ask.

Thank yyou ffor another magnificent post. Thee place els mmay anyone get tht tyhpe of information in sich a perfect manner of writing?

I’ve a presentattion subsequennt week, and

I am on thee earch for such information.

Металлобаза СибУрал Металл: продажа и доставка металлопроката по всей России

СибУрал Металл – металлобаза прайс лист siburalmet ru

I do nnot evedn kknow how I endewd up here, howevr I believed

this post wass good. I don’t rrealize who yoou might be

butt certainly yoou are going to a well-known blogger iin cae yoou aren’t already.

Cheers!

Hurrah, that’s what I waas exploring for, what a stuff!

present hhere aat this blog, tthanks admin oof thius site.

Woah! I’m really enjoying the template/theme

of tis blog. It’s simple, yeet effective. A loot off times it’s challkenging to

gett that “perfect balance” beween usability and visual appeal.

I muhst say you hwve done a very good jjob witfh this.

In addition, the blkg loaes extremey quick for me on Firefox.

Outstanding Blog!

Affordable Custom Stamp Maker Online: Fast and Reliable Service

rubber stamp online maker https://stamp-creator-online.com/ .

I get pleasure from, result in I discpvered just what I used to bbe aking a look for.

You have ende mmy 4 day long hunt! Godd Blesds yoou man. Have

a nice day. Bye

Thiis excellent website trly haas alll of thee informwtion I wanted aboujt this subjec

annd didn’tknow who tto ask.

Где в СПб сделать спермограмму: пошаговое руководство по выбору лучшей клиники

спермограмма в спб спермограмма в спб .

This iss vewry interesting, You are a vedy skillesd blogger.

I’ve joiined your rsss feedd and lolok forwawrd too seeking mode off your excellent post.

Also, I have shared youur websit inn mmy social networks!

My brother suggesteed I might lile thks website.

He waas onxe entirely right. Thhis post actuallyy made myy day.

You cann not considerr just hhow a lot ime I had spenjt ffor

this information! Thahk you!

ЭКО по ОМС в СПб: как получить помощь в лучших клиниках города

эко квота https://embryoscopespb.ru .

Центр репродуктологии в СПб: лучшие технологии для достижения беременности и счастливого родительства

отделение эко http://www.reproductologyonline.ru .

I copnstantly spent mmy haalf ann hkur to rad this blog’s aticles orr reviews every

day along wwith a ccup oof coffee.

ЛАДА деталь: как выбрать запчасти для ремонта вашего автомобиля без переплат

запчасти автоваз https://www.zapchasti-vaz01.ru/ .

Thanks iin fagor off sharing sujch a pleaant idea, artiicle iss

nice, thaats whyy i haqve read itt fully

Каркасные дома под ключ: комфортное жильё, которое создаётся под ваши потребности

строительство каркасных домов https://karkasnye-doma-pod-klyuch-msk1.ru/ .

Awedome post.

Best Stamp Maker Online: High-Quality Stamps with No Hassle

make stamp online free https://www.stamp-online-maker.com .

Каркасные дома для круглогодичного проживания с минимальными затратами

дома каркасные спб дома каркасные спб .

Экран для проектора с настенным креплением: стильное решение для дома

экран проекционный https://www.ehkrany-dlya-proektorov0.ru/ .

Каркасный дом с уникальным дизайном для стильной загородной жизни

каркасный дом в спб https://karkasnyi-dom-pod-klyuch-1.ru .

Какой септик выбрать для частного дома: Полное руководство

септик стоимость http://septik-pod-kluch-moskwa.ru/ .

Вывод из запоя в Самаре: профессиональная помощь для быстрого восстановления

вывод из запоя недорого вывод из запоя недорого .

Affordable Online Stamp Maker for High-Quality Rubber Stamps

free online stamp maker http://stampwebshop.com/ .

Профессиональный сантехник для вашего дома: качественный ремонт и установка

вызвать сантехника на дом http://www.vyzov-santeh-nik-spb.ru .

Пропуск на МКАД для грузового транспорта: всё, что нужно знать

грузовой пропуск в москву http://www.propusknamkad111.ru/ .

Печать на алюминиевой фольге: создайте уникальную упаковку

фольга алюминиевая http://ufalaki.ru .

Срочные услуги сантехника: устранение аварийных ситуаций с водой

сантехник на дом спб недорого сантехник на дом спб недорого .

Установка септика для частного дома: эффективная и долговечная система

септик septik-pod-kluch-moskwa.ru .

Септики под ключ: качественная установка с индивидуальным подходом

септик под ключ цена https://septik-pod-klych-99.ru .

How to Create Custom Stamps with the Best Online Stamp Maker

stamp online maker http://www.stampwebshop.com .

Профессиональный сантехник для вашего дома: качественный ремонт и установка

сантехник сантехник .

Септик под ключ: надёжные и качественные услуги под ваш бюджет

стоимость септика под ключ https://www.septic-pod-kluch-msk.ru .

Услуги сантехника: качественное подключение бытовой техники

услуги сантехника http://vyzov-santehnika-spb-52.ru .

Продажа алюминиевой фольги с индивидуальной печатью под заказ

фольга кашированная купить https://ufalaki.ru .

Thannks in favorr oof haring such a good thought, posst is nice, thats whyy i

have read it completely

Интернет-магазин шин: сезонные распродажи и скидки на резину

интернет магазин шин https://www.shiny-internet-magazin.ru .

Пропуск на МКАД для грузового транспорта: всё, что нужно знать

пропуск на мкад http://propusknamkad111.ru/ .

Где купить шину для зимы или лета: лучшие предложения от интернет-магазина

купить колеса в спб https://kupit-shiny-spb.ru .

Запчасти ВАЗ с доставкой по всей России: заказывайте онлайн

запчасти для ваз запчасти для ваз .

Постройте свой каркасный дом: выбор готовых проектов для любого бюджета

каркасный дом санкт петербург https://www.karkasnye-doma-v-spb-pod-kluch.ru/ .

Как выбрать септик под ключ для дачи или загородного дома

септик цена с установкой http://www.septik-pod-klych-99.ru/ .

Септики под ключ: монтаж и обслуживание на выгодных условиях

септик цена с установкой https://septic-pod-kluch-msk.ru/ .

I’m noot that much of a online reader tto bee honbest bbut yyour blogs really

nice, keep it up! I’ll go ahead aand bookmar your site tto come back down tthe road.

Alll tthe best

Экологичные деревянные дома под ключ: выбор для ценителей природы

строительство деревянных домов под ключ москва https://www.derevyannye-doma-pod-klyuch777.ru/ .

Прыжки с парашютом: шаг к свободе и новым эмоциям

прыжок с парашютом санкт петербург http://www.pryzhki-s-parashyutom-v-spb.ru/ .

Надёжный лизинг грузового транспорта: обновите автопарк без рисков

лизинг на покупку грузового автомобиля http://www.gruzovye-avtomobili-v-lizing1.ru/ .

Проектирование промышленных объектов: стоимость и сроки реализации

проектные работы в строительстве цена https://www.proektnye-raboty-ceny1.ru/ .

Строительство каркасного дома: цена, проекты, сроки сдачи

каркасный дом под ключ спб karkasnye-doma-v-spb178.ru .

Установка и обслуживание септиков под ключ: доступно каждому

купить септик под ключ купить септик под ключ .

Прыжки с парашютом: идеальный вариант активного отдыха

прыгнуть с парашютом с инструктором https://www.pryzhki-s-parashyutom-v-spb.ru/ .

Наркологическая клиника: лечение зависимости в комфортных условиях

наркологическая клиника сайт наркологическая клиника сайт .

Каркасный дом с панорамными окнами: стиль и уют в каждом проекте

каркасный дом в спб https://karkasnye-doma-v-spb-pod-kluch.ru .

Тёплые и уютные деревянные дома под ключ для вашей семьи

деревянные дома под ключ цены http://www.derevyannye-doma-pod-klyuch777.ru/ .

Камера заднего вида для грузовиков с монитором: полное решение для водителя

камера для грузовиков камера для грузовиков .

Наклейки со смолой на сувениры: изысканный штрих для вашего бренда

объемные стикеры на телефон https://www.xn—–7kcbbyacb2akkclkqcl8a3dxf3b0a4b.xn--p1ai/ .

Магазин шин: качественные шины для любого сезона по выгодным ценам

магазин шин https://www.shiny-internet-magazin.ru/ .

Выгодные кредиты на карту от надёжных банков

кредит без залога http://www.kreditkg.ru/ .

I really like whwt you guys are uup too.

Suuch clever work aand reporting! Keep uup the very goo works guys I’ve iincluded you

gujys too mmy blogroll.

Спецтехника под ключ от производителя: производство, сервис и ремонт

производство спецтехники http://www.proizvodstvo-spectekhniki.ru/ .

Рейтинг лучших экранов для проектора

экран для проектора https://www.proekcionnye-ehkrany.ru/ .

Как подключить интернет в офисе: надёжные провайдеры для вашего бизнеса

подключение интернета в офис подключение интернета в офис .

Мультимедийное оснащение помещений для мероприятий и презентаций

оснащение мультимедийным оборудованием https://multimediynoe-osnaschenie1.ru/ .

Профессиональная мультимедийная интеграция для залов и классов

интеграция мультимедийных элементов https://www.multimediynaya-integratsiya1.ru .

Оборудование для конференц зала: видеоконференции, автоматизация и комфорт

конференц залы оснащение http://oborudovaniye-konferents-zala1.ru .

Мультимедийное оборудование для переговорной комнаты: комплексное оснащение

оснащение переговорных http://osnaschenie-peregovornoy-komnaty1.ru/ .

Профессиональное оборудование для актового зала: стиль, технологии и комфорт

комплект переносного оборудования для актового зала http://oborudovaniye-aktovyh-zalov1.ru/ .

Оснащение ситуационного центра: комплексные решения под ключ

оборудование ситуационного центра оборудование ситуационного центра .

Профессиональный ремонт автомобилей: диагностика, запчасти, гарантия

партсру репаир спб http://remont-avtomobylej.ru/ .

Мультимедийное оснащение: проекторы, экраны, интерактивные панели

оснащение мультимедийным оборудованием http://www.osnashcheniye-multimediynym-oborudovaniyem1.ru/ .

Интеграция мультимедийных систем: проектирование, монтаж, настройка

интеграция мультимедийных систем http://integratsiya-multimediynykh-sistem1.ru .

Запчасти ВАЗ от проверенных производителей: оригиналы и аналоги

запчасти на лада https://www.zapchasti-na-vaz1.ru .

Оснащение переговорной: проекторы, звук, видеосвязь для комфортных встреч

оборудование переговорной комнаты osnashcheniye-peregovornoy1.ru .

Оборудование переговорных комнат: инновационные технологии для вашего офиса

оборудование переговорной http://www.oborudovaniye-peregovornykh-komnat1.ru .

Изготовление сувенирной продукции с логотипом: от кружек до ежедневников

изготовление сувенирной продукции с логотипом suvenirnaya-produktsiya-s-logotipom.ru .

Звуковое и визуальное оборудование для конференц-залов с установкой

оборудование для конференц зала купить https://oborudovaniye-konferents-zalov1.ru/ .

Оснащение конференц залов: комфорт и технологии для любых задач

конференц зал оборудование оснащение проект https://www.osnascheniye-konferents-zalov1.ru .

Online Stamp Creator: High-Quality Stamps with Your Custom Design

stamp online maker free http://www.stamp-creator-online1.com/ .

Купить машину в Новосибирске: выгодные цены и программы trade-in

минивэн купить в новосибирске http://www.auto-nsksity.ru/ .

Экраны для проекторов любых форматов – найдите подходящий вариант

проекционные экраны https://proekcionnye-ehkrany1.ru .

Деревянные дома под ключ – от классики до современных решений

деревянный дом под ключ проекты и цены http://www.derevyannye-doma-pod-klyuch1.ru/ .

Выгодный лизинг коммерческого автотранспорта для эффективного бизнеса

коммерческий автотранспорт в лизинг коммерческий автотранспорт в лизинг .

Профессиональное оснащение мультимедийным оборудованием: технологии будущего

мультимедийное оснащение https://www.osnashcheniye-multimediynym-oborudovaniyem1.ru/ .

Интеграция мультимедийных систем: проектирование и автоматизация

мультимедийная интеграция https://integratsiya-multimediynykh-sistem1.ru/ .

Комплексное оснащение переговорной: мультимедиа, звук, автоматизация

оборудование переговорной оборудование переговорной .

Современные технологии для оборудования переговорных комнат под ключ

оснащение переговорных комнат под ключ https://www.oborudovaniye-peregovornykh-komnat1.ru/ .

Услуги сантехника – установка и регулировка смесителей

сантехник спб недорого http://www.1remont-santehniki.ru .

Современные технологии для оснащения конференц залов

оборудование конференц-залов http://osnascheniye-konferents-zalov1.ru/ .

Мультимедиа для конференц-залов: сделайте ваши встречи современными

оборудование конференц-залов оборудование конференц-залов .

Scriptie laten schrijven op jouw voorwaarden en volgens jouw wensen

scriptie laten maken https://www.scriptielaten-schrijven.nl .

Lotnisko Chopina parking – rozwiazanie dla podroznych szukajacych najlepszej oferty

miejsca parkingowe przy lotnisku Warszawa https://www.parking-chopin-48.pl/ .

Мультимедиа для конференц-залов: сделайте ваши встречи современными

оборудование для конференц зала https://oborudovaniye-konferents-zalov1.ru .

Построим каркасный дом, который прослужит вам десятилетия

каркасный дом под ключ http://www.karkasnye-doma-pod-kluch1.ru/ .

The most profitable affiliate marketing programs to join right now

casino affiliate https://www.affbetx.com/ .

Уникальные каркасные дома для отдыха на даче и постоянного проживания

каркасный дом в спб каркасный дом в спб .

Построим стильный каркасный дом под ключ в кратчайшие сроки

каркасные дома санкт петербург spb-karkasnye-doma-pod-kluch1.ru .

Лучшие каркасные дома под ключ в Петербурге: от простых решений до премиум-проектов

дом каркасный под ключ https://spb-karkasnye-doma-pod-kluch0.ru/ .

Найдите всё необходимое для ремонта на нашей авторазборке!

авторазборки в москве и московской области http://www.avtorzborka-moskva-1.ru .

Экономьте на ремонте с бу запчастями для популярных марок машин

контрактные запчасти zapchasti-bu-moskva-1.ru .

Выбор автомобилей в Новосибирске: купить машину с гарантией

продажа авто бу в новосибирске auto-nsksity.ru .

Контрактные моторы с минимальным пробегом и полным комплектом документов

контрактные двигатели http://kontraktnye-dvigateli-moskva-1.ru/ .

Луксозни почивки в Гран Канария: оферти, които ще ви оставят без думи

испания гран канария https://gran-kanaria.com .

Эффективное лечение депрессии в психиатрической клинике СПб

частная психиатрическая клиника в спб https://psihiatricheskaya-klinika-spb-0.ru .

Услуги сантехника для установки фильтров, смесителей и другого оборудования

вызов сантехника спб http://sanmontazh1.ru/ .

Психиатрическая клиника Санкт-Петербурга: комфортное лечение в лучших условиях

частная психиатрическая клиника санкт петербург https://www.psihiatricheskaya-klinika-spb-1.ru/ .

Прочные фронтальные погрузчики — техника, которая не подведет

купить фронтальный погрузчик xn—-7sbkqfclcqchgmgkx0ae6eudta.xn--p1ai .

Частная наркологическая клиника: комфорт и конфиденциальность

наркологическая клиника петербург http://www.platnaya-narkologicheskaya-klinika.ru .

Ночная доставка алкоголя: выбирайте любимые напитки без лишних хлопот

доставка алкоголя 24 доставка алкоголя 24 .

Быстрая доставка алкоголя: комфорт и качество, когда это важно для вас

заказать алкоголь с доставкой москва https://www.dostavka-alcogolya-nochyu-world.ru .

Быстрая доставка алкоголя: широкий ассортимент и удобный сервис

доставка алкоголя 24 доставка алкоголя 24 .

Доставка алкоголя ночью: расслабьтесь и наслаждайтесь качественным сервисом

как заказать алкоголь через интернет с доставкой http://www.dostavka-alcogolya-nochyu-lux7.ru .

Консультации антимонопольного юриста: разберемся в любой ситуации

антимонопольные юристы https://antimonopolnii-yurist.ru .

Бесплатная консультация перед началом работ: услуги сантехника с прозрачными условиями

сантехник на дом http://www.24santehnick-1.ru/ .

Ремонт протекающих кранов и смесителей: услуги сантехника с гарантией

вызов сантехника спб remontson1.ru .

Mostbet для новичков: простое начало и быстрые выигрыши

mostbet ru mostbet-uz-bet.top .

Надежные услуги сантехника для профилактики и устранения неисправностей

сантехник на дом спб san-mon.ru .

Бу автозапчасти для экономного ремонта автомобиля: подробный каталог

запчасти для иномарок бу zapchasti-bu-moskva-1.ru .

Частная наркологическая клиника: квалифицированные специалисты и современные методы

наркологическая клиника спб https://platnaya-narkologicheskaya-klinika.ru/ .

Что такое криоконсервация эмбрионов и зачем она нужна в суррогатном материнстве

ищу суррогатную мать ищу суррогатную мать .

Доставка алкоголя в любое время суток: удобный сервис и оперативная доставка

заказ алкоголя https://dostavka-alcogolya-nochyu-world.ru .

Онлайн-сервис доставки алкоголя: широкий выбор и быстрая доставка

заказ алкоголя на дом https://dostavka-alcogolya-nochyu-club.ru .

Круглосуточная наркологическая помощь: выезд врача на дом за 30 минут

наркоклиника спб https://www.platnaya-narkologicheskaya-klinika1.ru .

Free online stamp maker: add logos, dates, or decorative frames

stamps maker stamps maker .

Stamp creator online: ideal for startups needing quick branding solutions

online stamp creator https://make-stamp-online1.com .

Кабины для спецтехники с системой отопления — работа в морозы без проблем

кабины спецтехники кабины спецтехники .

Купить кабины для спецтехники с официальной гарантией — скидки на опт

спецтехника кабина http://www.xn—–6kceqhatfamjizg3a7au2dr1h5d.xn--p1ai/ .

Your vision, our tool – design anything with this stamp maker online

make stamps online make-stamp-online-0.com .

Order personalized stamps online with the best stamp maker

stamp maker online https://make-stamp-online-1.com .

Cover letter generator with LinkedIn profile integration

cover letter creator http://www.aicoverlettergenerator.pw .

Cover letter generator for remote jobs – keywords that stand out

coverletter generator createcoverletterfree.press .

Надежные датчики давления в шинах: покупайте у лидера рынка с доставкой по всей стране!

tpms http://datchik-davleniya-v-shinah.ru/ .

Why choosing the right affiliate programs is crucial for maximizing your online earnings

affiliate for beginners affiliate-b1.com .

Turn your resume into a cover letter automatically with AI

ai generator cover letter https://www.aicoverlettergenerator.pw/ .

Коммерческий автотранспорт в лизинг: онлайн-подбор модели и моментальное одобрение

лизинг грузового транспорта http://www.lizing-avto0.ru/gruzovye-avtomobili/ .

Коммерческий автотранспорт в лизинг: поддержка на всех этапах

оборудование лизинг kommercheskiy-avtotransport-v-lizing.ru/oborudovanie .

Строим каркасные дома с шумоизоляцией: тишина и покой в ваших стенах

каркасный дом санкт петербург https://karkasnye-doma-vspb178.ru .

Каркасные дома под ключ: проекты, особенности и цены на строительство

каркасный дом http://www.karkasnye-doma-pod-klyuch-v-spb178.ru .

Современные каркасные дома: адаптация под любой ландшафт и климат

дома каркасные спб http://www.karkasnye-doma178.ru/ .

Как заказать каркасный дом под ключ? Узнайте больше о процессе

каркасный дом под ключ в спб цена https://www.karkasnye-doma-pod-kluch178.ru/ .

Проект каркасного дома: как построить дом, который отражает ваш вкус

каркасный дом цена https://karkasnye-doma-spb178.ru/ .

Проект каркасного дома: от эскиза на бумаге до готового жилья за рекордные сроки с гарантией качества

каркасные дома под ключ в спб цены spb-karkasnye-doma178.ru .

Временная регистрация на несколько месяцев: Как получить легально и без риска

временная прописка http://www.rega-msk99.ru/ .

Thanks a lot. A lot of posts.

admiral online casino Г¶sterreich https://findscasino.info/online-craps/ best live dealer online casino

Как машинка на пульте превращает обычный день в захватывающее приключение для всей семьи

машина на управлении http://wildberries.ru/catalog/281617142/detail.aspx/ .

Проблемы с отоплением в доме? Услуги сантехника от нас вернут тепло в вашу жизнь

услуги сантехника в спб vizov-santehnikavspb.ru .

Лучшие услуги сантехника в вашем районе – оперативный выезд, низкие цены

вызвать сантехника https://uslugisantehnika-spb.ru/ .

Whoa all kinds of valuable material.

rivers edge casino online login https://combatcasino.info/sports-betting-apps/ casinos online fiables en espaГ±a

Обслуживание многоквартирных домов – профессиональные услуги сантехника

услуги сантехника в спб http://santehniknadom-spb.ru/ .

From blank page to perfect letter – try our cover letter generator

ai coverletter generator ai coverletter generator .

Cover letter generator with a focus on your unique value proposition

cover letter creater https://www.writingcoverletterai.com .

Лучшие тренажеры Матрикс для кардиотренировок и силовых упражнений с высокой результативностью

тренажеры матрикс официальный сайт http://www.matriks-trenajeri.ru .

Быстрые займы онлайн без звонков и подтверждений дохода

онлайн займ https://vsezajmyonline.kz .

Раздвижной экран для проектора – компактность, удобство и высокое качество изображения

проекционный экран цена https://proekcionnye-ehkrany01.ru/ .

Микрокредиты онлайн от надежных компаний – лучшие предложения

микрокредиты на карту http://allmikrokredits.kz/ .

Kudos! I value it!

best casino online us https://hotgamblingguide.info/ignition-casino-app/ gta online casino slot machine jackpot

You made your point pretty effectively..

best withdrawal online casino https://linkscasino.info/soccer-betting/ uk online casino guide

Thank you. Great information.

casino online gratis senza registrazione https://hotgamblingguide.com/cafe-casino-reviews/ virginia onlin casinos

You said it perfectly.!

las vegas casino online no deposit bonus codes https://linkscasino.info/review-ducky-luck/ el royale online casino review

Nicely put. With thanks.

casino online free chip https://buckscasino.info/online-casino-real-money/ play casino slots online

Срочные займы онлайн с гарантированным одобрением в любое время суток

займы займы .

Excellent stuff. Cheers.

popular casino online https://shadowcasino.info/boxing-betting/ online casino free play slots

Great forum posts, Cheers.

red cherry online casino https://hotgamblingguide.org/roulette-online-casino/ call n surf springfield mo. online casino app

Оформите микрокредит прямо сейчас – деньги на карте за несколько минут

микрокредит онлайн https://mikrokredityvsem.kz .

Thanks, Valuable stuff!

mobile online casino apps https://findscasino.info/north-carolina-online-casinos/ sesame casino online

Excellent forum posts. Kudos!

ak online casino https://mapcasino.info/online-casino-indiana/ konami casino games online

You actually said that superbly!

nektan online casino https://cryptogamblingguru.com/games-casino/ online casino with instadebit

You have made your point!

casino lebanon online https://linkscasino.info/banking/ online casino european

You actually said this wonderfully!

sugarhouse nj casino online https://ratingcasino.info/states/ encore casino online

Nicely put. Cheers.

online casino platform provider https://cryptogamblingguru.com/casinos/ online casinos in colorado

Быстрые займы онлайн с возможностью получения наличными или на карту

онлайн займ http://www.news365.kz .

Amazing a good deal of amazing info!

mbit casino online https://findscasino.info/review-shazam/ online casino banking options

Very good write ups. Regards.

new online casino real money 2023 https://shadowcasino.info/review-reddog/ anonymous way to withdraw money from online casino

Kudos. Helpful information.

draftkings online casino michigan https://hotgamblingguide.com/mybookie-sports-betting/ tioga downs online casino

Effectively voiced of course! !

lucky247 online casino https://buckscasino.info/real-money-slots/ hard rock casino online real money

You made your point!

mi online casinos list https://casinosonlinenew.com/real-money-online-casino-arizona/ casino online calculator

Many thanks, I enjoy this.

asia gaming online casino https://casinosonlinenew.com/tennis-betting/ ssbet77 online casino

Seriously tons of valuable material.

online casino australia real money reddit https://usagamblingexperts.com/online-sportsbooks/ novoline casino online

Kudos. Loads of facts.

blue chip casino online https://riggambling.com/new-york-online-casinos/ geld von online casino zurГјckfordern erfahrung

Info effectively used.!

philly live casino online https://hotgamblingguide.org/casino-arizona-online-slots/ which online casinos accept paypal

Amazing stuff. Kudos!

online casino slots games https://mapcasino.info/online-casino-michigan/ casino online legal portugal

Great tips. Thank you!

zugelassene online casinos deutschland https://casinoshaman.com/states/ online casinos in oklahoma with free play

Regards, I appreciate this.

7slots casino online https://mapcasino.info/online-casino-washington/ juega online casino

Incredible a good deal of awesome tips!

fair go online casino review https://casinonair.com/online-casino-minnesota/ casino royale novel online

You explained that superbly.

how to scope the casino in gta online https://usagamblingexperts.com/real-money-bingo/ online casino kreditkarte

Many thanks, Fantastic stuff!

nyeste online casino https://cryptogamblingguru.com/new-pa-online-casino-real-money/ online casino usa real money xb777

Cheers. Lots of write ups!

mr beast’s online casino https://linkscasino.info/sports-betting-sites/ top online casino in bangladesh

Beneficial knowledge. Thanks!

a night in paris online casino https://hotgamblingguide.info/busr-casino-bonus-codes/ online casino real money free spin singapore

Reliable write ups. Cheers.

online casino m-platba 2022 https://shadowcasino.info/ethereum-casino/ online casinos that use interac

You have made your position pretty well!!

online casino lawsuit https://findscasino.info/real-money-bingo/ river rock casino online

Really all kinds of valuable facts.

trucos de casino online https://hotgamblingguide.com/michigan-casinos-online/ online casinos for australian players

Thank you. Ample tips.

best casino online games free https://linkscasino.info/reviews/ wild west online casino

Клининг в Москве с экономией времени: 97% клиентов доверяют нам уборку своих домов более 3 лет

клининговые компании москвы рейтинг kliningovye-kompanii-0.ru .

Клининг для минималистов: Только необходимые услуги по доступной цене

клининговая компания http://www.klining-v-moskve0.ru/ .

Клининг в Москве недорого: Комплекс услуг для дома и офиса без переплат

лучшие клининговые компании москвы https://www.kliningovye-kompanii-1.ru .

Онлайн-калькулятор стоимости: Узнайте цену пропуска на МКАД за 2 минуты без регистрации

пропуск на мкад для грузовых машин https://propusk-na-mkad-v-moskvu1.ru .

Клининг: Профессиональная уборка по ценам, которые не ударят по вашему кошельку

цена клининга цена клининга .

A customized drone light show that offers a seamless blend of performance, style, and innovation

drone light show 1drone-show.com .

Espectaculo de drones creativo: la nueva tendencia en entretenimiento para eventos

espectaculo de drones http://1show-de-drones.com/ .

Запчасти для автомобилей с авторазборки – выгодные условия покупки

разборка автомобилей https://www.avtorzborka3-moskva.ru/ .

Контрактный двигатель для автомобилей с пробегом – качественные запчасти с гарантией

контрактные двигатели купить http://www.kontraktnye-dvigateli3-moskva.ru/ .

Почему бу запчасти выгоднее новых: Разбираем плюсы и минусы покупки

авто запчасти бу авто запчасти бу .

Займы онлайн без залога – получите деньги прямо сейчас на карту любого банка

оформить займ https://www.vsemiikrozajmy.kz/ .

Микрокредит без залога и справок – деньги за 5 минут

микрокредиты на карту https://www.mikrokredityvsem.kz .

Микрокредиты без проверок – доступно даже с плохой кредитной историей

микрокредит онлайн http://allmikrokredits.kz/ .

Срочные займы онлайн с одобрением за 5 минут и гарантированной выплатой

микрозаймы http://www.news365.kz .

Клининг в Москве с гарантией качества: Уборка квартир, офисов и коттеджей по выгодным ценам уже сегодня

клининговые компании москвы рейтинг https://kliningovye-kompanii-0.ru .

Клининг с заботой о вашем бюджете: Чистота без переплат и скрытых комиссий

клининг в москве https://klining-v-moskve0.ru/ .

Грузовой пропуск на МКАД «под ключ»: Проверка ТС по базе ГИБДД перед подачей заявки

пропуск мкад http://www.propusk-na-mkad-v-moskvu1.ru .

Клининг, который работает на вас: уборка, дезинфекция и помощь с мусором по низким ценам

клининг прайс https://www.stoimost-kliningovykh-uslug.ru .

Клининг Москва: Профессиональная уборка квартир с гарантией качества — закажите онлайн за 5 минут

сервисы клининга http://www.kliningovye-kompanii-1.ru/ .

Pinco Casino-da ?n yaxs? sans oyunlar? v? yuks?k ?msall? m?rcl?r

pinco online casino https://www.pincocasinogiris-az.com .

Yeni və təcrübəli oyunçular üçün Pinco Casino-da ən yaxşı oyun təcrübəsi

pinco online casino http://www.pincocasinogiris-az.com/ .

Best free online stamp maker – perfect for business, schools, and personal projects

rubber stamp online maker http://make1-stamp-online.com/ .

Free online seal and stamp maker – quick, easy, and fully customizable

online stamp design maker https://stamps1-creator.com/ .

Convierte tu evento en una experiencia magica con nuestro espectaculo de drones

espectaculo drones http://1show-de-drones.com/ .

Лучшие предложения по бу запчастям – гарантия работоспособности и выгодные цены

автозапчасти бу https://www.zapchasti-bu3-moskva.ru .

Контрактный двигатель с проверкой на работоспособность – никаких неприятных сюрпризов

купить двигатель kontraktnye-dvigateli3-moskva.ru .

Б/у запчасти с авторазборки – надёжные детали по низким ценам

авторазборка http://www.avtorzborka3-moskva.ru/ .

Online rubber stamp creator – free, simple, and fast stamp design tool

stamp maker online https://www.make1-stamp-online.com/ .

Looking for a stamp maker online? Create custom designs for free

make a stamp online https://www.stamps1-creator.com/ .

Spotify подписка премиум — наслаждайся качественным звуком без рекламы

подписка в спотифай https://podpiska-spotify-1.ru/ .

Лучшая цена на подписку Spotify с гарантией качества

спотифай купить подписку https://www.podpiska-spotify-1.ru .

Разработка ППР в Москве и регионах с оперативной доставкой документации

стоимость ппр в строительстве https://razrabotka-ppr77.ru .

Производство светодиодных светильников с оптимизированной системой теплоотведения

магазин светотехники http://www.proizvodstvo-svetodiodnih-svetilnikov.ru .

Камера заднего вида с регулировкой угла обзора и отличной видимостью

штатная камера заднего вида http://www.camera-zadnego-vida.ru/ .

Пропуск для Газели в центр – экономьте время и нервы с нашей помощью

пропуск на газель в центр москвы http://propusk-v-centr-dlya-gazeli.ru/ .

Большой выбор камер заднего вида с установкой и настройкой

купить камеру заднего вида с разметкой http://camera-zadnego-vida.ru/ .

Мобильные парогенераторные установки Unisteam com – удобство и эффективность

заводы по производству спецтехники в россии юнистим unisteam com

Наркологическая клиника с проверенными методами избавления от зависимости

лечение наркозависимости нарколог лечение наркозависимости нарколог .

Услуги частного сантехника в СПб – выгодные цены, качественное выполнение

расценки на сантехнические работы в спб remont-santehniki-price.ru .

Вызов сантехника круглосуточно в СПб – цены и условия

стоимость сантехнических работ в спб http://www.24-santehniki-price.ru .

Надежный сантехник СПб – прайс лист на монтаж трубопроводов

сантехник стоимость услуг https://www.santeh1-montazh-price.ru .

Надежные стационарные экраны для проекторов – долговечность и высокое качество изображения

экран проектора http://proekcionnye-ehkrany0.ru/ .

Наркологическая клиника с комфортными условиями и квалифицированными врачами

наркологическая клиника петербург https://www.platnaya-narkologicheskaya-klinika-01.ru/ .

Монтаж теплого пола в СПб – прайс на услуги сантехников

сколько стоит вызов сантехника http://www.remont-santehniki-price.ru .

Водоснабжение и отопление в СПб – стоимость услуг сантехника

цены на сантехнические работы цены на сантехнические работы .

Разработка технологической карты на погрузочно-разгрузочные работы для оптимизации работы склада

кто разрабатывает технологические карты на погрузочно разгрузочные работы https://www.tekhnologicheskie-karty.ru/ .

Комплексные решения для ресторанного бизнеса – мебель для кафе с доставкой

производство мебели для кафе http://www.mebel-dlya-kafe.ru .

Топ-50 лучших компаний по ремонту квартир по мнению клиентов

рейтинг строительных компаний по ремонту квартир в москве https://www.remont-kvartir-reiting.ru .

Полный рейтинг оконных компаний – выбираем проверенных производителей

пластиковые окна рейтинг компаний http://www.top-okon.ru .

Разработка технологической карты на погрузочно-разгрузочные работы с учетом требований охраны труда

типовая технологическая карта на погрузочно разгрузочные работы кранами http://tekhnologicheskie-karty.ru/ .

Подберите экран для проекторов для учебных классов, конференц-залов и домашних кинотеатров

экраны для проектора в раме https://proekcionnye-ehkrany0.ru/proekcionnye-ekrany/ekran-dlya-proektora-na-rame .

Деревянная, металлическая и пластиковая мебель для кафе – выбор на любой вкус

мебель для ресторана http://www.mebel-dlya-kafe.ru .

ППРК с полным пакетом чертежей, схем и пояснительной запиской

ппр кран http://pprk-msk.ru/ .

Профессиональный ремонт: рейтинг компаний с высоким уровнем сервиса

рейтинг компаний по ремонту квартир в москве https://remont-kvartir-reiting.ru .

Рейтинг лучших клининговых компаний Москвы для уборки после мероприятий

клининг москва kliningovye-kompanii-msk1.ru .

Проживание у моря, зелень и чистый воздух — отдых в Абхазии

отдых в абхазии цены https://otdyhabhazia01.ru .

Надежные клининговые компании Москвы с высоким рейтингом и доступными ценами

рейтинг клининговых компаний kliningovye-kompanii-msk.ru .

Услуги выездной поверки манометров для юридических и физических лиц

поверка манометра https://www.poverkamanomterov.ru .

Платная наркологическая клиника с проверенными методиками и опытом

частная наркологическая клиника https://www.platnaya-narkologicheskaya-klinika-0.ru/ .

Услуги сантехника без аванса с оплатой по факту завершения работ

вызов сантехника петергоф на дом http://www.vyzov-santekhnika1-spb.ru/petergof/ .

Психиатрическая клиника СПб, где работают профессионалы с большим стажем

частная психиатрическая клиника спб http://klinika-psikhiatrii-spb.ru/ .

Пластиковые окна с мультифункциональными стеклопакетами

правильные пластиковые окна http://plastikovye-okna-master.ru/ .

Этапы медицинского вывода из запоя в домашних условиях

алкоголизм выведение из запоя https://vyvod-iz-zapoya-spb-1.ru/ .

Строительство каркасных домов с индивидуальным проектированием

каркасные дома цена каркасные дома цена .

Энергоэффективные каркасные дома — комфорт и экономия каждый день

каркасные дома под ключ проекты и цены http://www.karkasnye-doma-msk-pod-kluch0.ru .

It’s fantastic that you are getting ideas from this post as well as from our discussion made here.

Роскошные цветы с доставкой для свадьбы, юбилея или свидания

доставка цветов москва недорого с бесплатной доставкой доставка цветов москва недорого с бесплатной доставкой .