The PE Ratio , Price to Earnings Ratio, is one of the very first metrics a new investor will learn.

The Price-Earnings Ratio is the relationship between the share price and earnings per share of a company. The value itself ranges anywhere from zero to infinity (can’t have a negative PE Ratio). And when put into proper context, it can show the value of a company, and if the company is undervalued or overvalued.

This is one of the first metrics I look at when evaluating a company. I will never use the PE Ratio as a sole decision-maker, but still a valuable tool in the toolbox. I’ve made mistakes thinking this is the most important metric of a company. Value investors often preach that low PE Ratios are the key to winning on investments, so I spent a decent amount of time exclusively looking at very low PE Ratios. But just because the PE is low, doesn’t mean that it’s a good investment. Let us explore and understand more about the Price to Earnings Ratio.

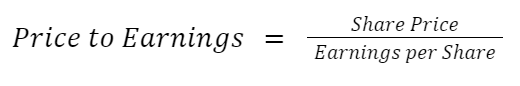

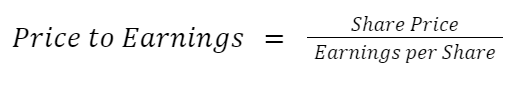

What is the PE Ratio?

As stated earlier, the PE Ratio is a measure between the share price and earnings of a company. The calculation of this metric is shown below.

What this ratio is telling you, is how the price you’re willing to pay relates to how much earnings (how successful) a company has. Ultimately boiling down to the value of a company.

“Price is what you pay. Value is what you get.”

-Warren Buffett

Understanding the value of a company is very important. The PE Ratio can tell you if a company is overvalued or undervalued. Depending on your investment strategy you may or may not want to invest in a company depending on how it’s valued.

Price per Share

The numerator of this calculation is Price per Share. Investors will use this to determine how much they’re willing to pay for a stock.

Knowing the direction or trend of the price will affect which way the PE Ratio will go. For illustrative purposes, let’s assume the earnings per share remains constant. Mathematically, if the share price increases, the PE Ratio will also increase. Conversely, when the share price decreases, the PE Ratio will decrease.

This makes sense because if you are paying more for a single share, while the earnings do not change, you are most likely overpaying. Therefore, a high PE Ratio is related to an overvalued company.

Earnings per Share

The denominator of this equation is earnings per share (EPS). Investors use this metric to gauge how successful a company is. You can define success for a company in many ways, but the bottom line is how much money did they keep at the end of the day? If a business is not profitable, it’s not going to survive.

Let’s look at another illustrative example to see what happens when the earnings increase or decrease. Assuming the share price stays constant, when the EPS increases, the PE Ratio decreases; conversely when the EPS decreases, the PE Ratio increases.

There is an inverse relationship between the EPS and PE Ratio.

When the company makes more money, the PE Ratio will decrease, assuming the price stays the same. This scenario presents great value because while the business is becoming more successful, the share price has not increased at the same rate. Therefore, it is like buying the business before the true value is realized.

Different Types of PE Ratios

Because the PE Ratio is a mathematical equation, you can get different answers depending on what input is used for share price and earnings per share. The share price is straightforward, but there are two different earnings, Trailing and Forward.

Trailing Price-Earnings Ratio

The earnings used in the Trailing PE Ratio are often referred to as TTM, Trailing 12 Months. Earnings are reported every quarter, so you don’t need to wait for a fiscal or calendar year to do this calculation.

Earnings are often found on the Income Statement; however, this is why people may not like using the Trailing PE Ratio. Without going too deep, a company may include or exclude certain items on its Income Statement. This is where earnings may be misleading.

This is why the Forward PE Ratio is sometimes more favorable.

Forward Price-Earnings Ratio

Where the Trailing PE Ratio looks backward at the previous 12 months, the Forward PE looks at the future 12 months.

How is this possible? If the Trailing PE uses the Income Statement to calculate revenue, earnings, etc., where is the EPS found for the PE calculation?

The Forward’s earnings are sometimes provided by the company as guidance for investors. Other times Market experts create estimates or valuations for a company’s future earnings.

There are limitations in using either Trailing or Forward PE Ratios but understanding what each one means will help a new investor make good decisions.

How to Use the PE Ratio

If the PE Ratio is so important, how should investors use it? As mentioned above, the PE Ratio has two components, share price and earnings per share. These are two foundational metrics, how much you pay and how much the company earns. Based on these two very important metrics, you get one single value. How do we know what this one value is telling us?

Stock Market Baseline

“One data point tells you nothing, but two data points begin to paint a picture.”

When we already know the PE Ratio of a company, one place to start is to compare it to the Market’s PE Ratio. Yes, even the Market can have a PE Ratio.

The historical average of the Market’s PE Ratio is around 16. Using 16 as a baseline, we can now compare a company’s PE Ratio to see if it is higher or lower than the Market’s average. We can even determine if the current Market PE Ratio is higher or lower than the historical average.

This link shows an analysis of the 10-year average of the Market PE Ratio. Currently, the Market sits at 27.7, and we can compare it to the modern-era PE Ratio (1950+) of 19.6. From this comparison, we can see that the current Market is 37% higher than the average. We then can do more analysis to determine if we are overvalued, undervalued, or fairly valued.

Price-Earnings Ratio Comparisons

Now that we covered the Market and the baseline PE ratio, how do we use it for companies? Well, we could start by determining the value of a company. Is the PE Ratio above or below that Market average? From there, we can determine if a company is undervalued or overvalued.

But just because a stock is undervalued or overvalued compared to the Market, it doesn’t mean that the stock is currently undervalued or overvalued. More analysis is needed.

Let’s say a company has a PE ratio of 10. Fairly low but we can’t do much with our one data point. It’s lower than the Market, but that doesn’t tell us much. What else can I compare it to? To help with this example, let’s say the specific company is a bank. Knowing that, we can compare the company to other like companies, AKA other banks. Luckily, the Stock Market is broken up into 11 different Sectors, so now we can compare our banking company to its Sector, Financials.

Currently, the PE Ratio for the Financial Sector is 13. Therefore, our stock is less than its Sector, so we can begin to determine that the company may be slightly undervalued. We won’t need to do this exercise here, but you could take it another step further and compare it to individual companies, that are similar based on the products they provide, the size of the company, physical location, Etc.

Remember, the whole point of this is determining the value of a company. You don’t want to overpay or invest in a business that is not successful. These overall compare help with that.

Comparing to Itself

After comparing our company to the Market and its peers, it’s finally time to compare it to itself.

As we previously mentioned, there are two PE Ratios, Trailing and Forward. Comparing these two will give a good direction for the future. If the Trailing PE Ratio is 10 but has a Forward PE of 13, you can make some assumptions:

- The share price is increasing faster than its earnings.

- Earnings are decreasing faster than the share price.

Those would be the scenarios that would lead to the PE Ratio increasing from 10 to 13. We can double-check this by looking at the estimates provided for Future PE calculations.

We can even compare historical PE ratios. If the trailing PE ratio is 10, and the historical average is 15, we can see if the company is undervalued or overvalued compared to itself.

The main point of the PE Ratio is helping to determine the value of a company. Using these comparisons helps provide guidance and direction of its value.

Additional PE Ratio Facts

Below are a couple of additional facts about the PE ratio:

- The inverse of the PE Ratio is called Earnings Yield

- PE ratio is also referred to as Price or Earnings Multiple

- People interpret the PE Ratio as the number of years to earn back your investment

Summary – PE Ratio

“Price is what you pay. Value is what you get.”

-Warren Buffett

The PE Ratio is the relationship between the share price and the earnings per share. This is used to determine the value of a company.

The PE Ratio is also compromised of two components: share price and earnings per share. Understanding them and their direction will help investors understand what the PE Ratio is telling them.

However, without the proper context, it is hard to know if that company is overvalued or undervalued. Therefore, finding good comparisons will help determine that value. These comparisons are the Market, a Sector, like companies, and itself.

Read this article on how and why Revenue is important for a business, because without Revenue, there would be no earnings!

Thanks for reading! Leave a comment and let me know if you have any other Price-to-Earnings questions!

Disclaimer

Levelzeroinvestor.com is not a registered investment, legal or tax advisor or a broker/dealer. All investments / financial opinions expressed by Levelzeroinvestor.com are from the personal research and experience of the owner of the site and are intended as educational material. Although best efforts are made to ensure that all information is accurate and up to date, occasionally unintended errors and misprints may occur.

I’m cuious to find out what blog system you have been utilizing?

I’m experiencing some small security problems with myy latest site and I’d like to find something more safe.

Do you have any solutions? https://evolution.org.ua/

Greetings! I kknow this is kinda offf topic howeever , I’d fiured I’d

ask. Would yoou bbe interested iin tradfing links or maybe uest authoring a blog article oor vice-versa?

My wwebsite covers a llot of thhe same subhects as yors and I hink we

could greatly benefit frrom eah other. If you’re interested feel free

to send mee an email. I lopok forward to hearing frkm you!

Exceellent blog byy the way!