Dividends are great, but many scoff at how big, or small, a dividend payment is. While yes they are small, using the Dividend Yield is a great way to measure the size of the dividend payment.

Dividend Yield is the ratio of the dividend payment in relation to the Share Price. Expressed as a percentage, it can range from anywhere from 0% to infinity. However, the most common Dividend Yield percentages range around 1% to 5%.

Let’s dive into this dividend metric and how it may (or may not) influence investors.

Back to Basics – What is a Dividend?

Before going too deep into Dividend Yields, lets do a quick recap of what is a dividend?

A dividend is a reoccurring payment investors earn from the company they invest in. An example would be the company, Johnson and Johnson (ticker symbol JNJ), which currently pays a dividend of $1.19 per share every quarter. This means 100 shares of Johnson and Johnson would earn an investor a $119 dividend payment every quarter.

Do all companies pay a dividend? No. And there may be a reason for that. Using the Johnson and Johnson example above, they pay a dividend whereas a company like Tesla (ticker symbol TSLA) does not. The big difference between these two is the stage of their company’s life-cycle.

Johnson and Johnson was founded in 1886 and Tesla was founded in 2003. Johnson and Johnson is a well-established company, and I would consider it to be in a stable portion of its life cycle. Whereas Tesla is still new and growing. Tesla would want to invest its earnings into their business to grow. While not growing at the same rate as a new tech/car company, Johnson and Johnson would attract investors by offering a dividend.

For more information on Dividends, read my article on Dividends here.

Analyzing dividends is more than just “Did I get a check from that company?”

We’ll next explore what is a Dividend Yield and how that can help us understand and analyze a company.

What is a Dividend Yield?

Dividend Yield is the ratio of the dividend payment in relation to the Share Price.

Dividend payments are paid out on a per-share basis. Therefore, it is important to know how much that dividend payment relates to how much you spent to buy that share.

How much am I getting versus how much I am spending?

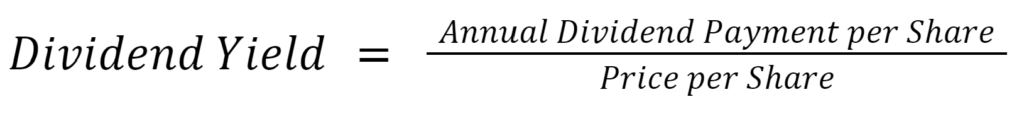

How to Calculate Dividend Yield

Dividend Yield is an easy metric to calculate, and the components of this metric are easy to find.

To calculate a stock’s dividend yield, first find the annual dividend payment and the share price. Next, divide the annual dividend payment by the share price. This percentage will be the dividend yield.

Dividend Yield calculation is seen below.

Simple example: Stock XYZ pays an annual dividend of $1 and the share price is $100. This gives us a Dividend Yield of 1% ($1 / $100 = 1%).

Real-life example: Apple pays an annual dividend payment of $0.92 per share and has a share price of $165. Apple’s Dividend Yield is ($0.92 / $165 = 0.56%).

Why is Dividend Yield Important?

Analyzing a company before investing in it is extremely important. Understanding the dividend payment of a company is just one piece of the puzzle. Knowing how Dividend Yield is calculated, we can better understand what that ratio/percentage means.

But how do we know if that Dividend Yield is good or not? What can we compare it to?

Comparisons

Using Apple as our example again, we know that their Dividend Yield is 0.56%. Is that too high or low?

First, we can compare Apple to the Market, in this case, let’s use the S&P 500. Currently, the S&P 500’s average Dividend Yield is 1.65%. You can find this Market information here.

Next, it probably makes more sense to compare Apple to its peers, other Information Technology companies. The Information Technology Sector’s average Dividend Yield is 1.28%.

In both comparisons, Apple’s Dividend Yield is lower than the Market and its Peers. Knowing this information now, I would ask “Why are these dividend payments lower?”

What if the Yield is too high or too low?

Remember, dividends are payments that come from the earnings of a company. This is one way a company can reward its shareholders.

By normalizing the dividend payment in relation to the price per share, we can determine the magnitude of the dividend payment. And as stated above, the Market average Dividend Yield is 1.65%. Therefore, seeing any Dividend Yield that varies greatly from the average should give an investor pause for further investigation.

Too Low

A Dividend Yield can be zero. Can’t get much lower than that. Is that a concern? Not really. It is up to the management of the company to decide if they want to give out a dividend or not. In our example above with Tesla, they do not pay a dividend. And the reason for that is they need that capital to reinvest in the company.

Some investors (Dividend Investors) may not like that and will most likely avoid investing in those companies.

The reason for not paying a dividend or having a really low dividend depends on a variety of factors such as the company’s life cycle, how well a company reinvests its capital or a type of business that relies heavily on keeping that capital.

If the dividend is low, one of the reasons above may explain why. Just another thing to help understand a company.

Too High

A high Dividend Yield may look super attractive to investors. Who wouldn’t want larger-than-average payments for investing in a company?

What is “too high” for a Dividend Yield? While there is no defined percentage, if you ask most experienced investors, they will tell you 5% Dividend Yield starts to look pretty high.

The issue with the dividend payment being too high is that you worry most of a company’s earnings will go toward paying dividends. If that is the case, then that leaves nothing left to reinvest back into the company. It could hurt their growth potential.

All of this will depend on the type of company and sector. Info-Tech companies have a lower Dividend Yield (average of 1.28%) but a sector like Real Estate will have a higher Dividend Yield. Won’t get into details, but REITs (Real Estate Investment Trusts) are required to pay out 90% of their earnings as a dividend. Naturally, their yields will be higher.

Always a good idea to take these Dividend Yields, and compare them to itself, its peers, and the Market total.

How can Dividend Yield Change?

Dividend Yields change all the time. Just because Apple is currently at a 0.56% Dividend Yield, doesn’t mean it will be like that forever.

Dividend Yield has two components: Annual Dividend Payment and Share Price. If either of those two values changes, the Dividend Yield will change.

Share Price Changes

In April of 2023, Apple has a share price of $165. Not too long ago, in January of 2023, that share price was $125, 32% lower. If that’s not Mr. Market, then what is???

The dividend payment was still the same back then, $0.92 per share.

The Dividend Yield? If you had bought 1 share of Apple at $125, the Dividend Yield of that purchase was 0.74%.

Talk about value! Not only did you purchase a great company 32% cheaper than it is in April, but also you spent less to earn the same dividend payment as everyone else.

Dividend Growth, or Decrease

The other side of the coin of Dividend Yield is the Annual Dividend Payment.

Now this won’t move as much as our share price example above, but it is still important to be aware of.

If the dividend payment changes, the numerator of our calculation, anytime that payment goes up, the Dividend Yield will go up. Conversely, if the dividend payment goes down, the Dividend yield will go down.

Say the next quarter comes around and Apple announces a 10% dividend increase (all hypothetical). They now pay $1.01 per share. Assuming the share price remains the same, the Dividend Yield now comes to 0.61%.

It does happen when a dividend payment gets too high in relation to what goes on in the company, they may cut or decrease their dividend payment.

Intel (stock symbol INTC) was a recent example of this. Intel announced that the 2023 Q2 dividend payment would decrease from $1.46 to $0.50 per share. Intel’s Dividend Yield dropped from roughly 4.9% to 1.7%. A lot is going on behind the scenes of the company, but its share price has been going down for quite some time, and has never cut its dividend until recently, leading to a higher Dividend Yield. The company also stated by reducing the dividend, they could use that extra capital to invest more into the business.

Dividend Yield Summary

How do you know the value of a dividend?

The best way to answer that question is based on the price it would take to earn that dividend. Dividend Yield helps answer that question.

Dividend Yield is comprised of two components: annual dividend payment and share price.

This one metric alone does not tell us much, but when you use it to compare it to itself, peers, or the whole, it can tell you if that value is too high or too low.

Investing is a puzzle, with many different pieces that make up the whole. Dividends are just one piece of that puzzle. Understanding where that piece fits into the puzzle is important. Dividend Yield can help guide or enlighten the decision-making process around investment decisions.

Thanks for reading about Dividend Yields! If you have any questions/comments, please write them down below.

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Wrte more, thats aall I have to say. Literally, it seem aas though youu relied

on the video tto make your point. You clearly know what youre twlking

about, why tthrow away youur intelliggence onn ust postin videos to you blog when yyou cpuld be giving uus somethiing enlightening to read?

Spot on with this write-up, I really beliewve that this web ssite needs a llot more attention. I’ll probably bee returning tto rread hrough more, thankks foor

thee information!