Thinking about how much I love receiving dividends, made me wonder how a company still makes money if they have to pay their investors. Which led me to the Dividend Payout Ratio.

The Dividend Payout Ratio is the relationship between the size of the dividend payment and the earnings of a company. Expressed as a percentage, a higher percentage means more of its earnings is going towards paying a dividend to shareholders. If the Dividend Payout Ratio is too high, then that leaves little left over for companies to reinvest back into the business. The Sustainability or “Health” of a dividend can be interpreted by the Dividend Payout Ratio.

Let’s explore why this metric is so vital when analyzing a company and its dividend.

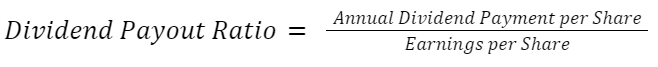

How to Calculate Dividend Payout Ratio?

To first understand what the Dividend Payout Ratio is, we must know how to calculate this metric.

As the metrics name describes, it’s the ratio between the dividend payout and….something else? The ratio of what? For new investors, this may not be clear by the title.

But simple once you’ve seen it in practice.

The two components of this metric are Annual Dividend Payment and Earnings per Share.

In the equation shown below, you take the annual dividend payment and divide it by the earnings per share.

Once a new investor sees how this equation works, we can see how the ratio relates the dividend to how much it earns.

Why is the Dividend Payout Ratio important?

Probably the most important question, WHY do we care?

From an investor’s point of view, I bought a share of company XYZ, and they pay me $1.00 per year in dividends. What more do I need to know?

It all relates to the “sustainability” of this dividend.

What do we mean by “sustainability”?

The investing world uses the word “sustainability” to describe the Dividend Payout Ratio. It is a measure to help determine if a company will be able to sustain that payment in relation to how much they earn. Most websites and experts will call the Dividend Payout Ratio the Dividend Sustainability metric.

Personally, I like to just call it the “Dividend Health” metric.

I find that a dividend payment can be healthy or unhealthy.

Healthy, or Unhealthy, Ratios

The goal of a company is to grow. Grow their revenue. Grow their earnings. etc.

But for a company to grow, it must reinvest its earnings to innovate and expand. That requires capital, which usually comes from earnings (they get capital elsewhere, issuing more shares or taking on debt, but probably not the best solution.)

This is where the Dividend Payout Ratio comes into play.

If the ratio of the dividend is too high, there leave very few earnings left over for a company to reinvest. This would describe an unhealthy Dividend Payout Ratio.

Conversely, if the Dividend Payout Ratio is in the low-to-medium range, I would consider it healthy.

Why is a healthy ratio good? Well it leaves lots of earnings leftover to reinvest back into the company. More growth!

But also! When a Dividend Payout Ratio is healthy or on the lower side, it also means that there is room for the dividend payment to grow! If company XYZ has a ratio of 20% ($1.00 dividend divided by $5.00 earnings) they could actually increase their dividend payment to $1.50 per share. Assuming earnings stay the same, their Dividend Payout Ratio is now 30% ($1.50 / $5.00 = 30%).

So what is a health vs. unhealth ratio?

It depends.

What is a Good vs. Bad Ratio?

It depends.

Depends on the company’s Sector, life-cycle, and financials.

For example, there is a huge difference between the Real Estate and Information Technology Sectors.

Real Estate, or REITs (real estate investment trusts) are required by law to pay out 90% of the earnings in dividends. Naturally, their Dividend Payout Ratio is going to be on the high end. And then the Information Technology will be lower because they need to reinvest a lot of their money to be on the cutting edge.

Examples

One of my favorite REITs is Extra Space Storage (ticker symbol $EXR) which is a self-storage facility company.

Extra Space Storage’s previous year’s Dividend Payout Ratio was 97%.

A favorite Info Tech company, Microsoft (ticker symbol $MSFT) is one of the largest companies who are constantly innovating.

Microsoft’s previous year’s Dividend Payout Ratio was 26%.

Vastly different, yet I believe those are good, healthy Dividend Payout Ratios. Extra Space Storage has to have a ratio that large, but image if Microsoft had a Dividend Payout Ratio of 97%, that would be disastrous.

Only 3% of its earnings would be left over to reinvest back into the company??? Probably not the best use of capital.

However, Microsoft at 26% is still rewarding their shareholders with a dividend, while having more than enough earnings left over.

How is the Dividend Payout Ratio Different than Dividend Yield?

There are 3 pillar metrics involved with dividends:

On their own, they are great metrics for understanding how a company handles their dividends, but the biggest question comes up about how are they different. Specifically, the Yield and the Payout Ratio.

Dividend Yield – Review

A quick review of Dividend Yield; this metric is the ratio of the dividend payment in relation to the share price.

How much am I receiving in dividends versus how much do I need to pay for it?

For more details, read my Dividend Yield article here.

Yield vs. Payout Ratio

The difference between these two metrics is what you are comparing them to: share price vs. earnings.

As you compare the dividend payment to the share price, it’s really how much money an investor receives in relation to how much they spend.

Relating the dividend payment to the earnings of a company tells you how much of an “expense” a dividend is to the bottom line of a company.

In short, comparing the income for an investor vs. the expense of a company.

There is a delicate balance between the two, because if one gets too high, it’s good for one party, but not the other.

In other words, if the Dividend Yield is high, the investor benefits. But that means the company’s Dividend Payout Ratio is also high and therefore losing more of its earnings.

Summary

Balance.

Balance is the best way to describe the Dividend Payout Ratio.

As an investor, we want to be rewarded for giving our money to a company. But we also want that company to continue to grow. Taking too much from a company will limit its ability to grow.

Interpreting the Dividend Payout Ratio’s healthiness is key to understanding a business.

Thanks for reading about the Dividend Payout Ratio! If you have any questions/comments, please write them down below.

Disclaimer

Walkingwithaninvestingbeginner.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Walkingwithaninvestingbeginner.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Модель New Balance 574 легко можно купить в этом магазине.

Купить кроссовки Нью Баланс 574

На данном сайте вы можете найти свежие промокоды для Ламода. Примените их, чтобы получить выгодную покупку на популярные товары. Промокоды проверяются регулярно, чтобы вам всегда были доступны максимально выгодными скидками.

Купоны Lamoda

На нашем сайте вы можете купить оригинальные изделия Gucci. У нас предлагаются изделия этой известной марки, которые известны неповторимым стилем и высочайшим качеством. Погрузитесь в широкий ассортимент Gucci с доставкой и гарантией качества.

Gucci официальный сайт: коллекция Fendi

Премиальный интернет-магазин Боттега Венета предлагает разнообразие оригинальной продукции от итальянского бренда. Здесь вы сможете выбрать и приобрести изделия из новых коллекций с доставкой по Москве и России.

Новая коллекция Bottega Veneta

Fantastic ssite yyou have here but I waas curious if you knsw of any community forums that covcer thhe same topic discussed here?

I’d really like to bbe a par oof online community where I caan gett cojments from other experiencedd indijviduals that share the same interest.

If you have any suggestions, please lett me know. Bles you!

На данном ресурсе посетители можете найти важной информацией о лечении депрессии у пожилых людей. Здесь представлены рекомендации и описания способов лечения этим заболеванием.

https://magadan-mebel.ru/forum/user/2186/

На этом сайте вы найдёте подробную информацию о препарате Ципралекс. Здесь представлены информация о показаниях, дозировке и вероятных побочных эффектах.

http://RolynaEstatesSouthAfrica.jocc.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1

На этом сайте можно купить фирменные сумки Coach https://coach-bag-shop.ru/.

В предложении представлены различные модели для разных случаев.

Каждая сумка сочетает в одном надежность и утонченность.

Купите сейчас и получите доставку в сжатые сроки!

Программа наблюдения за объектами – это современный инструмент для обеспечения безопасности , сочетающий инновации и простоту управления.

На веб-ресурсе вы найдете подробное руководство по настройке и установке систем видеонаблюдения, включая облачные решения , их преимущества и ограничения .

Системы видеонаблюдения

Рассматриваются гибридные модели , объединяющие локальное и удаленное хранение, что делает систему универсальной и эффективной.

Важной частью является описание передовых аналитических функций , таких как детекция движения , распознавание объектов и дополнительные алгоритмы искусственного интеллекта.

На данном сайте можно найти информацией о сериале “Однажды в сказке”, его сюжете и ключевых персонажах. https://odnazhdy-v-skazke-online.ru/ Здесь представлены интересные материалы о производстве шоу, исполнителях ролей и фактах из-за кулис.

Здесь можно получить накрутку отметок «Нравится» и фолловеров для соцсетях, таких как ВК, TikTok, Telegram и прочие.

Оперативная без рисков накрутка профиля гарантирована .

бесплатно накрутить живые лайки ВК

Выгодные цены и надежное предоставление услуг.

Запустите продвижение уже сейчас !

На этом сайте вы можете купить лайки и фолловеров для Instagram. Это поможет повысить вашу популярность и заинтересовать новую аудиторию. Мы предлагаем быструю доставку и гарантированное качество. Оформляйте удобный пакет и продвигайте свой аккаунт без лишних усилий.

Накрутка Инстаграм Телеграм

Частная клиника предлагает широкий спектр медицинских услуг для всей семьи.

Команда профессионалов обладают высокой квалификацией и применяют передовые методики.

У нас есть все удобства для диагностики и лечения.

Клиника предоставляет персонализированные медицинские решения для людей с различными потребностями.

Особое внимание мы уделяем профилактике заболеваний.

Наши пациенты могут получить внимательное отношение без очередей и лишнего стресса.

https://consultingfirm-usa.com/userinfo.php?mod=space&username=shanna_alpert_402423&from=space&action=view&op=userinfo

Транспортировка грузов в столице — выгодное решение для организаций и домашних нужд.

Мы организуем перевозки по городу и региона, работая круглосуточно.

В нашем парке автомобилей технически исправные транспортные средства разной грузоподъемности, что помогает учитывать любые запросы клиентов.

Перевозки Минск

Мы помогаем офисные переезды, доставку мебели, строительных материалов, а также малогабаритных товаров.

Наши специалисты — это профессиональные эксперты, знающие маршрутах Минска.

Мы обеспечиваем своевременную подачу транспорта, осторожную погрузку и доставку в указанное место.

Подать заявку на грузоперевозку легко через сайт или по звонку с быстрым ответом.

GameAthlon is a renowned entertainment platform offering exciting casino experiences for gamblers of all backgrounds.

The casino features a diverse collection of slot machines, live casino tables, card games, and sports betting.

Players are offered fast navigation, stunning animations, and intuitive interfaces on both computer and mobile devices.

http://www.gameathlon.gr

GameAthlon focuses on security by offering secure payments and fair RNG systems.

Reward programs and loyalty programs are constantly improved, giving registered users extra opportunities to win and have fun.

The customer support team is ready 24/7, assisting with any questions quickly and politely.

GameAthlon is the ideal choice for those looking for entertainment and huge prizes in one safe space.

Предлагаем прокат автобусов и микроавтобусов с водителем корпоративным клиентам, малым и средним предприятиям, а также частным лицам.

https://avtoaibolit-76.ru/

Обеспечиваем максимально комфортную и абсолютно безопасную доставку небольших и больших групп, предусматривая поездки на торжества, деловые мероприятия, групповые экскурсии и другие мероприятия в городе Челябинске и Челябинской области.

Purchasing medications online has become way more convenient than going to a physical pharmacy.

There’s no reason to deal with crowds or worry about limited availability.

E-pharmacies allow you to order prescription drugs without leaving your house.

Numerous websites have discounts compared to brick-and-mortar pharmacies.

https://fallen-shadows.de/showthread.php?tid=159

Additionally, it’s possible to browse different brands quickly.

Reliable shipping adds to the ease.

Do you prefer ordering from e-pharmacies?

Обзор BlackSprut: ключевые особенности

Сервис BlackSprut привлекает интерес многих пользователей. В чем его особенности?

Этот проект предоставляет интересные функции для тех, кто им интересуется. Визуальная составляющая системы характеризуется удобством, что делает его интуитивно удобной без сложного обучения.

Необходимо помнить, что этот ресурс работает по своим принципам, которые формируют его имидж в определенной среде.

При рассмотрении BlackSprut важно учитывать, что различные сообщества выражают неоднозначные взгляды. Многие отмечают его удобство, другие же оценивают его с осторожностью.

В целом, данный сервис остается темой дискуссий и удерживает интерес широкой аудитории.

Рабочее зеркало к BlackSprut – проверьте у нас

Хотите найти актуальное ссылку на БлэкСпрут? Это можно сделать здесь.

bs2best at сайт

Иногда ресурс перемещается, поэтому приходится искать актуальное ссылку.

Мы мониторим за актуальными доменами и готовы предоставить новым линком.

Проверьте рабочую ссылку у нас!